Insider Sell: President & COO David Novack Sells 40,000 Shares of Dynavax Technologies Corp ...

On August 8, 2023, David Novack, President & COO of Dynavax Technologies Corp (NASDAQ:DVAX), sold 40,000 shares of the company. This move comes amidst a year where Novack has sold a total of 109,719 shares and purchased none.

Dynavax Technologies Corp is a biopharmaceutical company focused on leveraging the power of the body's innate and adaptive immune responses through toll-like receptor (TLR) stimulation. The company's lead product candidates are HEPLISAV-B, a hepatitis B vaccine, and SD-101, a cancer immunotherapy. These are built on its proprietary immunostimulatory platform. The company's pipeline also includes DV281, an investigational TLR9 agonist for the treatment of lung cancer.

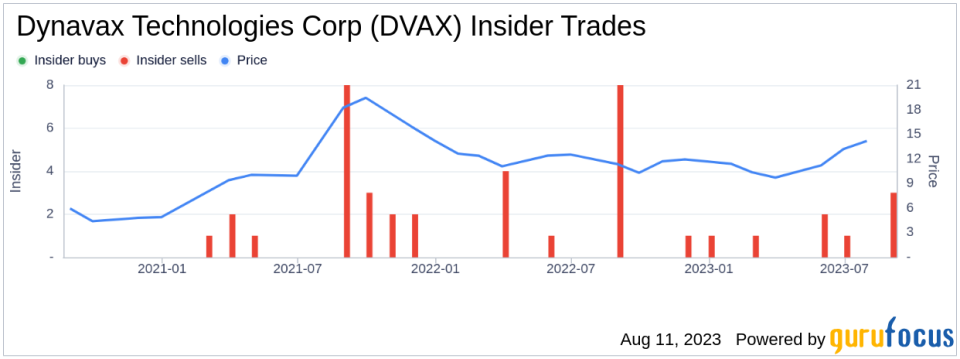

The insider transaction history for Dynavax Technologies Corp shows a trend of selling over the past year, with 11 insider sells and no insider buys. This could be indicative of the insiders' perception of the company's future performance. However, it's important to note that insider selling does not necessarily imply a negative outlook. Insiders may sell shares for personal reasons unrelated to the company's performance.

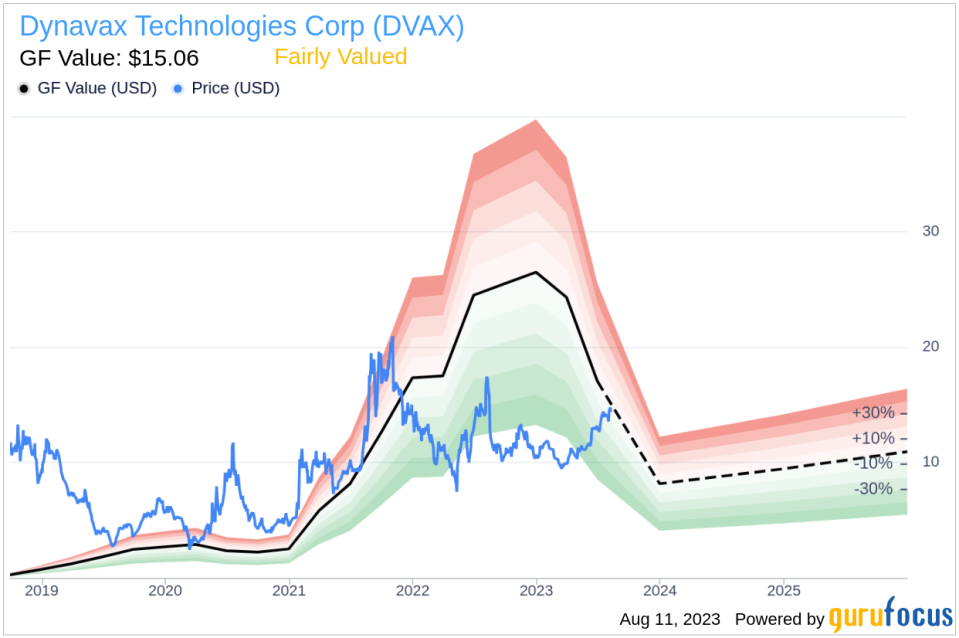

As of the day of Novack's recent sell, shares of Dynavax Technologies Corp were trading at $14.87, giving the company a market cap of $1.848 billion. The price-earnings ratio stands at 19.93, lower than the industry median of 23.05 but higher than the company's historical median price-earnings ratio.

The GuruFocus Value for Dynavax Technologies Corp is $15.06, resulting in a price-to-GF-Value ratio of 0.99. This suggests that the stock is fairly valued based on its GF Value. The GF Value is an intrinsic value estimate developed by GuruFocus, calculated based on historical multiples, a GuruFocus adjustment factor based on the company's past returns and growth, and future estimates of business performance from Morningstar analysts.

In conclusion, while the recent insider sell by David Novack may raise eyebrows, it's crucial to consider the broader context. The stock appears to be fairly valued, and the company's business model remains robust. Investors should keep a close eye on Dynavax Technologies Corp's performance and any future insider transactions.

This article first appeared on GuruFocus.