Insider Sell: Rockwell Automation's Scott Genereux Divests 762 Shares

Rockwell Automation Inc (NYSE:ROK), a leader in industrial automation and digital transformation, has recently witnessed an insider sell that has caught the attention of investors and market analysts. Scott Genereux, the Senior Vice President and Chief Revenue Officer of Rockwell Automation, sold 762 shares of the company on December 11, 2023. This transaction has prompted a closer look into the insider's trading behavior and its potential implications for the stock's performance.

Who is Scott Genereux?

Scott Genereux is a seasoned executive with a wealth of experience in the technology and industrial sectors. As the Senior Vice President and Chief Revenue Officer at Rockwell Automation, Genereux is responsible for overseeing the company's global sales and marketing efforts, driving revenue growth, and enhancing customer relationships. His role is pivotal in shaping the company's strategic direction and ensuring its competitive edge in the rapidly evolving industrial automation landscape.

Rockwell Automation Inc's Business Description

Rockwell Automation Inc is a global leader in industrial automation and digital transformation solutions. The company's offerings are designed to help businesses increase productivity, improve efficiency, and enhance safety across various industries. Rockwell Automation's portfolio includes control systems, industrial control components, information software, motor control devices, and safety technology, all integrated under the Connected Enterprise framework. This approach enables customers to connect, manage, and analyze data across their operations, fostering better decision-making and operational excellence.

Analysis of Insider Buy/Sell and Relationship with Stock Price

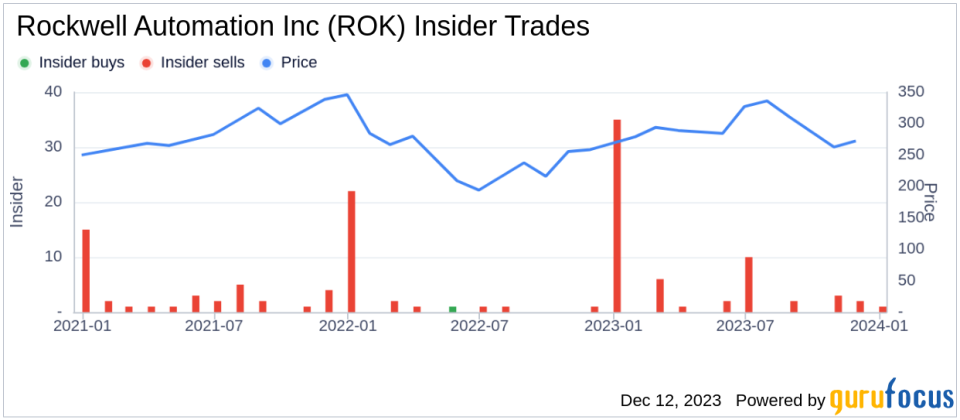

Insider trading activities, such as buys and sells, can provide valuable insights into a company's internal perspective on its stock's valuation. In the case of Rockwell Automation, the insider transaction history reveals a notable pattern: over the past year, there have been no insider buys, while there have been 38 insider sells. This could suggest that insiders, including Scott Genereux, may perceive the stock's current price as being relatively high or may have personal financial planning reasons for selling.

On the day of Genereux's recent sell, shares of Rockwell Automation were trading at $279.45, giving the company a market cap of $32.08 billion. The price-earnings ratio stood at 23.39, slightly above the industry median of 22.48, indicating a higher valuation compared to peers. However, it is also lower than the company's historical median price-earnings ratio, suggesting some level of undervaluation relative to its own past performance.

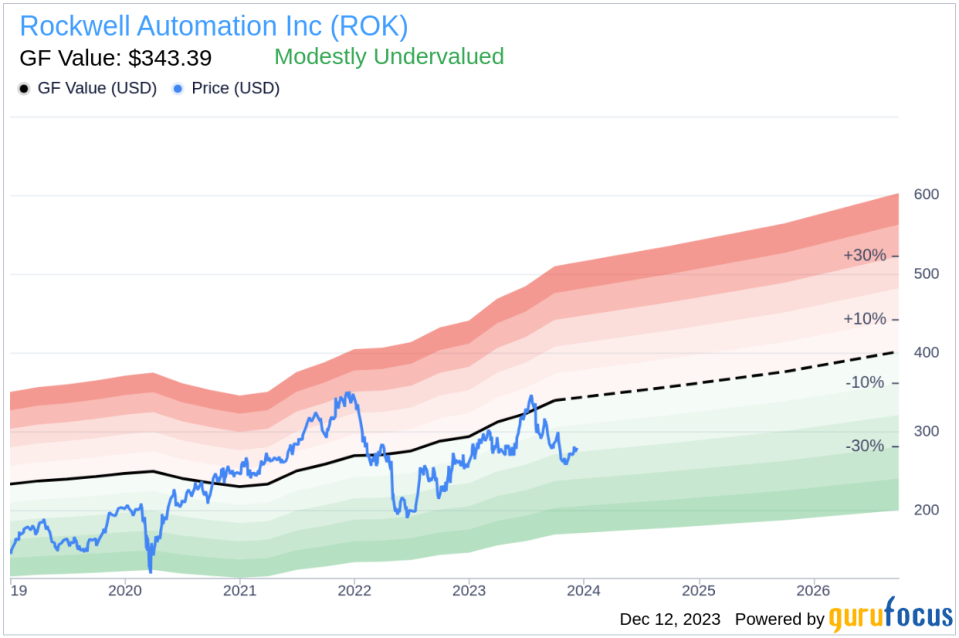

When considering the price-to-GF-Value ratio, which is currently at 0.81, Rockwell Automation Inc appears to be modestly undervalued based on its GF Value of $343.39. This intrinsic value estimate, developed by GuruFocus, takes into account historical trading multiples, a GuruFocus adjustment factor, and future business performance estimates from Morningstar analysts.

The insider trend image above illustrates the recent selling pattern among Rockwell Automation's insiders. This trend can be a critical factor for investors to consider, as it may signal insiders' confidence levels in the company's future prospects.

The GF Value image provides a visual representation of the stock's valuation relative to its intrinsic value. The current modest undervaluation could present an opportunity for investors, especially if the insider selling is not indicative of fundamental issues within the company.

Conclusion

Scott Genereux's recent sale of 762 shares of Rockwell Automation Inc is a transaction that warrants attention from the investment community. While insider sells can be motivated by various factors, they are often scrutinized for potential insights into the company's valuation and future performance. In the context of Rockwell Automation's current valuation metrics and the broader insider selling trend, investors may want to closely monitor the company's financial reports, market developments, and any further insider trading activity to inform their investment decisions.

It is also important to note that insider trading is just one piece of the puzzle when it comes to evaluating a stock's potential. A comprehensive analysis should include a review of the company's financial health, growth prospects, competitive position, and macroeconomic factors. As always, investors are encouraged to conduct their own due diligence and consult with financial advisors before making any investment decisions.

For those interested in following Rockwell Automation's stock and insider trading activities, resources like GuruFocus provide valuable data and analysis tools to stay informed and make data-driven investment choices.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.