Insider Sell: OFG Bancorp's Chief Strategy Officer Ganesh Kumar Divests 14,045 Shares

In a notable insider transaction, Chief Strategy Officer Ganesh Kumar of OFG Bancorp (NYSE:OFG) sold 14,045 shares of the company's stock on December 14, 2023. This sale is part of a series of transactions over the past year, where Kumar has sold a total of 138,405 shares and made no purchases. The recent sale has caught the attention of investors and market analysts, prompting a closer look at the insider's trading behavior and its potential implications for OFG Bancorp's stock performance.

Who is Ganesh Kumar of OFG Bancorp?

Ganesh Kumar has been serving as the Chief Strategy Officer of OFG Bancorp, a financial institution with a significant presence in Puerto Rico. Kumar's role involves overseeing the strategic planning and execution of initiatives that drive the company's growth and operational efficiency. His insights and decisions are crucial for the bank's direction, making his trading activities in the company's stock particularly noteworthy for investors.

OFG Bancorp's Business Description

OFG Bancorp is a diversified financial services company that operates primarily through its subsidiaries, offering a wide range of banking, wealth management, and treasury services. The company caters to both retail and commercial clients, providing solutions such as loans, deposits, financial planning, and investment banking. With a strong foothold in Puerto Rico, OFG Bancorp has established itself as a key player in the region's financial landscape.

Analysis of Insider Buy/Sell and the Relationship with the Stock Price

Insider transactions can provide valuable insights into a company's health and future prospects. In the case of OFG Bancorp, the absence of insider buys over the past year, coupled with 19 insider sells, may raise questions about the insiders' confidence in the company's near-term growth potential. However, it is essential to consider the context of these sales, including the personal financial planning of the insiders and their individual investment strategies.

On the day of Kumar's recent sale, OFG Bancorp's shares were trading at $36.67, giving the company a market cap of $1.743 billion. The price-earnings ratio stood at 9.72, which is slightly higher than the industry median of 8.74 but lower than the company's historical median. This suggests that, while the stock may not be undervalued, it is not significantly overpriced compared to its historical trading multiples.

The insider trend image above illustrates the pattern of insider transactions over time. A consistent pattern of insider selling, as seen in the case of OFG Bancorp, can sometimes be interpreted as a bearish signal. However, without significant insider buying to counterbalance the selling, it is difficult to draw a definitive conclusion about the insiders' collective sentiment.

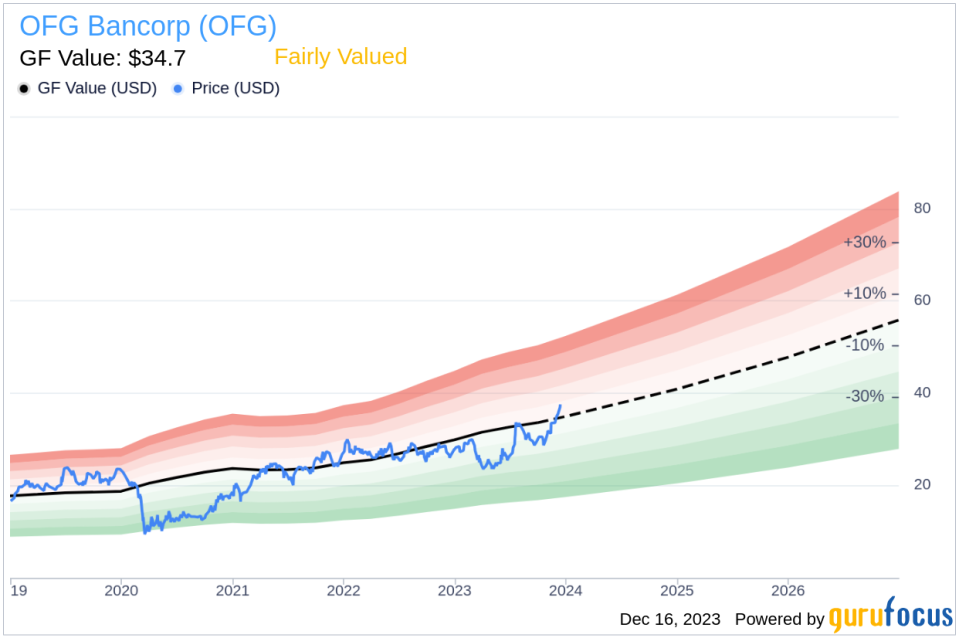

The GF Value image provides an additional layer of analysis. With a price of $36.67 and a GuruFocus Value of $34.70, OFG Bancorp's price-to-GF-Value ratio is 1.06, indicating that the stock is Fairly Valued based on its GF Value. The GF Value is a proprietary intrinsic value estimate that takes into account historical trading multiples, a GuruFocus adjustment factor, and future business performance estimates. This metric suggests that the stock is trading at a price that is in line with its intrinsic value, which may mitigate concerns about the insider selling activity.

Conclusion

The recent insider sell by Ganesh Kumar, along with the broader pattern of insider selling at OFG Bancorp, warrants attention from investors. While the absence of insider buying could be perceived as a lack of confidence by insiders, the company's current valuation metrics suggest that the stock is not overvalued. Investors should consider the insider trading activity as one of many factors in their analysis of OFG Bancorp and continue to monitor the company's financial performance and market conditions for a more comprehensive assessment.

As always, insider transactions should not be used in isolation when making investment decisions. They are one piece of the puzzle that, when combined with other financial and market data, can help investors form a more complete picture of a company's potential investment value.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.