Insider Sell: R Elliott Sells 10,000 Shares of Liberty Energy Inc (LBRT)

On November 3, 2023, R Elliott, the Chief Legal Officer of Liberty Energy Inc (NYSE:LBRT), sold 10,000 shares of the company. This move is part of a larger trend for the insider, who has sold a total of 40,000 shares over the past year and has not made any purchases.

Liberty Energy Inc is a leading player in the energy sector, providing a range of services to support the exploration, extraction, and production of oil and gas. The company's operations span across multiple regions, leveraging advanced technologies and innovative solutions to deliver value to its customers and shareholders.

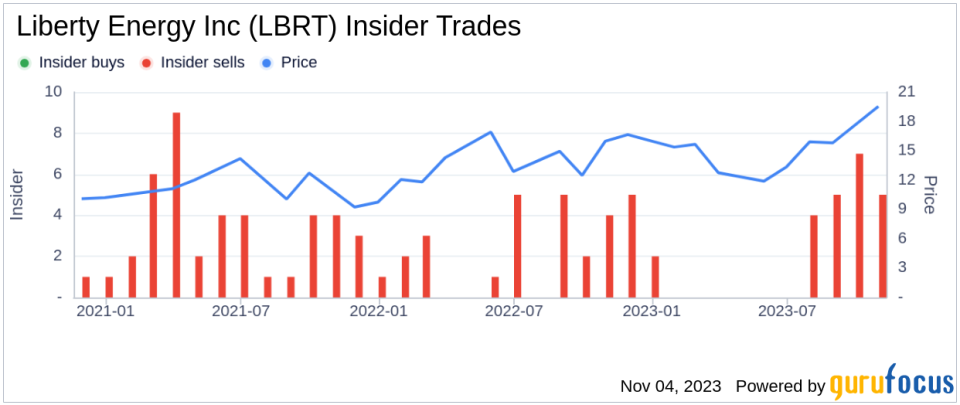

The insider's recent sell-off has raised some eyebrows among investors and market watchers. Over the past year, there have been 28 insider sells and no insider buys for Liberty Energy Inc. This trend is illustrated in the following chart:

The timing of the insider's sell-off coincides with the stock trading at $20.4 per share, giving the company a market cap of $3.41 billion. This is interesting to note as the stock's price-earnings ratio is 5.88, lower than the industry median of 9.09 and also lower than the companys historical median price-earnings ratio.

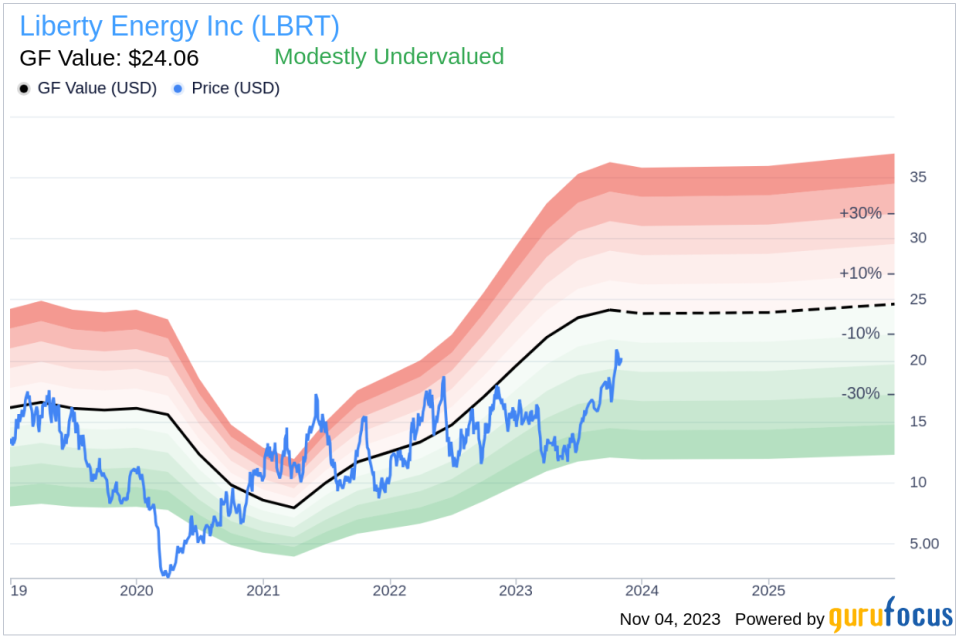

Furthermore, the stock's price-to-GF-Value ratio is 0.85, indicating that the stock is modestly undervalued based on its GF Value of $24.06. The GF Value is an intrinsic value estimate developed by GuruFocus, calculated based on historical multiples, a GuruFocus adjustment factor, and future estimates of business performance from Morningstar analysts. The GF Value is illustrated in the following chart:

The insider's decision to sell at a time when the stock appears to be undervalued could suggest a lack of confidence in the company's future prospects. However, it's also possible that the insider's sell-off is driven by personal financial planning needs rather than a negative outlook on the company.

Regardless of the reasons behind the insider's sell-off, it's always important for investors to consider the broader market context and the specific circumstances of the company before making investment decisions. In the case of Liberty Energy Inc, while the insider's sell-off may raise some concerns, the company's strong position in the energy sector and its undervalued stock price could still make it an attractive investment opportunity.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.