Insider Sell: ShockWave Medical Inc's President & CEO Douglas Godshall Sells 10,000 Shares

On October 16, 2023, Douglas Godshall, President & CEO of ShockWave Medical Inc (NASDAQ:SWAV), sold 10,000 shares of the company. This move is part of a series of insider sell transactions that have been taking place over the past year.

Douglas Godshall is a seasoned executive with a wealth of experience in the medical device industry. Prior to joining ShockWave Medical Inc, he held various leadership roles at HeartWare International, a leading innovator of less invasive, miniaturized, mechanical circulatory support technologies for the treatment of advanced heart failure. As the President & CEO of ShockWave Medical Inc, Godshall has been instrumental in driving the company's growth and innovation in the medical device sector.

ShockWave Medical Inc is a pioneer in the development and commercialization of Intravascular Lithotripsy (IVL) to treat complex calcified cardiovascular disease. IVL is an innovative therapy designed to selectively target hardened calcified lesions within the cardiovascular system with significantly less impact on soft vascular tissues. The company's robust product portfolio and cutting-edge technology have positioned it as a leader in the medical device industry.

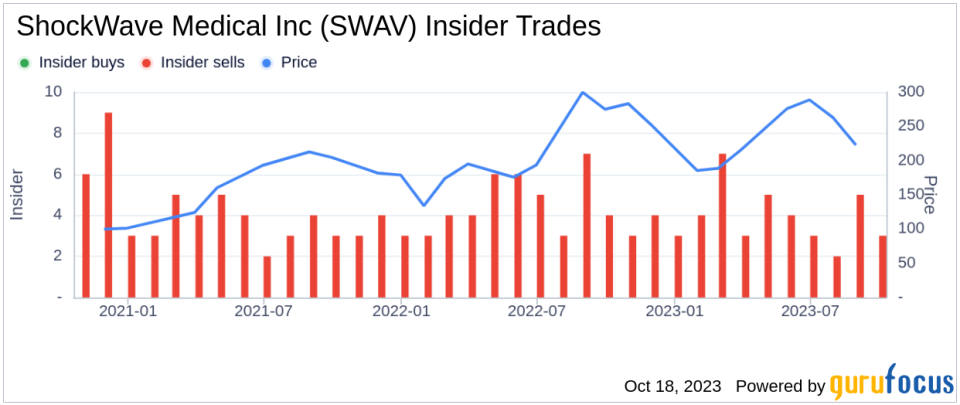

Over the past year, Douglas Godshall has sold a total of 60,000 shares and purchased 0 shares. This recent sell transaction is part of a broader trend within the company. The insider transaction history for ShockWave Medical Inc shows that there have been 0 insider buys and 47 insider sells over the past year.

The relationship between insider sell transactions and the stock price is often closely watched by investors. In the case of ShockWave Medical Inc, the stock was trading for $200.78 per share on the day of the insider's recent sell, giving the company a market cap of $7.716 billion.

The company's price-earnings ratio stands at 32.70, which is higher than the industry median of 26.76 but lower than the companys historical median price-earnings ratio. This suggests that the stock is currently trading at a premium compared to its peers but is undervalued based on its own historical standards.

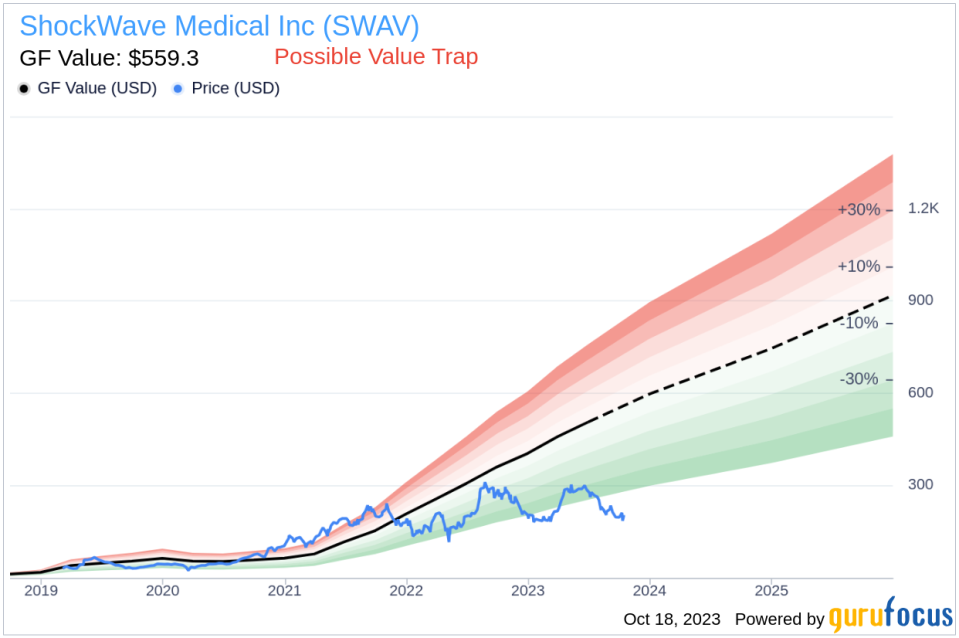

With a price of $200.78 and a GuruFocus Value of $559.30, ShockWave Medical Inc has a price-to-GF-Value ratio of 0.36. This indicates that the stock is a possible value trap, and investors should think twice before investing. The GF Value is an intrinsic value estimate developed by GuruFocus, calculated based on historical multiples, a GuruFocus adjustment factor, and future estimates of business performance from Morningstar analysts.

In conclusion, the recent sell transaction by Douglas Godshall, along with the broader insider sell trend within ShockWave Medical Inc, may raise some concerns for potential investors. However, the company's strong position in the medical device industry and its potential for growth should not be overlooked. As always, investors are advised to conduct their own thorough research before making any investment decisions.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.