Insider Sell: Roger Susi Sells 10,000 Shares of iRadimed Corp (IRMD)

On September 13, 2023, Roger Susi, the CEO, President, Chairman, and 10% Owner of iRadimed Corp (NASDAQ:IRMD), sold 10,000 shares of the company. This move is part of a trend for the insider, who over the past year, has sold a total of 300,000 shares and purchased none.

Roger Susi is a significant figure in iRadimed Corp, holding multiple key positions. His decisions and actions can have a substantial impact on the company's stock price and overall performance. iRadimed Corp is a leading provider of non-magnetic medical devices. They are known for their innovative products, such as the MRI compatible IV infusion pump system and the MRI compatible patient vital signs monitoring system.

The insider's recent sell-off is part of a broader trend within iRadimed Corp. Over the past year, there have been 32 insider sells and no insider buys. This could potentially signal a lack of confidence in the company's future performance, which may impact the stock price.

On the day of the insider's recent sell, iRadimed Corp's shares were trading at $43.87 each, giving the company a market cap of $557.038 million. The price-earnings ratio stood at 38.10, higher than the industry median of 27.46 but lower than the company's historical median price-earnings ratio.

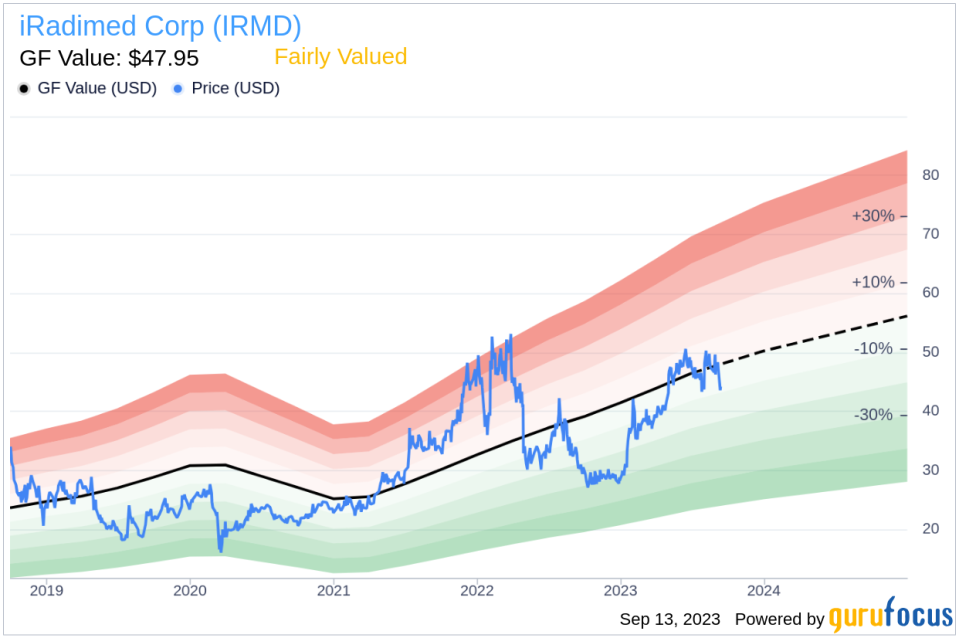

According to GuruFocus Value, which is calculated based on historical multiples, a GuruFocus adjustment factor, and future business performance estimates, iRadimed Corp's stock is fairly valued. With a price of $43.87 and a GuruFocus Value of $47.95, the price-to-GF-Value ratio stands at 0.91.

The insider's decision to sell shares could be based on various factors, including personal financial needs or a belief that the stock is currently overvalued. However, it's essential for investors to consider the broader context, including the company's performance, industry trends, and other insider trading activities. While the insider's sell-off might raise some concerns, the company's fair valuation suggests that the stock is not overpriced at its current trading price.

As always, potential investors should conduct thorough research and consider multiple factors before making investment decisions.

This article first appeared on GuruFocus.