Insider Sell: Silver Point Capital L.P. Offloads Shares of Gulfport Energy Corp

In a notable insider transaction, Silver Point Capital L.P., a director and 10% owner of Gulfport Energy Corp (NYSE:GPOR), sold 146,455 shares of the company on December 4, 2023. This sale is part of a series of transactions over the past year, where Silver Point Capital L.P. has sold a total of 2,383,269 shares and made no purchases. The recent sell-off by the insider raises questions about the firm's outlook and potential impact on Gulfport Energy Corp's stock price.

Who is Silver Point Capital L.P.?

Silver Point Capital L.P. is an investment firm that specializes in distressed debt and credit opportunities. As a significant shareholder and director of Gulfport Energy Corp, Silver Point Capital L.P. has a substantial influence on the company's strategic decisions. The firm's trading activities, particularly insider sales, are closely watched by investors as they can provide insights into Silver Point Capital L.P.'s perspective on Gulfport Energy Corp's future prospects.

Gulfport Energy Corp's Business Description

Gulfport Energy Corp is an independent natural gas and oil company focused on the exploration, development, acquisition, and production of natural gas, natural gas liquids, and crude oil in the United States. The company primarily operates in the Utica Shale of Eastern Ohio and has a significant presence in the SCOOP (South Central Oklahoma Oil Province) play. Gulfport Energy Corp's strategy revolves around generating value through efficient operations, technological innovation, and strategic asset management.

Analysis of Insider Buy/Sell and Relationship with Stock Price

The recent insider sell by Silver Point Capital L.P. comes at a time when Gulfport Energy Corp's stock is trading at $136.56, giving the company a market cap of $2.492 billion. The price-earnings ratio of 1.54 is significantly lower than the industry median of 9.13 and below the company's historical median price-earnings ratio. This low P/E ratio could suggest that the stock is undervalued, or it may reflect market skepticism about the company's future earnings potential.

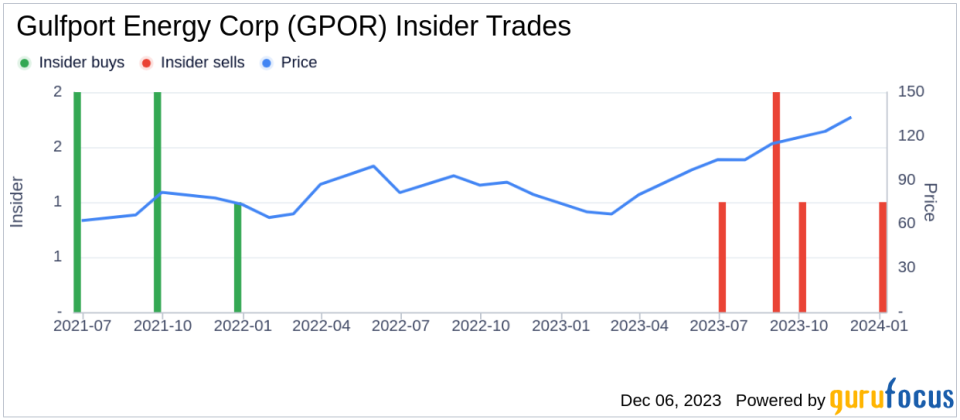

Insider selling can be interpreted in various ways. While it may indicate that insiders believe the stock is overvalued or that there are better investment opportunities elsewhere, it can also be motivated by personal financial planning or diversification needs. In the case of Silver Point Capital L.P., the consistent selling over the past year without any insider purchases could signal a lack of confidence in the near-term appreciation of Gulfport Energy Corp's stock price.

However, it is essential to consider the overall insider trend when evaluating the significance of a single transaction. Over the past year, there have been no insider buys and five insider sells for Gulfport Energy Corp, suggesting a general trend of insiders reducing their holdings in the company.

When analyzing the relationship between insider trading activity and stock price, it is crucial to look for patterns or significant transactions that could impact investor sentiment. In this case, the substantial sell-off by Silver Point Capital L.P. could potentially weigh on the stock price if the market perceives it as a lack of confidence from a major insider.

Valuation and GF Value

Regarding valuation, Gulfport Energy Corp's current price-to-GF-Value ratio stands at 0, indicating that the stock is a possible value trap, and investors should think twice before investing. The GF Value is an intrinsic value estimate that considers historical trading multiples, a GuruFocus adjustment factor, and future business performance estimates.

Given the current price of $136.56 and a GuruFocus Value of $53,406.68, the discrepancy between the market price and the GF Value is stark. This discrepancy could suggest that the market has not fully recognized the company's intrinsic value or that the GF Value may not accurately reflect the company's true worth due to changing market conditions or company-specific factors.

Historical multiples indicate that the stock is trading at a lower price-earnings ratio compared to its historical averages and industry median.

The GuruFocus adjustment factor may have been influenced by the company's past returns and growth, which could have been affected by the volatile energy market and regulatory changes.

Future estimates of business performance from Morningstar analysts could be conservative due to uncertainties in the energy sector, including fluctuating commodity prices and demand.

Investors should approach Gulfport Energy Corp with caution, considering the insider selling trend, the low price-earnings ratio, and the significant gap between the market price and the GF Value. While the company may have strong fundamentals, the insider activity and valuation metrics suggest that there may be underlying challenges or a potential misalignment with market expectations.

In conclusion, Silver Point Capital L.P.'s recent insider sell transaction and the overall insider trend at Gulfport Energy Corp warrant attention from current and potential investors. The company's valuation and GF Value also provide critical data points for evaluating the stock's investment potential. As always, investors should conduct thorough due diligence and consider a wide range of factors before making investment decisions.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.