Insider Sell: Silicon Laboratories Inc's President & CEO Robert Johnson Sells 3,534 Shares

On October 2, 2023, Robert Johnson, President & CEO of Silicon Laboratories Inc (NASDAQ:SLAB), sold 3,534 shares of the company. This move is part of a series of insider transactions that have taken place over the past year.

Robert Johnson is a seasoned executive with a wealth of experience in the technology sector. As the President & CEO of Silicon Laboratories Inc, he has been instrumental in guiding the company's strategic direction and overseeing its operations. His insider transactions provide valuable insights into the company's financial health and future prospects.

Silicon Laboratories Inc is a leading provider of silicon, software, and solutions for a smarter, more connected world. The company's award-winning technologies are shaping the future of the Internet of Things, Internet infrastructure, industrial automation, consumer, and automotive markets. Its world-class engineering team creates products focused on performance, energy savings, connectivity, and simplicity.

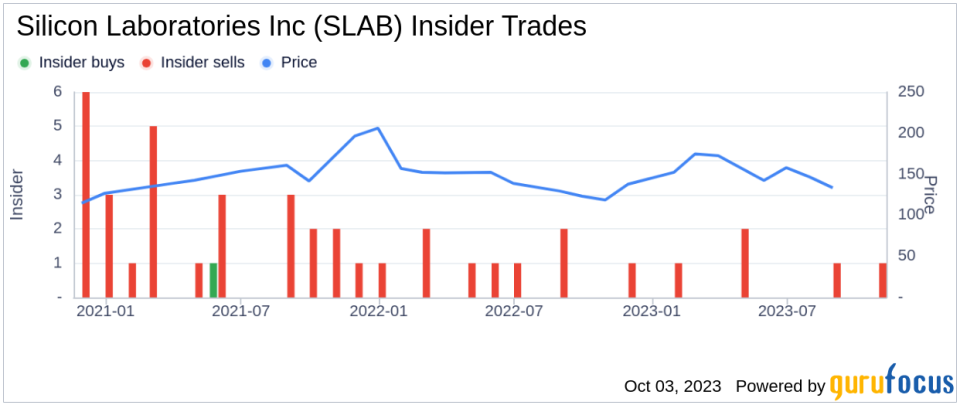

Over the past year, Robert Johnson has sold a total of 7,032 shares and has not made any purchases. This trend is mirrored in the company's overall insider transactions, with 6 insider sells and 0 insider buys over the same period.

The insider's selling activities often have a direct relationship with the stock price. In this case, the continuous selling by the insider could be interpreted as a lack of confidence in the company's future performance, which may negatively impact the stock price. However, it's also important to note that insiders may sell shares for reasons unrelated to the company's performance, such as personal financial planning.

On the day of the insider's recent sell, shares of Silicon Laboratories Inc were trading at $115.23, giving the company a market cap of $3.599 billion. The stock's price-earnings ratio stands at 53.79, higher than the industry median of 23.68 but lower than the company's historical median price-earnings ratio.

The company's price-to-GF-Value ratio is 0.43, based on a GuruFocus Value of $270.14. This suggests that the stock is a possible value trap, and investors should think twice before investing.

The GF Value is an intrinsic value estimate developed by GuruFocus. It is calculated based on historical multiples that the stock has traded at, a GuruFocus adjustment factor based on the company's past returns and growth, and future estimates of business performance from Morningstar analysts.

In conclusion, while the insider's selling activities may raise some concerns, it's crucial for investors to consider the company's financial health, market position, and future growth prospects before making investment decisions.

This article first appeared on GuruFocus.