Insider Sell: President & COO David Novack Sells 40,000 Shares of Dynavax Technologies Corp

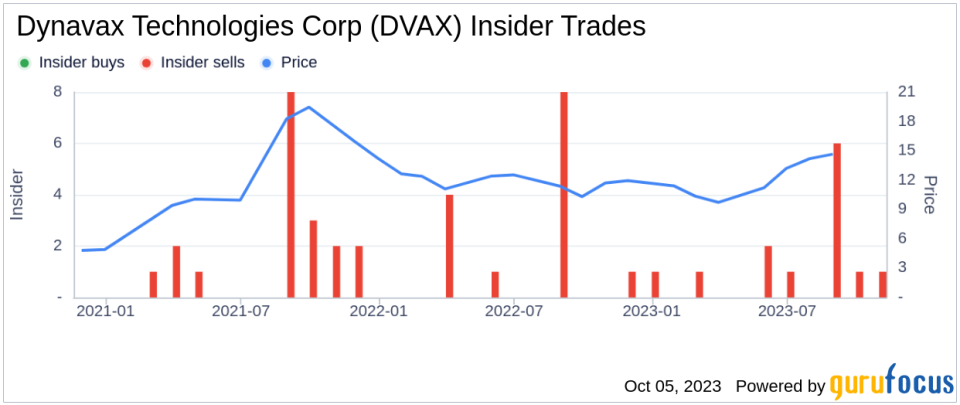

On October 2, 2023, David Novack, President & COO of Dynavax Technologies Corp (NASDAQ:DVAX), sold 40,000 shares of the company. This move comes as part of a series of transactions by the insider over the past year, during which Novack has sold a total of 169,719 shares and purchased none.

Dynavax Technologies Corp is a biopharmaceutical company focused on leveraging the power of the body's innate and adaptive immune responses through toll-like receptor (TLR) stimulation. The company's lead product candidates are HEPLISAV-B, a hepatitis B vaccine, and SD-101, a cancer immunotherapy. The company is based in Berkeley, California.

The insider's recent sell-off is part of a broader trend within Dynavax Technologies Corp. Over the past year, there have been 15 insider sells and no insider buys. This trend could be a signal to investors about the insider's perspective on the company's future prospects.

On the day of the insider's recent sell, shares of Dynavax Technologies Corp were trading at $14.88, giving the company a market cap of $1.848 billion. The price-earnings ratio stood at 19.92, lower than the industry median of 23.03 but higher than the companys historical median price-earnings ratio.

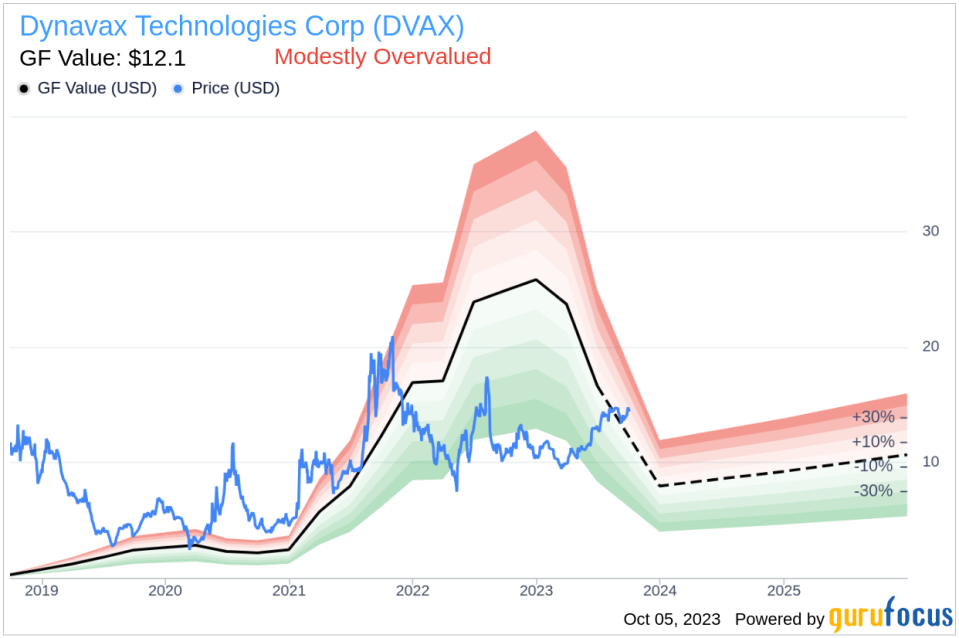

According to the GuruFocus Value, which is an intrinsic value estimate based on historical multiples, a GuruFocus adjustment factor, and future estimates of business performance, Dynavax Technologies Corp is modestly overvalued. The stock's price-to-GF-Value ratio is 1.23, with a GF Value of $12.10 and a current price of $14.88.

The insider's decision to sell a significant number of shares could be interpreted in various ways. It might indicate a lack of confidence in the company's future prospects, or it could simply be a personal financial decision. Regardless, investors should always consider insider trading trends as one of many factors in their investment decisions.

As always, it's crucial to conduct thorough research and consider a company's performance, industry trends, and market conditions before making investment decisions. Insider trading activity, such as that of David Novack, can provide valuable insights, but it should not be the sole basis for any investment decision.

This article first appeared on GuruFocus.