Insider Sell: President AS and AET Peters Stanley W III Sells 2000 Shares of Conmed Corp

On September 13, 2023, Peters Stanley W III, President AS and AET of Conmed Corp (NYSE:CNMD), sold 2,000 shares of the company. This move comes as part of a series of transactions made by the insider over the past year, during which he sold a total of 10,000 shares and made no purchases.

Conmed Corp is a New York-based medical technology company that provides surgical devices and equipment for minimally invasive procedures. The company's products are used by surgeons and physicians in a variety of specialties, including orthopedics, general surgery, gynecology, neurosurgery, and gastroenterology.

The insider's recent sell has raised questions about the company's stock performance and its relationship with insider transactions. Over the past year, there have been 16 insider sells and no insider buys at Conmed Corp. This trend is illustrated in the following image:

On the day of the insider's recent sell, Conmed Corp's shares were trading at $107.31, giving the company a market cap of $3.31 billion. The stock's price-earnings ratio was 38.05, higher than the industry median of 28.08 but lower than the company's historical median price-earnings ratio.

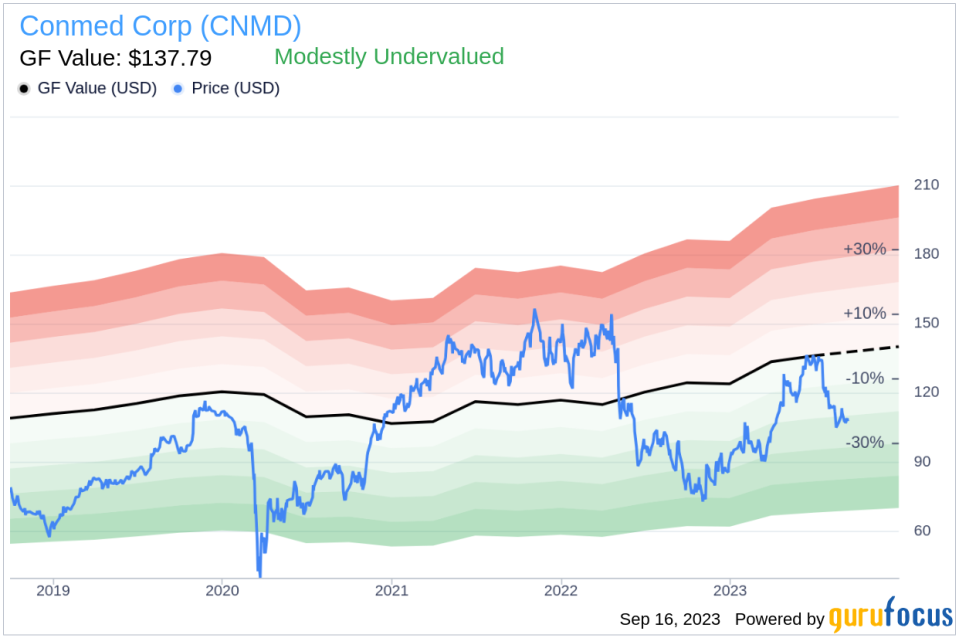

According to GuruFocus Value, Conmed Corp's stock is modestly undervalued. With a price of $107.31 and a GuruFocus Value of $137.79, the stock has a price-to-GF-Value ratio of 0.78. The GF Value is an intrinsic value estimate developed by GuruFocus, calculated based on historical multiples, a GuruFocus adjustment factor, and future estimates of business performance from Morningstar analysts. The GF Value image below provides a visual representation of this analysis:

The insider's recent sell, coupled with the stock's modest undervaluation, suggests that investors should keep a close eye on Conmed Corp. While the insider's sell does not necessarily indicate a negative outlook for the company, it does highlight the importance of monitoring insider transactions as part of a comprehensive investment strategy.

As always, it's crucial to consider a range of factors when evaluating a stock, including the company's financial health, market conditions, and industry trends. Investors should also consider their own investment goals and risk tolerance.

This article first appeared on GuruFocus.