Insider Sell: President & CEO Julian Francis Sells Shares of Beacon Roofing Supply Inc (BECN)

Beacon Roofing Supply Inc (NASDAQ:BECN), a leading distributor of roofing materials and complementary building products, has recently seen a significant insider sell by its President & CEO, Julian Francis. On November 20, 2023, the insider executed a sale of 7,013 shares of the company's stock. This transaction has caught the attention of investors and market analysts, as insider activity can often provide valuable insights into a company's financial health and future prospects.

Who is Julian Francis?

Julian Francis has been serving as the President and CEO of Beacon Roofing Supply Inc since September 2019. With a wealth of experience in the building materials industry, Francis has been instrumental in steering the company through the dynamic and competitive landscape of the roofing supply sector. His leadership has been pivotal in the company's strategic initiatives and growth plans, making his trading activities particularly noteworthy for investors and analysts alike.

Beacon Roofing Supply Inc's Business Description

Beacon Roofing Supply Inc is a prominent player in the North American building materials distribution industry. The company specializes in residential and commercial roofing products, as well as complementary building products such as siding, windows, and waterproofing systems. With a vast network of branches and a robust distribution system, Beacon Roofing Supply Inc is well-positioned to serve contractors, home builders, and homeowners across the United States and Canada.

Analysis of Insider Buy/Sell and Relationship with Stock Price

Insider trading activities, including both buys and sells, can provide valuable clues about a company's internal perspective on its stock's value. Over the past year, Julian Francis has sold a total of 7,013 shares and has not made any purchases. This one-sided activity might raise questions about the insider's confidence in the company's future performance.

When analyzing the broader insider transaction history for Beacon Roofing Supply Inc, we observe that there have been 4 insider buys and 9 insider sells over the past year. This trend suggests a tilt towards selling, which could be interpreted in various ways. It might indicate that insiders are taking profits after a period of stock appreciation or that they perceive the stock to be fully valued at current levels.

On the day of the insider's recent sell, shares of Beacon Roofing Supply Inc were trading at $80.28, giving the company a market cap of $5,115.769 million. This price point is particularly interesting when considering the company's valuation in relation to the GuruFocus Value (GF Value).

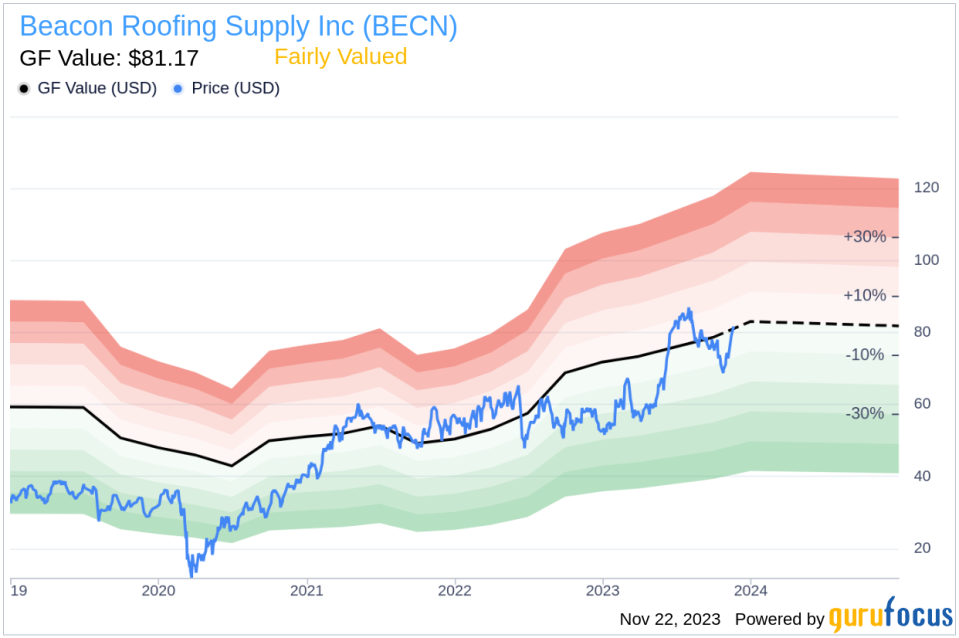

With a price of $80.28 and a GF Value of $81.17, Beacon Roofing Supply Inc has a price-to-GF-Value ratio of 0.99, indicating that the stock is Fairly Valued based on its GF Value. The GF Value is a proprietary intrinsic value estimate developed by GuruFocus, which factors in historical trading multiples, a GuruFocus adjustment factor based on past returns and growth, and future business performance estimates from Morningstar analysts.

It is important to note that while the stock appears to be fairly valued, the insider's decision to sell could be based on a variety of personal or professional reasons that may not necessarily reflect a bearish view on the company's valuation or prospects.

The insider trend image above provides a visual representation of the insider trading activities over the past year. The pattern of insider sells, including the recent transaction by Julian Francis, can be juxtaposed against the stock's price movement to search for correlations. However, without additional context, it is challenging to draw definitive conclusions from this data alone.

The GF Value image offers a snapshot of Beacon Roofing Supply Inc's valuation metrics and how the current stock price compares to the calculated GF Value. This comparison can be a useful tool for investors considering whether the stock is trading at a discount or premium relative to its intrinsic value.

Conclusion

The recent insider sell by President & CEO Julian Francis of Beacon Roofing Supply Inc is a transaction that warrants attention from the investment community. While the company's stock appears to be fairly valued according to the GF Value, the pattern of insider sells over the past year could suggest a cautious stance from those with intimate knowledge of the company's operations and market position.

Investors should consider insider trading activity as one of many factors in their investment decision-making process. It is essential to conduct thorough due diligence, examining the company's financials, industry trends, and broader market conditions before making any investment decisions. As always, a well-rounded approach that includes multiple data points will provide the most robust foundation for understanding the potential risks and rewards associated with investing in Beacon Roofing Supply Inc or any other stock.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.