Insider Sell: President and CEO Edward Meyercord Sells 28,443 Shares of Extreme Networks Inc (EXTR)

Edward Meyercord, the President and CEO of Extreme Networks Inc, has recently made a significant change in his holdings of the company's stock. On December 1, 2023, the insider sold a total of 28,443 shares of Extreme Networks Inc (NASDAQ:EXTR), a notable transaction that has caught the attention of investors and market analysts alike.

Who is Edward Meyercord?

Edward Meyercord has been at the helm of Extreme Networks Inc as the President and CEO, leading the company through various phases of growth and transformation. His tenure has been marked by strategic initiatives aimed at expanding the company's product offerings and market reach. Meyercord's leadership has been instrumental in steering the company through the competitive landscape of network solutions and services.

About Extreme Networks Inc

Extreme Networks Inc is a company that specializes in software-driven networking solutions for enterprise customers. With a focus on delivering end-to-end, cloud-driven networking solutions and top-notch customer service, Extreme Networks provides a comprehensive suite of products and services that cater to a wide range of industries, including education, healthcare, government, and hospitality. The company's innovative approach to networking enables its customers to achieve more efficient and secure connectivity, which is essential in today's digital landscape.

Analysis of Insider Buy/Sell and Relationship with Stock Price

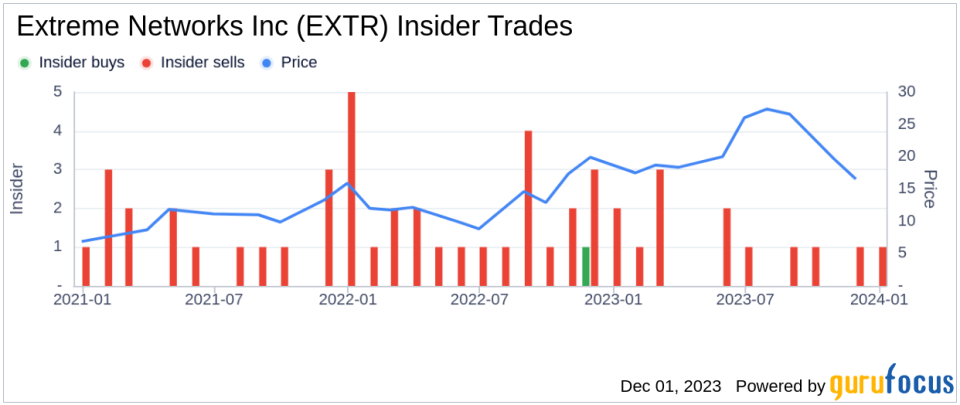

Insider transactions, particularly those involving high-ranking executives, can provide valuable insights into a company's financial health and future prospects. In the case of Extreme Networks Inc, the insider, President and CEO Edward Meyercord, has a history of selling shares over the past year, with a total of 156,886 shares sold and no shares purchased. This pattern of selling could be interpreted in various ways by investors.

On one hand, insiders may sell shares for personal financial reasons that do not necessarily reflect their outlook on the company's future. On the other hand, consistent selling by insiders, especially without any corresponding insider purchases, might raise questions about their confidence in the company's stock and its valuation.

The recent sale of 28,443 shares by Meyercord occurred when the stock was trading at $16.32 per share, giving Extreme Networks Inc a market cap of $2.121 billion. This transaction follows the broader trend of insider selling over the past year, with 12 insider sells and no insider buys recorded.

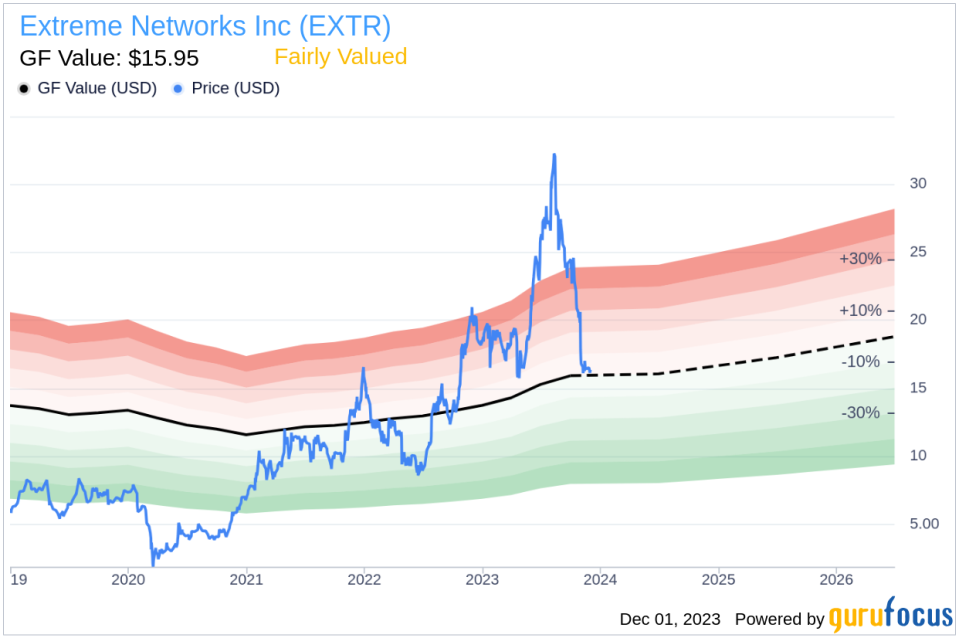

When analyzing the relationship between insider transactions and stock price, it's important to consider the company's valuation metrics. Extreme Networks Inc's price-earnings ratio stands at 23.40, slightly above the industry median of 22.64 but below the company's historical median. This suggests that the stock may be fairly valued or even slightly overvalued compared to its peers and its own historical standards.

Moreover, with a current stock price of $16.32 and a GuruFocus Value (GF Value) of $15.95, the price-to-GF-Value ratio is 1.02, indicating that the stock is Fairly Valued based on its intrinsic value estimate. The GF Value is calculated considering historical trading multiples, a GuruFocus adjustment factor, and future business performance estimates from analysts.

Given the stock's current valuation and the insider's recent sell transaction, investors may want to closely monitor any further insider activity for signs of how the company's top executives view the stock's future prospects. While the insider's sell transactions alone do not necessarily predict the stock's future movement, they are a piece of the puzzle that investors should consider when evaluating their investment decisions.

Conclusion

Edward Meyercord's recent sale of 28,443 shares of Extreme Networks Inc is a significant event that warrants attention from the investment community. While the reasons behind the insider's decision to sell may vary, the consistent pattern of insider selling over the past year could be a signal for investors to watch closely. With the stock currently deemed Fairly Valued based on the GF Value, investors should weigh the insider's actions alongside other financial metrics and market conditions to make informed investment choices.

As always, it's crucial for investors to conduct their own due diligence and consider a multitude of factors, including insider transactions, company performance, industry trends, and broader market dynamics, before making any investment decisions.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.