Insider Sell: President & COO David Novack Sells 20,000 Shares of Dynavax Technologies Corp

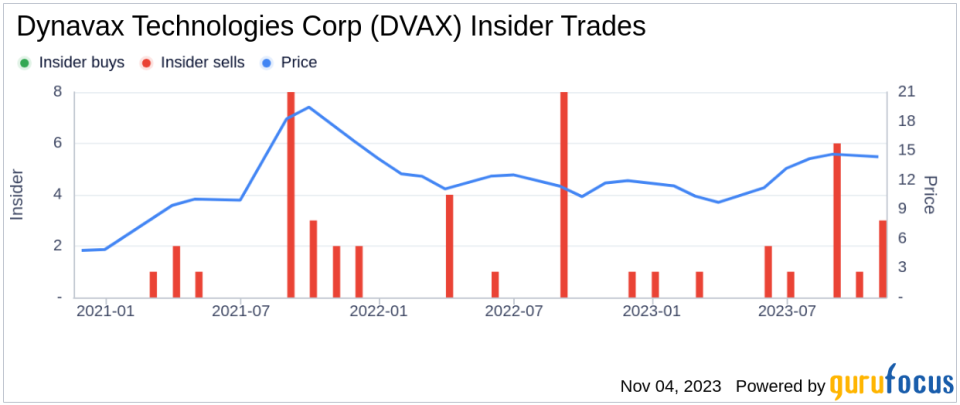

On November 1, 2023, David Novack, President & COO of Dynavax Technologies Corp (NASDAQ:DVAX), sold 20,000 shares of the company. This move is part of a larger trend for the insider, who over the past year has sold a total of 189,719 shares and purchased none.

Dynavax Technologies Corp is a biopharmaceutical company focused on leveraging the power of the body's innate and adaptive immune responses through toll-like receptor (TLR) stimulation. The company's lead product candidates are HEPLISAV-B, a hepatitis B vaccine, and SD-101, a cancer immunotherapy. These are built on its proprietary immunostimulatory platform. The company's pipeline also includes preclinical programs for autoimmune and inflammatory diseases.

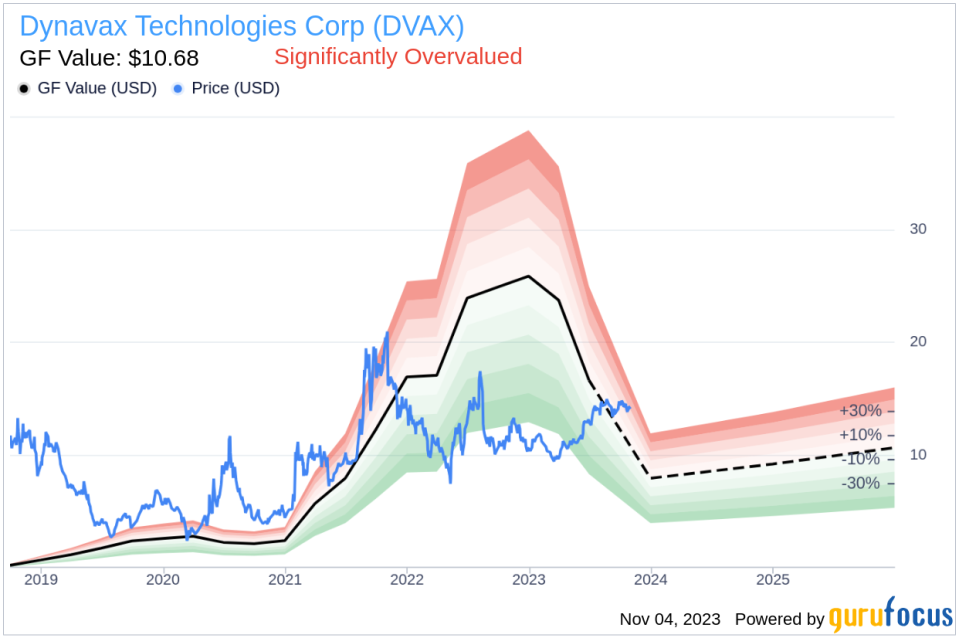

The insider's recent sell comes at a time when the stock is trading at $14.12 per share, giving the company a market cap of $1.838 billion. The price-earnings ratio stands at 19.75, lower than the industry median of 22.56 but higher than the companys historical median price-earnings ratio.

According to the GuruFocus Value, which is an intrinsic value estimate based on historical multiples, a GuruFocus adjustment factor, and future estimates of business performance, the stock is significantly overvalued. The price-to-GF-Value ratio stands at 1.32, indicating that the stock is trading above its intrinsic value.

The insider's decision to sell shares could be interpreted in various ways. It could be a personal financial decision or it could be based on the insider's assessment of the company's current valuation and future prospects. However, it's important to note that insider selling does not necessarily indicate a negative outlook for the company. Insiders may sell shares for reasons unrelated to the company's performance or prospects.

Over the past year, there have been 17 insider sells and no insider buys at Dynavax Technologies Corp. This trend could be a signal to investors to pay close attention to the company's performance and valuation metrics. While the insider's recent sell does not necessarily indicate a negative outlook for the company, it does underscore the importance of conducting thorough research and analysis before making investment decisions.

As always, it's crucial to consider a wide range of factors when evaluating a stock, including the company's financial health, market conditions, and industry trends, in addition to insider trading activity.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.