Insider Sell: Robert Traube Sells 83,791 Shares of Zuora Inc

On October 4, 2023, Robert Traube, the Chief Revenue Officer of Zuora Inc (NYSE:ZUO), sold 83,791 shares of the company. This move is part of a series of transactions made by the insider over the past year, which have seen Traube sell a total of 376,774 shares.

Robert Traube is a key figure in Zuora Inc, a leading enterprise software company that provides businesses with subscription billing, commerce, and finance capabilities. The company's cloud-based software is designed to help businesses transition to a subscription-based model, a trend that is increasingly prevalent in today's digital economy.

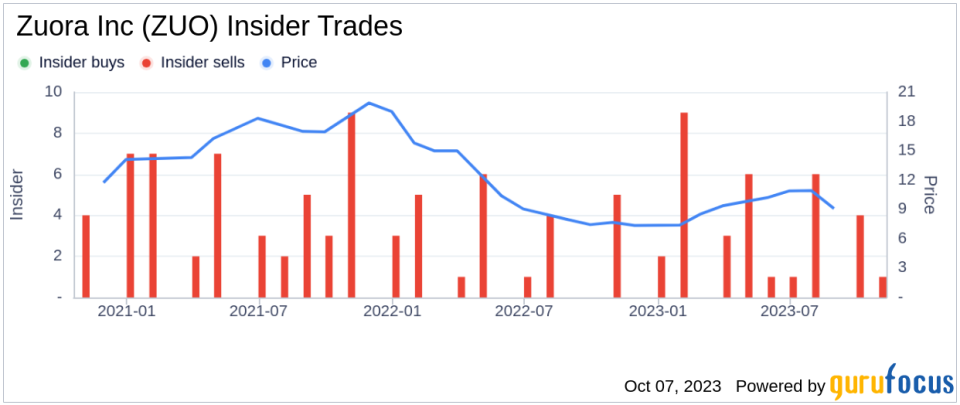

The insider's recent sell-off is part of a broader trend within Zuora Inc. Over the past year, there have been 37 insider sells and no insider buys. This trend is illustrated in the following chart:

The relationship between insider transactions and the stock price is often closely watched by investors. In the case of Zuora Inc, the stock was trading at $7.89 per share on the day of Traube's recent sell, giving the company a market cap of $1.118 billion.

The stock's current price represents a price-to-GF-Value ratio of 0.6, based on a GuruFocus Value of $13.18. This suggests that the stock is a possible value trap, and investors should think twice before buying. The GF Value is calculated based on historical multiples, a GuruFocus adjustment factor, and future business performance estimates from Morningstar analysts. The GF Value for Zuora Inc is shown in the following chart:

In conclusion, the insider's recent sell-off, coupled with the stock's current valuation, suggests that investors should exercise caution when considering Zuora Inc. While the company's business model is well-positioned for the digital economy, the lack of insider buying and the stock's potential status as a value trap are factors that investors should consider.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.