Insider Sell: Nicholas Daffan Sells 1,516 Shares of Verisk Analytics Inc (VRSK)

On September 12, 2023, Chief Information Officer Nicholas Daffan sold 1,516 shares of Verisk Analytics Inc (NASDAQ:VRSK). This move comes amidst a year where Daffan has sold a total of 6,173 shares and purchased none.

Nicholas Daffan is the Chief Information Officer of Verisk Analytics Inc, a leading data analytics provider serving customers in insurance, natural resources, and financial services. The company uses advanced technologies to collect, analyze, and deliver information, helping customers make better decisions about risk, investments, and operations.

The insider transaction history for Verisk Analytics Inc shows a trend of more sells than buys over the past year. There have been 13 insider sells and only 1 insider buy. This could indicate that insiders believe the stock is currently overvalued.

On the day of the insider's recent sell, shares of Verisk Analytics Inc were trading for $244.63 apiece, giving the stock a market cap of $35.61 billion. The price-earnings ratio is 74.19, significantly higher than the industry median of 16.68 and the companys historical median price-earnings ratio. This suggests that the stock is currently overpriced compared to its earnings.

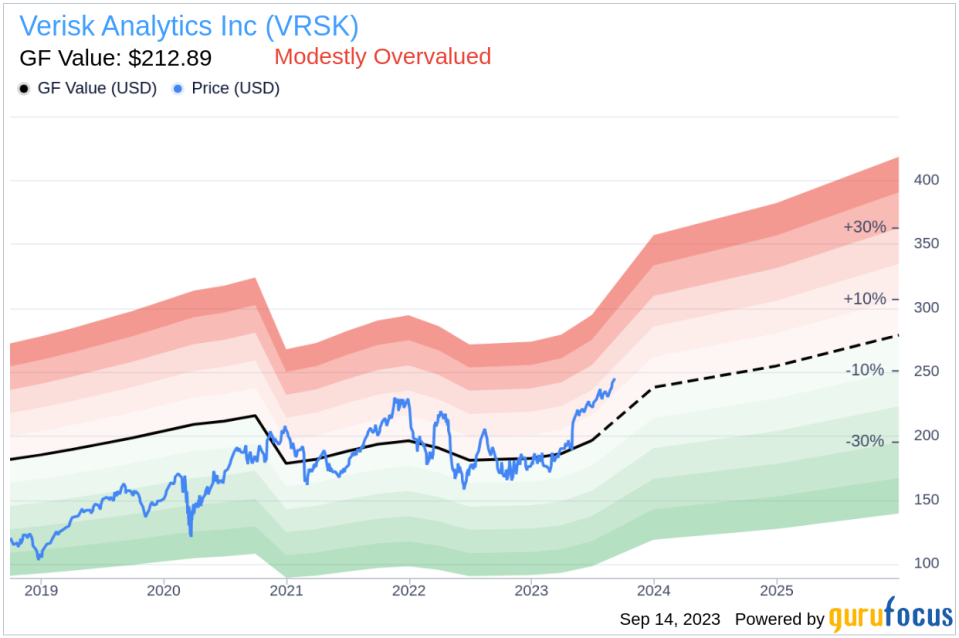

The GuruFocus Value for Verisk Analytics Inc is $212.89, resulting in a price-to-GF-Value ratio of 1.15. This indicates that the stock is modestly overvalued based on its GF Value.

The GF Value is an intrinsic value estimate developed by GuruFocus. It is calculated based on historical multiples (price-earnings ratio, price-sales ratio, price-book ratio, and price-to-free cash flow) that the stock has traded at, a GuruFocus adjustment factor based on the companys past returns and growth, and future estimates of business performance from Morningstar analysts.

The recent sell by the insider, coupled with the high price-earnings ratio and the price-to-GF-Value ratio, suggests that the stock may be overvalued. Investors should exercise caution and conduct further research before making investment decisions.

It's important to note that insider sells do not always indicate a bearish outlook. Insiders may sell shares for personal reasons or portfolio diversification. However, they do provide valuable insights into the company's perceived value by those closest to its operations.

This article first appeared on GuruFocus.