Insider Sell: Paycom Software Inc's Jason Clark Offloads 9,005 Shares

In a notable insider transaction, Jason Clark, the Chief Administrative Officer of Paycom Software Inc (NYSE:PAYC), sold 9,005 shares of the company on December 6, 2023. This move has caught the attention of investors and market analysts, as insider transactions can often provide valuable insights into a company's prospects and the sentiment of its top executives.

Who is Jason Clark?

Jason Clark has been an integral part of Paycom Software Inc, serving as the Chief Administrative Officer. His role involves overseeing various administrative functions within the company, ensuring that Paycom's operations run smoothly and efficiently. Clark's position gives him a deep understanding of the company's inner workings and strategic direction, making his trading activities particularly noteworthy to investors.

About Paycom Software Inc

Paycom Software Inc is a leading provider of comprehensive, cloud-based human capital management (HCM) software solutions delivered as Software-as-a-Service (SaaS). The company offers an integrated suite of products that enables businesses to manage the complete employment lifecycle, from recruitment to retirement. Paycom's solutions encompass talent acquisition, time and labor management, payroll, talent management, and HR management. With a focus on innovation and client satisfaction, Paycom has established itself as a key player in the HCM market.

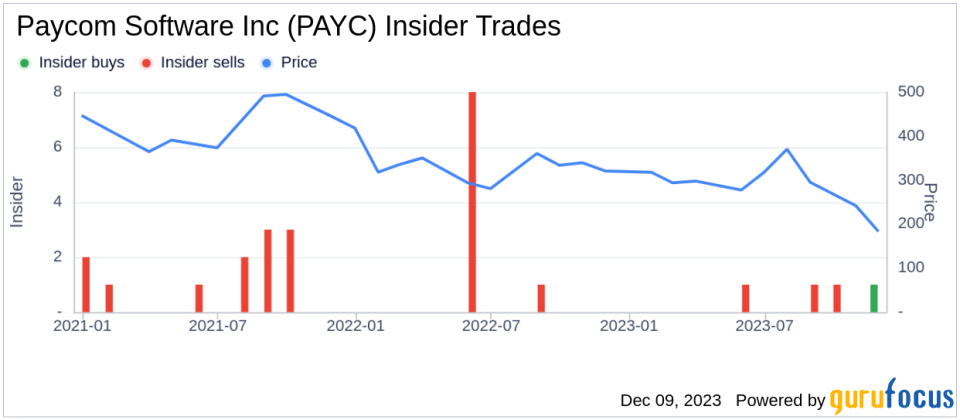

Analysis of Insider Buy/Sell and Stock Price Relationship

The insider transaction history for Paycom Software Inc reveals a pattern of more insider sells than buys over the past year. Specifically, there has been only 1 insider buy compared to 4 insider sells. This could suggest that insiders, including Jason Clark, may perceive the stock's current price or future prospects as less favorable, prompting them to reduce their holdings.

When analyzing insider transactions, it's important to consider the context and magnitude of the trades. Jason Clark's recent sale of 9,005 shares follows a year in which he sold a total of 9,565 shares and made no purchases. This consistent selling trend could be interpreted as a lack of confidence in the stock's short-term growth potential or as a personal financial decision unrelated to the company's performance.

Valuation and Market Cap

On the day of the insider's recent sale, shares of Paycom Software Inc were trading at $184.55, giving the company a market cap of $10.765 billion. The price-earnings ratio stands at 31.89, which is higher than the industry median of 26.65 but lower than the company's historical median price-earnings ratio. This suggests that while Paycom's valuation is above the industry average, it may be trading at a discount compared to its own historical valuation.

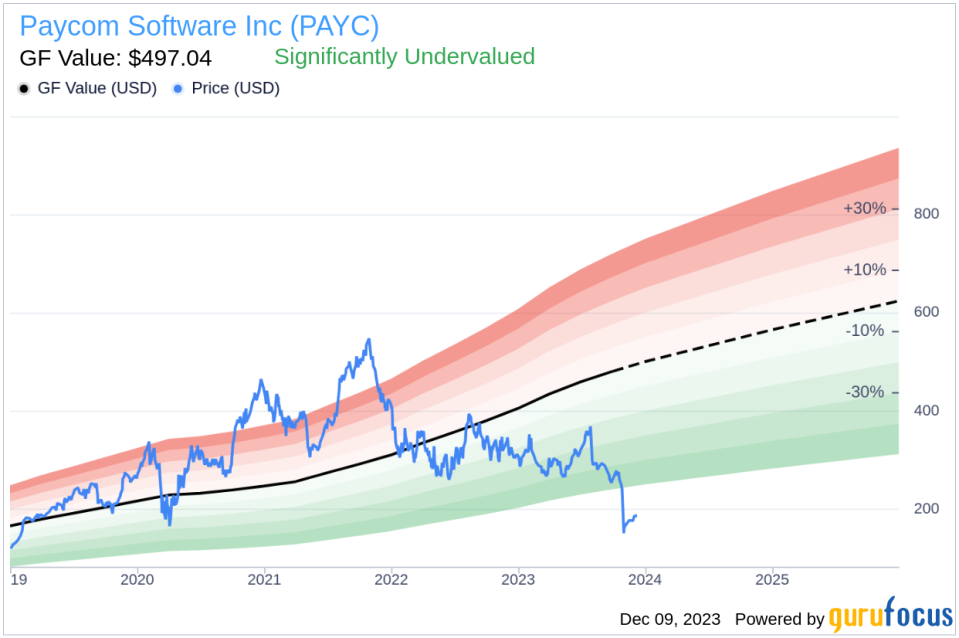

GF Value and Stock Assessment

With a current price of $184.55 and a GuruFocus Value of $497.04, Paycom Software Inc has a price-to-GF-Value ratio of 0.37, indicating that the stock is significantly undervalued based on its GF Value.

The GF Value is a proprietary intrinsic value estimate from GuruFocus, which takes into account historical trading multiples, a GuruFocus adjustment factor based on past returns and growth, and future business performance estimates from Morningstar analysts. The significant undervaluation based on this metric could mean that the market has not fully recognized Paycom's growth potential or that there are other factors at play that might be influencing the stock price.

Conclusion

The recent insider sell by Jason Clark, the Chief Administrative Officer of Paycom Software Inc, is a development that investors should consider in the context of the company's valuation and stock performance. While the insider's selling trend might raise questions, the GF Value suggests that the stock is significantly undervalued. Investors should weigh these factors, along with their own research and investment goals, when making decisions about Paycom Software Inc's stock. It's also crucial to monitor any further insider transactions and company announcements that could provide additional insights into the stock's future direction.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.