Insider Sell: Signet Jewelers Ltd's CIO Howard Melnick Disposes of 5,511 Shares

Signet Jewelers Ltd (NYSE:SIG), a leading name in the world of specialty jewelry retail, has witnessed a significant insider sell that has caught the attention of investors and market analysts alike. Howard Melnick, the Chief Information Officer of Signet Jewelers Ltd, has sold 5,511 shares of the company on December 5, 2023. This transaction has raised questions about the insider's confidence in the company's future prospects and its current valuation.

Who is Howard Melnick?

Howard Melnick serves as the Chief Information Officer (CIO) of Signet Jewelers Ltd. In his role, Melnick is responsible for overseeing the company's information technology strategies and ensuring that its IT infrastructure aligns with the organization's overall business goals. His position places him at the core of Signet's operations, where he can influence the company's use of technology to enhance customer experience, streamline operations, and drive innovation. Melnick's decisions and insights are crucial for the company's ability to adapt to the rapidly changing retail landscape.

About Signet Jewelers Ltd

Signet Jewelers Ltd is a global leader in the retail jewelry industry, with a portfolio of well-known brands such as Kay Jewelers, Zales, Jared, H.Samuel, Ernest Jones, Peoples, and Piercing Pagoda. The company operates in the United States, Canada, and the United Kingdom, offering a wide range of products including diamond jewelry, watches, and other accessories. Signet is committed to delivering a superior customer experience through its omni-channel retail strategy, which encompasses both physical stores and digital platforms.

Analysis of Insider Buy/Sell and Relationship with Stock Price

Insider transactions, particularly those involving high-ranking executives, are closely monitored by investors as they can provide insights into the insiders' perspective on the company's valuation and future performance. Over the past year, Howard Melnick has sold a total of 9,511 shares and has not made any purchases. This one-sided activity could suggest that the insider perceives the stock's current price as an opportune moment to realize gains.

The broader insider transaction history for Signet Jewelers Ltd shows a trend of more insider sells than buys over the past year, with 47 insider sells and no insider buys. This pattern may indicate a consensus among insiders that the stock's price has been favorable for selling, or it could reflect individual financial planning decisions rather than a bearish outlook on the company's future.

On the day of Melnick's recent sell, shares of Signet Jewelers Ltd were trading at $90, giving the company a market cap of $4.315 billion. The price-earnings ratio of 11.79 is lower than both the industry median of 17.63 and the company's historical median, suggesting that the stock may be undervalued based on earnings.

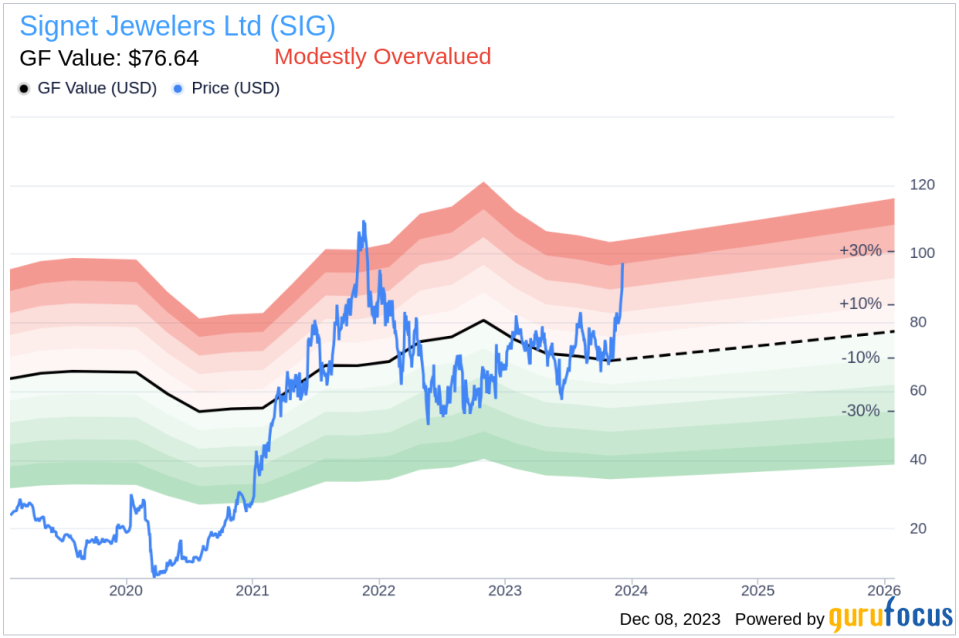

However, with a price-to-GF-Value ratio of 1.17, Signet Jewelers Ltd is considered modestly overvalued according to the GF Value, which stands at $76.64. The GF Value is a proprietary intrinsic value estimate from GuruFocus, factoring in historical trading multiples, a GuruFocus adjustment factor, and future business performance estimates.

The insider trend image above provides a visual representation of the selling pattern among Signet's insiders, which could be interpreted as a signal to investors. While insider selling does not always indicate a lack of confidence in the company, a consistent pattern of disposals may warrant a closer examination of the company's fundamentals and market position.

The GF Value image further illustrates the stock's valuation in relation to its intrinsic value. Although the stock is trading above the GF Value, suggesting a modest overvaluation, investors should consider the broader market conditions and the company's growth prospects before drawing conclusions.

Conclusion

The recent insider sell by Howard Melnick, the CIO of Signet Jewelers Ltd, is a significant event that investors should consider in the context of the company's valuation and the insider's potential outlook on the stock. While the price-earnings ratio indicates potential undervaluation, the GF Value suggests that the stock is modestly overvalued. Investors should weigh these factors, along with the overall insider selling trend, when making investment decisions regarding Signet Jewelers Ltd.

It is important to remember that insider transactions are just one piece of the puzzle when evaluating a stock. A comprehensive analysis should include a review of the company's financial health, competitive position, growth strategy, and market dynamics. As always, investors are encouraged to conduct their own due diligence and consult with financial advisors before making investment choices.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.