Insider Sell: Nicholas Lynton Sells 12,751 Shares of Cardlytics Inc (CDLX)

On October 2, 2023, Nicholas Lynton, Chief Legal & Privacy Officer of Cardlytics Inc (NASDAQ:CDLX), sold 12,751 shares of the company. This move comes amidst a year where the insider has sold a total of 35,813 shares and purchased none.

Cardlytics Inc is a purchase intelligence platform that makes marketing more relevant and measurable. It partners with financial institutions to run their banking rewards programs that promote customer loyalty and deepen banking relationships. In turn, marketers use the company's platform to identify, reach, and influence likely buyers at scale, as well as measure the true sales impact of marketing campaigns.

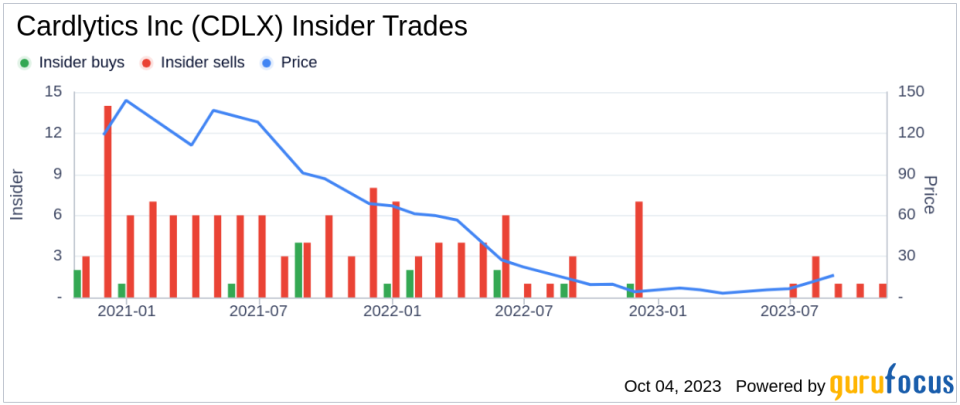

The insider's recent sell-off could be seen as a bearish signal, especially considering the insider's trading history. Over the past year, there have been 15 insider sells and only 1 insider buy for Cardlytics Inc. This trend is illustrated in the following image:

The relationship between insider trading and stock price can be complex. However, it's generally accepted that insider selling can be a negative signal, as it could indicate that those with the most information about the company believe its stock is overvalued or that the company's future prospects are not as positive as the market believes.

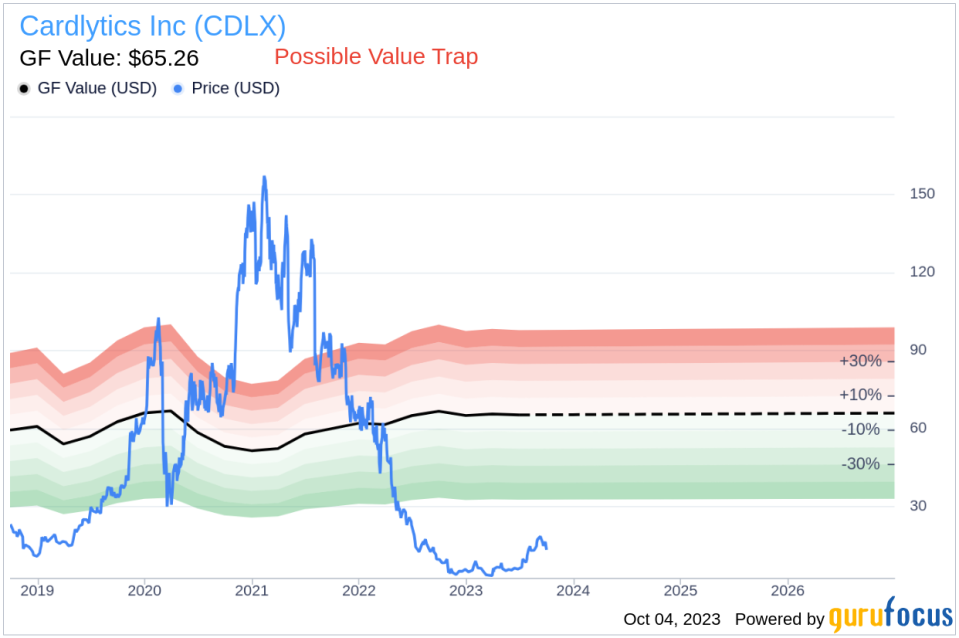

On the day of the insider's recent sell, shares of Cardlytics Inc were trading for $14.31, giving the company a market cap of $496.262 million. However, the GuruFocus Value of the stock is $65.26, which suggests that the stock is a possible value trap. This is illustrated in the following image:

The GF Value is an intrinsic value estimate developed by GuruFocus. It's calculated based on historical multiples that the stock has traded at, a GuruFocus adjustment factor based on the company's past returns and growth, and future estimates of business performance from Morningstar analysts. With a price-to-GF-Value ratio of 0.22, Cardlytics Inc's stock may seem undervalued, but investors should think twice before buying due to the potential value trap.

In conclusion, the insider's recent sell-off, combined with the company's insider trading history and its current valuation, could be seen as a bearish signal for Cardlytics Inc. Investors should carefully consider these factors before making investment decisions.

This article first appeared on GuruFocus.