Insider Sell: President Marcio Sandri Sells 6,111 Shares of Owens-Corning Inc

In a notable insider transaction, President of Composites, Marcio Sandri, sold 6,111 shares of Owens-Corning Inc (NYSE:OC) on December 15, 2023. This sale has caught the attention of investors and analysts who closely monitor insider activities as an indicator of a company's financial health and future performance. Marcio Sandri's role within Owens-Corning Inc positions him with a deep understanding of the company's operations and prospects, making his trading activities particularly noteworthy.

Marcio Sandri has been associated with Owens-Corning Inc, a company known for its comprehensive range of insulation, roofing, and fiberglass composite materials. His position as President of the Composites segment involves overseeing a critical division within the company, which contributes significantly to its overall revenue and strategic direction. Sandri's tenure and experience within the company provide him with unique insights into the market dynamics and internal factors that could influence Owens-Corning's stock performance.

Owens-Corning Inc is a global leader in the production of insulation, roofing, and fiberglass composites. The company's products are essential in residential and commercial construction, as well as in various industrial applications. With a commitment to sustainability and innovation, Owens-Corning Inc has established a strong reputation for delivering high-quality materials that meet the evolving needs of its customers.

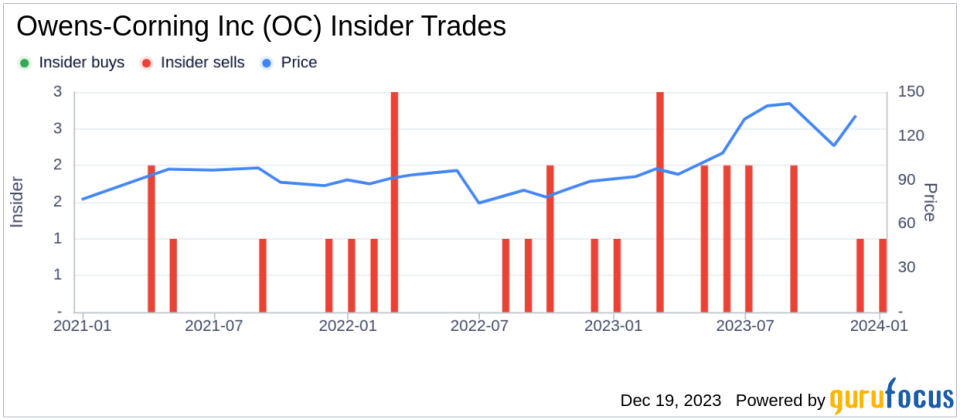

The insider's recent transaction follows a pattern observed over the past year, where Marcio Sandri has sold a total of 14,111 shares and has not made any purchases. This selling trend raises questions about the insider's confidence in the company's future growth and valuation.

The broader insider transaction history for Owens-Corning Inc reveals a lack of insider buying over the past year, with zero insider purchases recorded. On the other hand, there have been 14 insider sells during the same period, suggesting a possible consensus among insiders about the stock's valuation or future prospects.

On the day of the insider's recent sale, shares of Owens-Corning Inc were trading at $152.47, giving the company a market cap of $13,232.592 billion. This valuation reflects the market's assessment of the company's worth, factoring in its financial performance, growth potential, and industry position.

The price-earnings ratio of Owens-Corning Inc stands at 11.47, which is lower than the industry median of 14.87 and also below the company's historical median price-earnings ratio. This lower P/E ratio could indicate that the stock is undervalued compared to its peers or that investors have tempered expectations for the company's earnings growth.

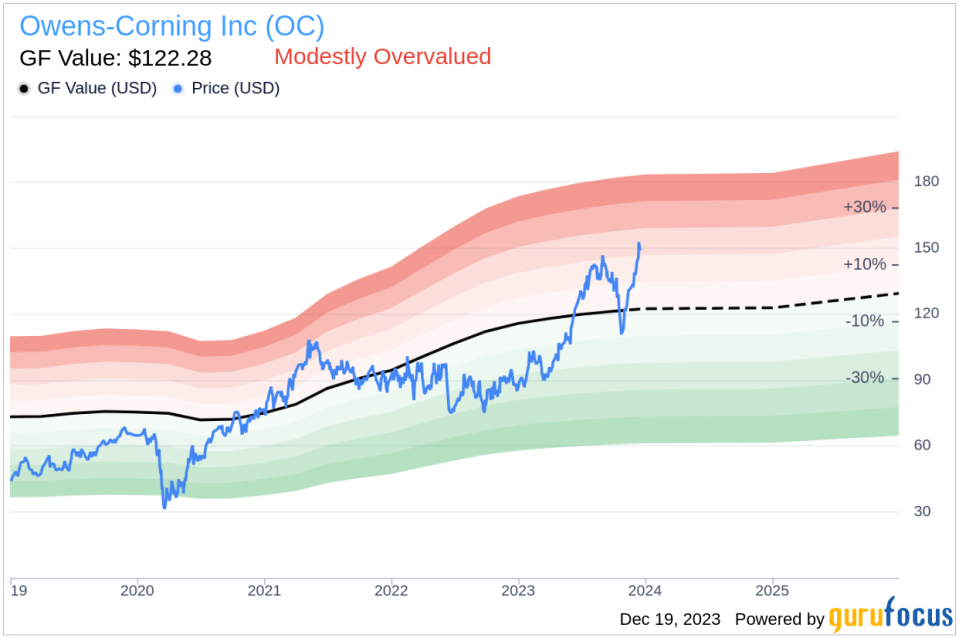

When considering the stock's valuation in relation to the GuruFocus Value, Owens-Corning Inc appears to be modestly overvalued. With a share price of $152.47 and a GuruFocus Value of $122.28, the price-to-GF-Value ratio is 1.25. This suggests that the stock is trading above its intrinsic value estimate as per GuruFocus's calculations.

The GF Value is a proprietary metric developed by GuruFocus, which takes into account historical trading multiples, a GuruFocus adjustment factor based on past returns and growth, and future business performance estimates from Morningstar analysts. This comprehensive approach to valuation aims to provide a more nuanced view of a stock's worth.

The insider trend image above illustrates the recent selling activities of insiders at Owens-Corning Inc. This visual representation can help investors discern patterns and make more informed decisions regarding their investments in the company.

The GF Value image provides a graphical representation of Owens-Corning Inc's current stock price in relation to its intrinsic value. This can be a useful tool for investors looking to gauge whether the stock is trading at a premium or discount to its estimated fair value.

In conclusion, the insider selling activity by Marcio Sandri, particularly in the absence of insider buying, may signal caution to some investors. However, it is essential to consider that insider transactions are influenced by various factors, including personal financial planning, diversification of assets, and market conditions. As such, while insider trends can provide valuable insights, they should be evaluated alongside a comprehensive analysis of the company's financials, industry trends, and broader market indicators before making investment decisions.

Investors and analysts will continue to monitor insider activities at Owens-Corning Inc, as these can offer clues about the company's internal perspective on its valuation and future prospects. As always, a balanced approach that considers multiple data points will be key in making informed investment choices.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.