Insider Sell: Moody's Corporation President and CEO Robert Fauber Sells 2,546 Shares

Moody's Corporation (NYSE:MCO), a leading global risk assessment firm, has recently witnessed a significant insider sell by its President and CEO, Robert Fauber. On November 30, 2023, Robert Fauber sold 2,546 shares of the company, a transaction that has caught the attention of investors and market analysts alike.

Who is Robert Fauber?

Robert Fauber is the President and CEO of Moody's Corporation, a position he has held since January 2021. Fauber has been with Moody's since 2009, serving in various leadership roles, including Chief Operating Officer of Moody's Investors Service and Senior Vice President of Corporate Development. His extensive experience in the financial services industry and his leadership at Moody's have been integral to the company's strategic initiatives and global expansion.

Moody's Corporation's Business Description

Moody's Corporation is a global integrated risk assessment firm that provides credit ratings, research, tools, and analysis for investors and other market participants. The company's core divisions include Moody's Investors Service, which offers credit ratings and research covering debt instruments and securities, and Moody's Analytics, which provides software, advisory services, and research for financial analysis and risk management. Moody's plays a critical role in global capital markets by providing transparent and independent assessments that help investors make informed decisions.

Analysis of Insider Buy/Sell and Relationship with Stock Price

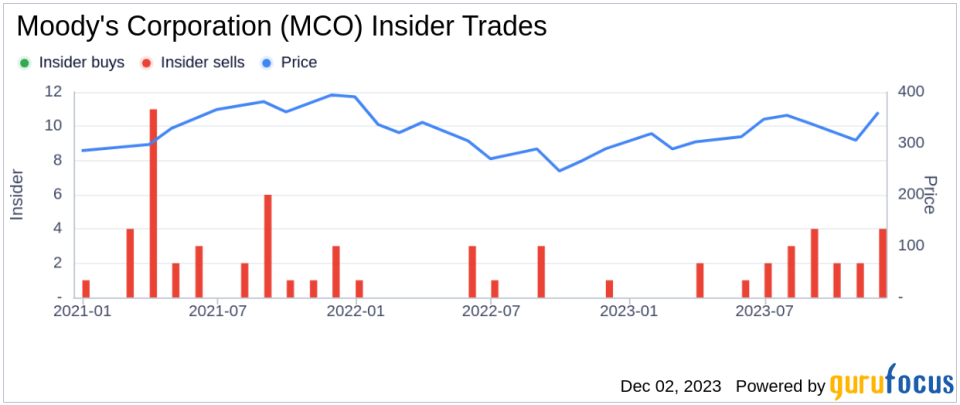

Insider transactions are often scrutinized by investors as they can provide insights into a company's internal perspective on its stock's valuation. Over the past year, Robert Fauber has sold a total of 27,821 shares and has not made any purchases. This pattern of selling without corresponding buys could signal that insiders, including the CEO, believe the stock may be fully valued or overvalued at current prices.

When examining the insider transaction history for Moody's Corporation, it is notable that there have been no insider buys over the past year, while there have been 21 insider sells during the same period. This trend suggests a lack of buying interest from insiders, which could be interpreted as a lack of confidence in the stock's potential for near-term appreciation.

On the day of the insider's recent sell, shares of Moody's Corporation were trading at $360.43, giving the company a market cap of $67.904 billion. This price level reflects a price-earnings ratio of 45.14, which is significantly higher than the industry median of 18.13 and above the company's historical median price-earnings ratio. Such a high price-earnings ratio could indicate that the stock is overvalued relative to its earnings potential.

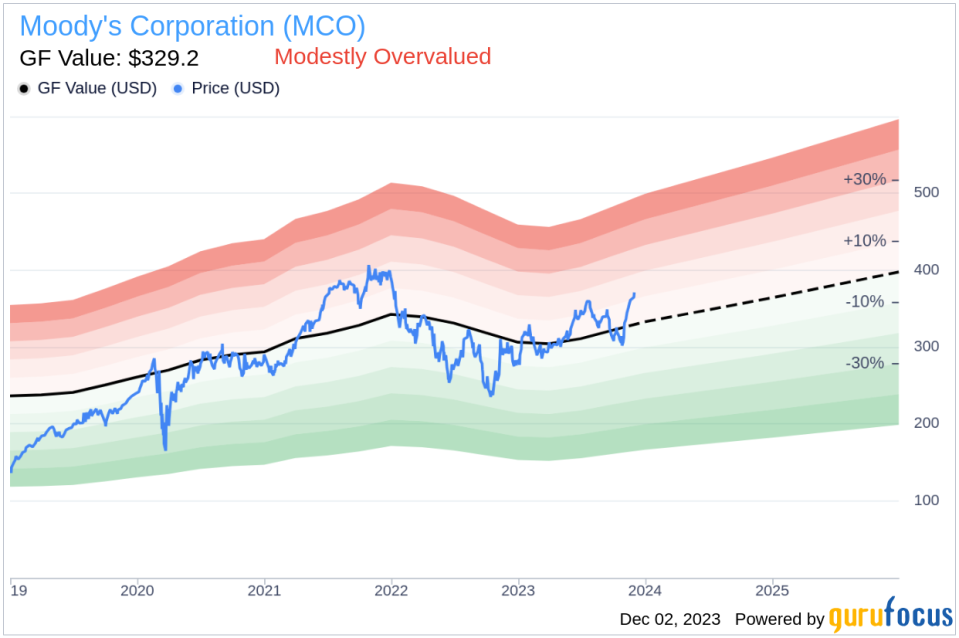

Furthermore, with a price of $360.43 and a GuruFocus Value of $329.20, Moody's Corporation has a price-to-GF-Value ratio of 1.09. This suggests that the stock is modestly overvalued based on its GF Value.

The GF Value is a proprietary intrinsic value estimate developed by GuruFocus. It is calculated considering historical trading multiples, a GuruFocus adjustment factor based on the company's past returns and growth, and future business performance estimates from Morningstar analysts. When the price-to-GF-Value ratio is above 1, it indicates that the stock may be overvalued compared to its intrinsic value.

Given the current valuation metrics and the insider selling trend, investors may want to exercise caution with Moody's Corporation stock. While the company holds a strong position in the risk assessment industry, the high price-earnings ratio and the modest overvaluation based on the GF Value could limit the stock's upside potential in the near term. Additionally, the lack of insider buying could be a sign that those with the most knowledge of the company's prospects are not compelled to increase their stakes at current prices.

It is important for investors to consider these insider trading patterns and valuation metrics as part of a broader investment analysis. While insider selling alone does not necessarily predict a decline in stock price, it can provide context for understanding how insiders view the stock's valuation and future prospects.

In conclusion, the recent insider sell by Moody's Corporation's President and CEO, Robert Fauber, along with the absence of insider buying, may suggest a cautious outlook on the stock's current valuation. Investors should weigh these factors alongside other fundamental and technical analyses to make informed investment decisions regarding Moody's Corporation shares.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.