Insider Sell: President Jeff Walsh Sells 17,864 Shares of loanDepot Inc (LDI)

On September 11, 2023, President of LDI Mortgage, Jeff Walsh, sold 17,864 shares of loanDepot Inc (NYSE:LDI). This move comes amidst a flurry of insider activity at the company, with a notable trend towards selling.

Jeff Walsh is a key figure at loanDepot Inc, serving as the President of LDI Mortgage. His role involves overseeing the company's operations and strategic direction, making his trading activities particularly noteworthy for investors.

loanDepot Inc is a leading retail mortgage lender in the United States. The company provides a range of loan products, including home purchase and refinance loans. It operates through a network of retail locations and also offers its services online, making it accessible to a broad range of customers.

Over the past year, the insider has sold a total of 1,078,429 shares and has not made any purchases. This trend is mirrored in the wider company, with 78 insider sells and only 4 insider buys over the same period.

The high volume of insider selling could be a cause for concern for potential investors. It's often said that insiders sell their shares for many reasons, but they buy them for only one: they think the price will rise. In this case, the high number of sells could indicate that insiders believe the stock is overvalued.

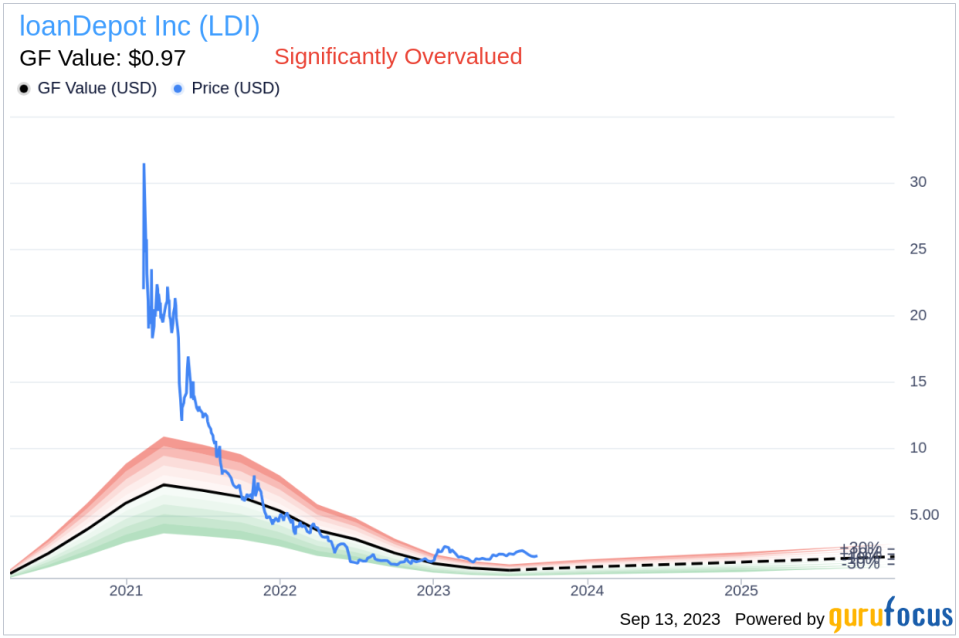

On the day of the insider's recent sell, shares of loanDepot Inc were trading for $1.98 each, giving the company a market cap of $336.01 million. However, the GuruFocus Value of the stock is only $0.97, indicating that the stock is significantly overvalued with a price-to-GF-Value ratio of 2.04.

The GF Value is an intrinsic value estimate developed by GuruFocus. It is calculated based on historical multiples that the stock has traded at, a GuruFocus adjustment factor based on the companys past returns and growth, and future estimates of business performance from Morningstar analysts.

In conclusion, the recent insider sell by Jeff Walsh, coupled with the high price-to-GF-Value ratio, could suggest that loanDepot Inc's stock is currently overvalued. Investors should carefully consider these factors when making their investment decisions.

This article first appeared on GuruFocus.