Insider Sell: Prothena Corp PLC's Chief Legal Officer Michael Malecek Sells 5,000 Shares

On September 27, 2023, Michael Malecek, the Chief Legal Officer of Prothena Corp PLC (NASDAQ:PRTA), sold 5,000 shares of the company. This move is part of a trend for the insider, who over the past year has sold a total of 140,000 shares and purchased none.

Michael Malecek is a key figure at Prothena Corp PLC, serving as the company's Chief Legal Officer. His role involves overseeing the company's legal affairs, including corporate governance, intellectual property, litigation, and securities compliance, among other areas. His insider trading activities, therefore, are closely watched by investors for insights into the company's performance and prospects.

Prothena Corp PLC is a clinical-stage neuroscience company engaged in the discovery and development of novel therapies with the potential to fundamentally change the course of progressive, life-threatening diseases. The company's pipeline includes treatments for diseases such as Parkinson's and Alzheimer's.

The insider transaction history for Prothena Corp PLC shows a clear trend: over the past year, there have been no insider buys and 66 insider sells. This could suggest that insiders at the company believe the stock is currently overvalued, prompting them to sell their shares.

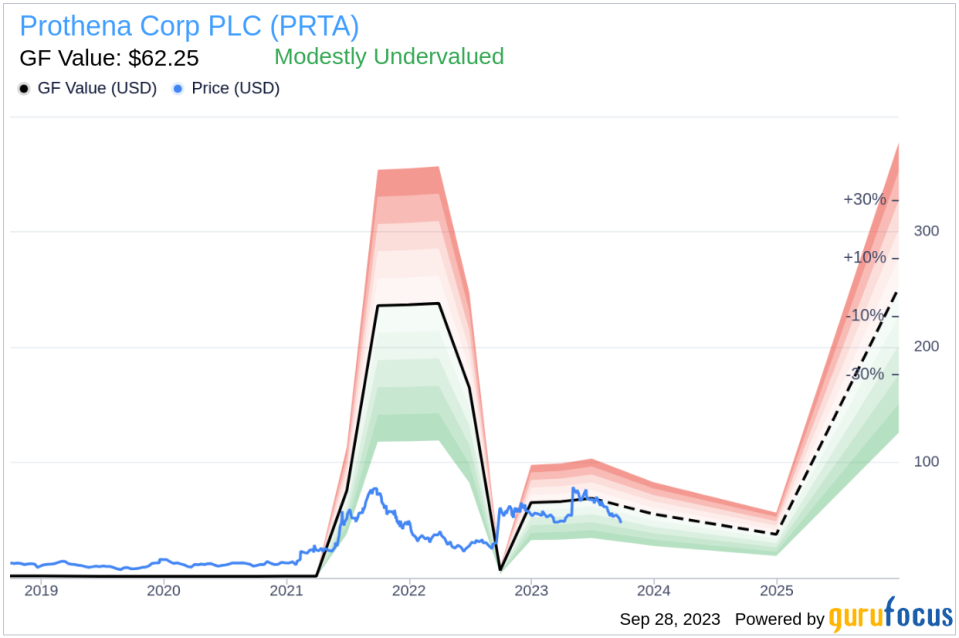

On the day of the insider's recent sell, shares of Prothena Corp PLC were trading at $47.38 apiece, giving the stock a market cap of $2.54 billion.

However, according to the GuruFocus Value, which is an intrinsic value estimate based on historical multiples, a GuruFocus adjustment factor, and future business performance estimates, the stock is modestly undervalued. With a price of $47.38 and a GuruFocus Value of $62.25, Prothena Corp PLC has a price-to-GF-Value ratio of 0.76.

This discrepancy between the stock's current price and its GF Value could suggest that, despite the recent insider sell, the stock may still present a good investment opportunity. However, potential investors should also consider the insider's trading activities and the overall trend of insider sells at the company when making their decision.

In conclusion, while the insider's recent sell of Prothena Corp PLC shares may raise some concerns, the stock's modest undervaluation according to the GF Value could still make it an attractive investment. As always, potential investors should conduct their own thorough research before making any investment decisions.

This article first appeared on GuruFocus.