Insider Sell: President Steven Fendley Divests 14,000 Shares of Kratos Defense & Security ...

In a notable insider transaction, Steven Fendley, President of the US Division at Kratos Defense & Security Solutions Inc (NASDAQ:KTOS), sold 14,000 shares of the company's stock. The sale took place on November 21, 2023, and has caught the attention of investors and market analysts. Understanding the context and implications of such insider activity is crucial for stakeholders and potential investors.

Who is Steven Fendley?

Steven Fendley is an integral part of Kratos Defense & Security Solutions Inc, serving as the President of the US Division. His role involves overseeing the strategic direction and operational execution within the division, which is a significant contributor to the company's overall success. Fendley's insider status provides him with a deep understanding of the company's operations, challenges, and growth opportunities.

About Kratos Defense & Security Solutions Inc

Kratos Defense & Security Solutions Inc is a specialized national security technology company. The firm is engaged in providing mission-critical products, solutions, and services for United States national security priorities. Kratos' core capabilities include unmanned systems, satellite communications, cybersecurity/warfare, microwave electronics, missile defense, hypersonic systems, training, and combat systems. The company's unique products and services are designed to support government and commercial clients.

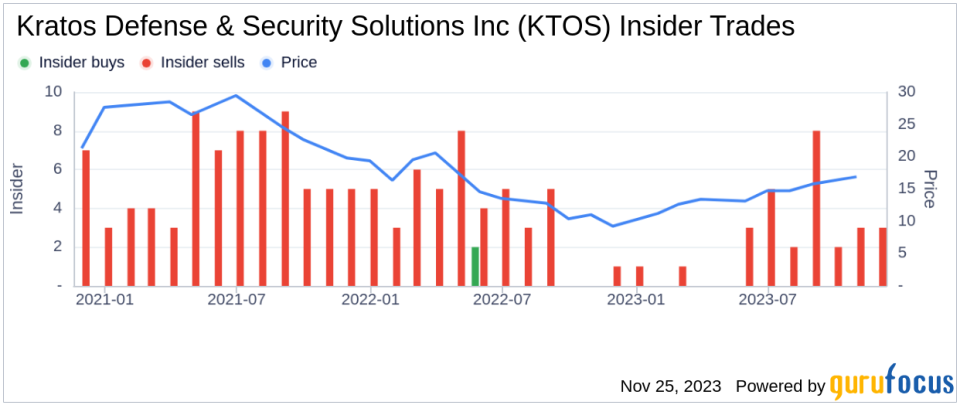

Analysis of Insider Buy/Sell and Stock Price Relationship

The recent sale by Steven Fendley of 14,000 shares is part of a broader pattern of insider activity at Kratos Defense & Security Solutions Inc. Over the past year, Fendley has sold a total of 81,000 shares and has not made any purchases. This could signal a variety of things, from personal financial planning to a belief that the stock may be fully valued.The insider transaction history for Kratos Defense & Security Solutions Inc shows a trend of more insider selling than buying over the past year, with 29 insider sells and no insider buys. This trend can sometimes indicate that insiders believe the stock may not have much room for growth or that they perceive the current stock price as being on the higher end of the company's value.

On the day of Fendley's recent sale, shares of Kratos Defense & Security Solutions Inc were trading at $18.8, giving the company a market cap of $2.509 billion. This price point is particularly interesting when considering the company's valuation metrics.

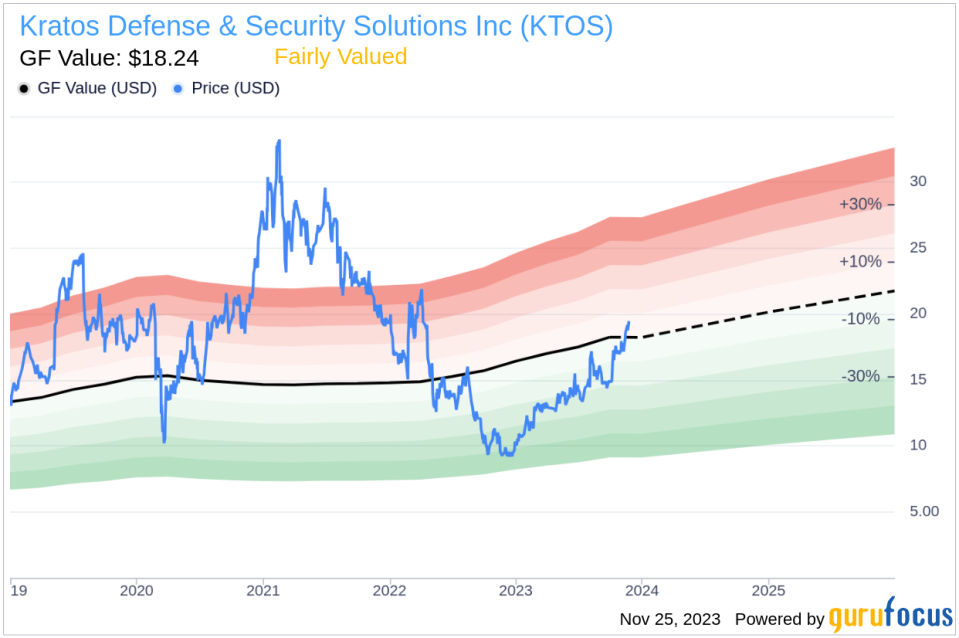

Valuation and GF Value

With a trading price of $18.8 and a GuruFocus Value (GF Value) of $18.24, Kratos Defense & Security Solutions Inc has a price-to-GF-Value ratio of 1.03. This suggests that the stock is Fairly Valued based on its GF Value. The GF Value is a proprietary intrinsic value estimate from GuruFocus, which takes into account historical trading multiples, a GuruFocus adjustment factor based on past returns and growth, and future business performance estimates from analysts.

The close alignment between the stock's trading price and the GF Value indicates that the market is pricing Kratos Defense & Security Solutions Inc's shares in a way that reflects its estimated true value. This could mean that the insider's decision to sell shares is not necessarily based on an undervaluation of the stock but rather on a perception that the stock is appropriately valued or for personal financial reasons.

Conclusion

The insider selling activity by Steven Fendley at Kratos Defense & Security Solutions Inc, particularly the recent sale of 14,000 shares, provides investors with information to consider when evaluating the stock. While insider sells can sometimes raise concerns about a company's future prospects, the current valuation metrics suggest that Kratos Defense & Security Solutions Inc is fairly valued in the market.Investors should consider the insider trends, the company's business description, and the GF Value analysis when making investment decisions. It is also important to look at the broader market conditions, the company's financial performance, and other factors that could influence the stock price. As always, insider transactions are just one piece of the puzzle when it comes to assessing a company's investment potential.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.