Insider Sell: President Elan Moriah Sells 2,270 Shares of Verint Systems Inc

On September 13, 2023, President Elan Moriah sold 2,270 shares of Verint Systems Inc (NASDAQ:VRNT). This move is part of a series of transactions made by the insider over the past year, which have seen a total of 87,464 shares sold and no shares purchased.

Elan Moriah is a key figure at Verint Systems Inc, serving as the company's President. Verint Systems Inc is a leading provider of Actionable Intelligence solutions and value-added services worldwide. Its solutions capture and analyze complex, underused information sources, such as voice, video, and unstructured text. The company's mission is to help organizations make more informed, effective, and timely decisions.

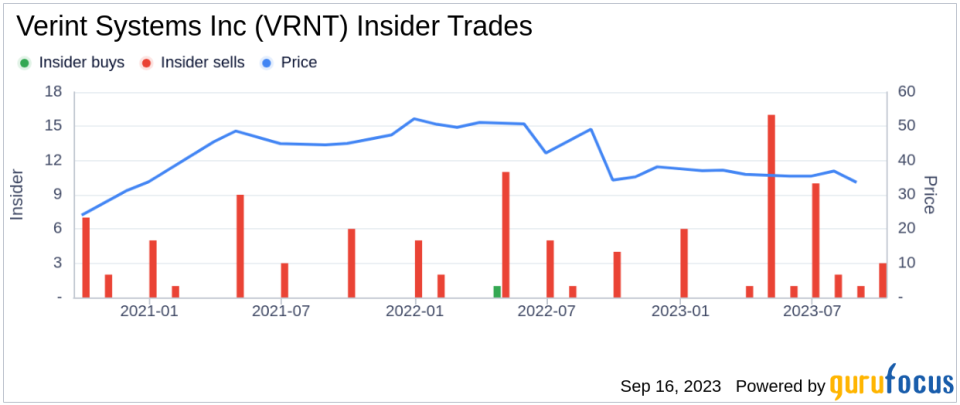

The insider's recent sell-off is part of a broader trend within the company. Over the past year, there have been 40 insider sells and no insider buys. This trend is illustrated in the following image:

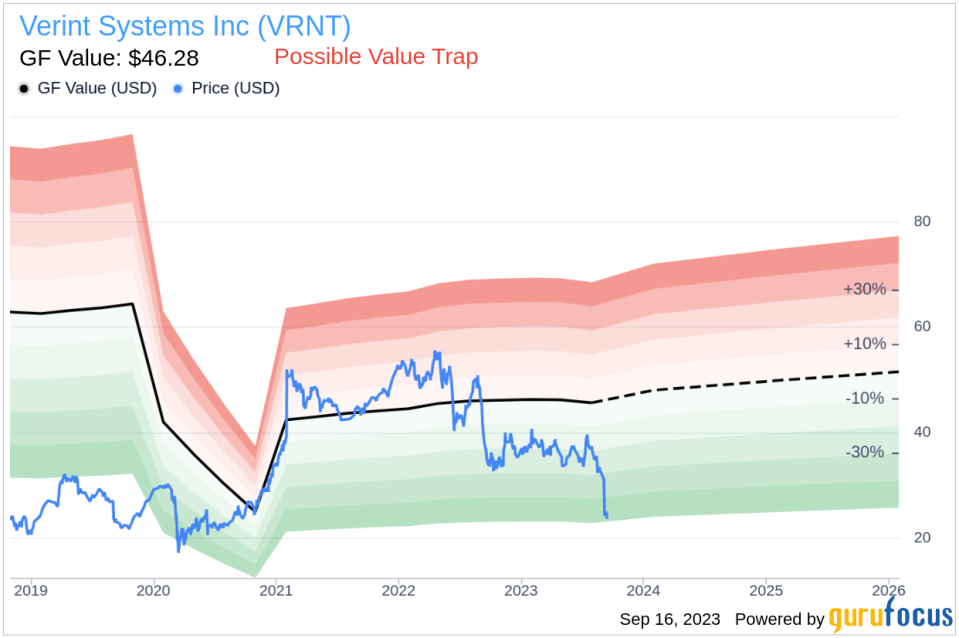

On the day of the insider's recent sell, shares of Verint Systems Inc were trading for $24.94 apiece, giving the stock a market cap of $1.519 billion. Despite the insider's sell-off, the stock's price-to-GF-Value ratio of 0.54 suggests that it may be undervalued. This is further supported by the company's GuruFocus Value of $46.28, as shown in the following image:

The GF Value is an intrinsic value estimate developed by GuruFocus. It is calculated based on historical multiples (price-earnings ratio, price-sales ratio, price-book ratio, and price-to-free cash flow) that the stock has traded at, a GuruFocus adjustment factor based on the companys past returns and growth, and future estimates of business performance from Morningstar analysts.

While the insider's recent sell-off may raise some eyebrows, it's important to consider the broader context. The stock's low price-to-GF-Value ratio suggests that it may be undervalued, and the company's strong fundamentals could make it an attractive investment opportunity. However, potential investors should always conduct their own due diligence and consider the company's overall insider trading trends before making a decision.

This article first appeared on GuruFocus.