Insider Sell: Senior VP and CFO John Kober Sells 13,703 Shares of MACOM Technology Solutions ...

Senior Vice President and Chief Financial Officer John Kober of MACOM Technology Solutions Holdings Inc (NASDAQ:MTSI) has recently made a significant stock transaction, according to regulatory filings. On November 27, 2023, the insider sold 13,703 shares of the company, a move that has caught the attention of investors and market analysts alike. This article delves into the details of the transaction, the insider's history, and the potential implications for MACOM Technology Solutions Holdings Inc.

Who is John Kober?

John Kober serves as the Senior Vice President and Chief Financial Officer of MACOM Technology Solutions Holdings Inc. In his role, Kober is responsible for overseeing the financial operations of the company, including financial planning and analysis, accounting and reporting, and investor relations. His decisions and actions are closely watched by investors as they can provide insights into the company's financial health and strategic direction.

About MACOM Technology Solutions Holdings Inc

MACOM Technology Solutions Holdings Inc is a leading provider of high-performance analog semiconductor solutions that enable next-generation internet applications, the cloud infrastructure, and modern, intelligent applications. The company's products are essential components in the complex electronics that drive advancements in communication infrastructure, including high-speed networks that connect cities and data centers, as well as military and aerospace systems. MACOM's semiconductors are also used in a variety of industrial and medical applications, showcasing the company's broad reach in the tech sector.

Analysis of Insider Buy/Sell and Relationship with Stock Price

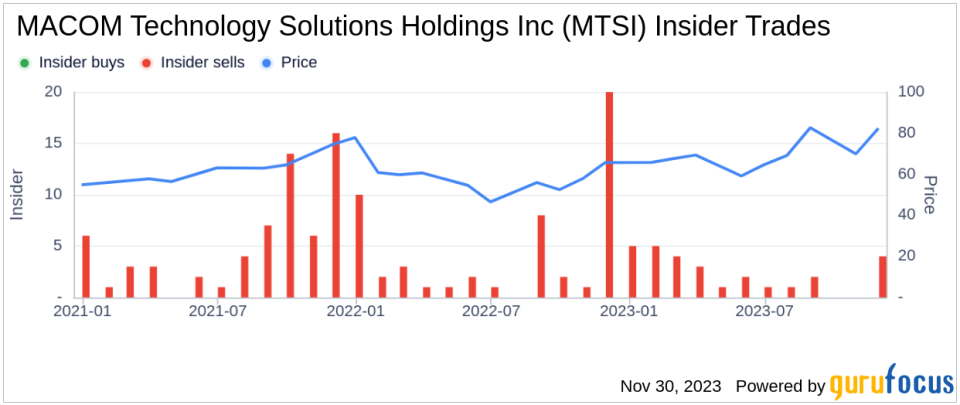

Insider transactions can provide valuable clues about a company's prospects. Over the past year, John Kober has sold a total of 20,309 shares and has not made any purchases. This pattern of selling without corresponding buys could signal that the insider believes the stock may be fully valued or overvalued at current levels.

When examining the broader insider transaction history for MACOM Technology Solutions Holdings Inc, we see a trend of more insider selling than buying. There have been zero insider buys and 29 insider sells over the past year. This trend could indicate that those with the most intimate knowledge of the company's workings are taking profits or reallocating their investments, possibly due to a belief that the stock's growth potential is limited in the near term.

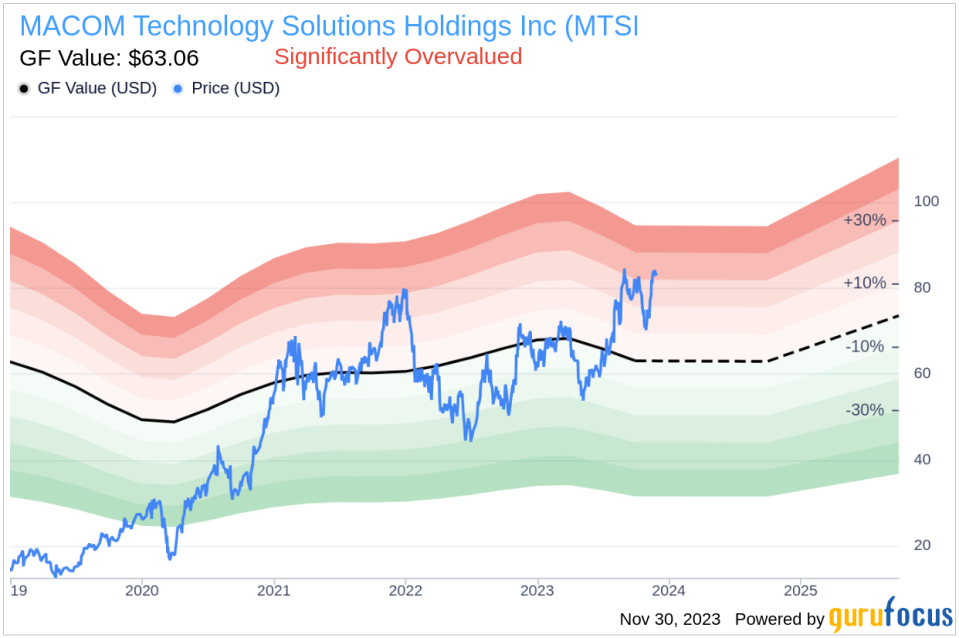

On the day of Kober's recent sell, shares of MACOM Technology Solutions Holdings Inc were trading at $83.76, giving the company a market cap of $5.881 billion. This price level reflects a price-earnings ratio of 64.52, which is significantly higher than the industry median of 26.49 and the company's historical median price-earnings ratio. Such a high price-earnings ratio could suggest that the stock is overvalued compared to its peers and its own historical valuation.

Adding to the valuation analysis, the price-to-GF-Value ratio stands at 1.33, with the stock's price at $83.76 and the GuruFocus Value at $63.06. This indicates that MACOM Technology Solutions Holdings Inc is significantly overvalued based on its GF Value. The GF Value is a proprietary intrinsic value estimate from GuruFocus, which factors in historical trading multiples, a GuruFocus adjustment factor based on past returns and growth, and future business performance estimates from Morningstar analysts.

The insider trend image above provides a visual representation of the selling and buying activities of insiders over time. The absence of buying transactions and the prevalence of selling could be interpreted as a lack of confidence in the stock's future appreciation among insiders.

The GF Value image further illustrates the stock's valuation relative to its intrinsic value estimate. The current price level above the GF Value line suggests that the stock is trading at a premium to what GuruFocus considers its fair value.

Conclusion

The recent insider sell by John Kober, the Senior VP and CFO of MACOM Technology Solutions Holdings Inc, is a transaction that warrants attention. While insider selling does not always indicate a problem with the company, the consistent pattern of insider sales, coupled with the absence of insider purchases, could be a red flag for potential investors. Furthermore, the stock's high price-earnings ratio and its significant overvaluation based on the GF Value metric suggest that the stock may not offer an attractive entry point at current levels.

Investors should consider these insider transactions and valuation metrics as part of a broader analysis, taking into account the company's fundamentals, industry trends, and overall market conditions before making investment decisions. As always, it is recommended to consult with financial advisors or conduct thorough research when evaluating the potential risks and rewards associated with investing in any stock.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.