Insider Sell: Nicholas Daffan Sells 1,516 Shares of Verisk Analytics Inc (VRSK)

On October 12, 2023, Chief Information Officer Nicholas Daffan sold 1,516 shares of Verisk Analytics Inc (NASDAQ:VRSK). This move comes amidst a year where the insider has sold a total of 7,689 shares and purchased none.

Nicholas Daffan is the Chief Information Officer of Verisk Analytics Inc, a leading data analytics provider serving customers in insurance, natural resources, and financial services. The company uses advanced technologies to collect, analyze, and deliver information, helping customers make better decisions about risk, investments, and operations.

The insider's recent sell-off is part of a broader trend within Verisk Analytics Inc. Over the past year, there have been 14 insider sells and only one insider buy. This trend is illustrated in the following image:

On the day of the insider's recent sell, shares of Verisk Analytics Inc were trading for $246.02 apiece, giving the stock a market cap of $35.91 billion. This price represents a price-earnings ratio of 74.31, significantly higher than the industry median of 16.88 and the companys historical median price-earnings ratio.

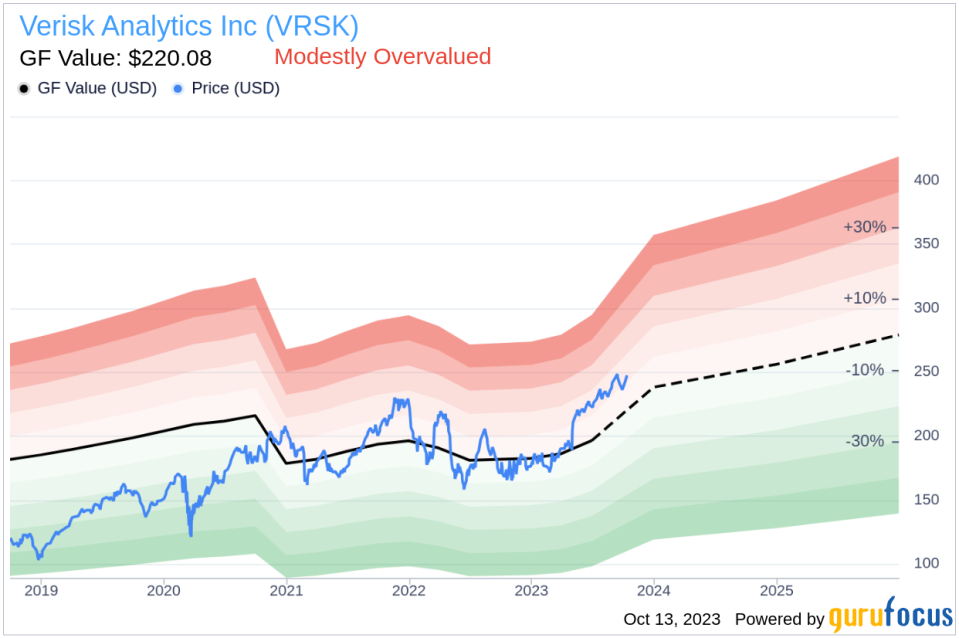

According to the GuruFocus Value, which is an intrinsic value estimate based on historical multiples, a GuruFocus adjustment factor, and future business performance estimates, Verisk Analytics Inc is modestly overvalued. The stock's price-to-GF-Value ratio is 1.12, with a GF Value of $220.08 and a current price of $246.02. The GF Value image below provides a visual representation of this analysis:

The insider's decision to sell shares could be influenced by the stock's current overvaluation. However, it's important to note that insider selling does not necessarily indicate a negative outlook for the company. Insiders may sell shares for personal reasons or portfolio diversification. Nonetheless, the insider's sell-off, coupled with the broader trend of insider selling within Verisk Analytics Inc, warrants attention from investors.

As always, investors should consider a variety of factors, including insider transactions, when making investment decisions. While the insider's recent sell-off and the stock's current overvaluation may raise concerns, Verisk Analytics Inc's position as a leading data analytics provider in multiple industries should not be overlooked.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.