Insider Sell: Pascal Deschatelets Sells 12,000 Shares of Apellis Pharmaceuticals Inc

On September 8, 2023, Pascal Deschatelets, the Chief Scientific Officer of Apellis Pharmaceuticals Inc (NASDAQ:APLS), sold 12,000 shares of the company. This move is part of a larger trend for the insider, who has sold a total of 144,000 shares over the past year and purchased none.

Apellis Pharmaceuticals Inc is a clinical-stage biopharmaceutical company that focuses on the development of novel therapeutic compounds for autoimmune and inflammatory diseases. The company's lead product candidate, APL-2, is designed to inhibit the complement system at the level of C3, a central protein in the complement cascade.

The insider's recent sell has raised questions about the company's stock performance and its relationship with insider trading activities. Over the past year, there have been 58 insider sells and no insider buys for Apellis Pharmaceuticals Inc. This trend suggests a lack of confidence among insiders about the company's future performance.

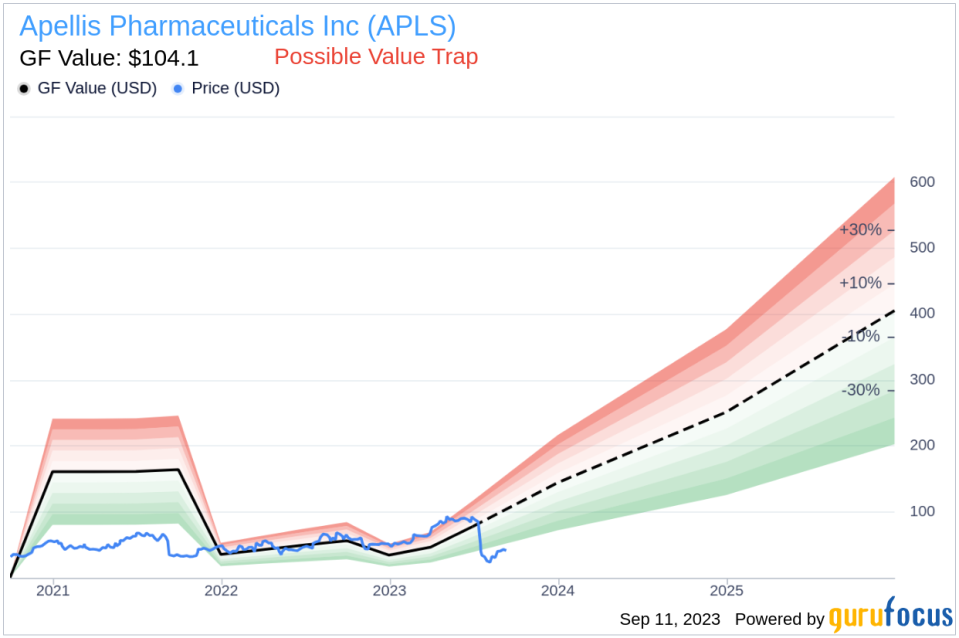

On the day of the insider's recent sell, shares of Apellis Pharmaceuticals Inc were trading at $42.87, giving the company a market cap of $4.89 billion. However, the company's GF Value stands at $104.10, indicating a price-to-GF-Value ratio of 0.41. This suggests that the stock is a possible value trap, and investors should think twice before investing.

The GF Value is an intrinsic value estimate developed by GuruFocus. It is calculated based on historical multiples that the stock has traded at, a GuruFocus adjustment factor based on the company's past returns and growth, and future estimates of business performance from Morningstar analysts.

The insider's recent sell, coupled with the company's high GF Value and the lack of insider buys over the past year, suggests that the stock may be overvalued. Investors should exercise caution and conduct thorough research before making any investment decisions.

As always, insider trading activities should not be used as the sole basis for any investment decisions. They are just one of many factors that investors should consider when evaluating a company's stock.

This article first appeared on GuruFocus.