Insider Sell: Snap-on Inc's VP & Chief Information Officer June Lemerand Sells 3,600 Shares

In a notable insider transaction, June Lemerand, the Vice President & Chief Information Officer of Snap-on Incorporated (NYSE:SNA), sold 3,600 shares of the company on November 30, 2023. This sale has caught the attention of investors and market analysts, as insider transactions can provide valuable insights into a company's prospects and the sentiment of its top executives.

Who is June Lemerand at Snap-on Inc?

June Lemerand has been serving as the VP & Chief Information Officer at Snap-on Inc, a pivotal role that involves overseeing the company's information technology strategies and infrastructure. Lemerand's position places her at the core of Snap-on's technological advancements and operational efficiencies. Her actions and decisions, particularly in selling or buying company stock, are closely monitored by investors for indications of the company's internal health and future direction.

Snap-on Inc's Business Description

Snap-on Incorporated is a leading global innovator, manufacturer, and marketer of tools, equipment, diagnostics, repair information, and systems solutions for professional users. The company's products and services are critical for a wide range of industries, including automotive, aviation, marine, and industrial sectors. With a reputation for quality and durability, Snap-on has established a strong brand presence and a loyal customer base. The company's offerings extend from hand and power tools to shop and tech equipment, ensuring a comprehensive solution for professionals in the maintenance and repair space.

Analysis of Insider Buy/Sell and Relationship with Stock Price

The insider transaction history for Snap-on Inc reveals a pattern that could be of interest to investors. Over the past year, there have been no insider buys but 24 insider sells, indicating that insiders may perceive the stock's current price as a favorable selling point or that they are reallocating their personal investment portfolios for other reasons.

On the day of the insider's recent sale, shares of Snap-on Inc were trading at $273.38, giving the company a market cap of $14.568 billion. This price point is significant as it reflects a price-earnings ratio of 14.98, which is lower than both the industry median of 22.77 and the company's historical median price-earnings ratio. This could suggest that the stock is undervalued based on earnings, potentially offering an attractive entry point for value investors.

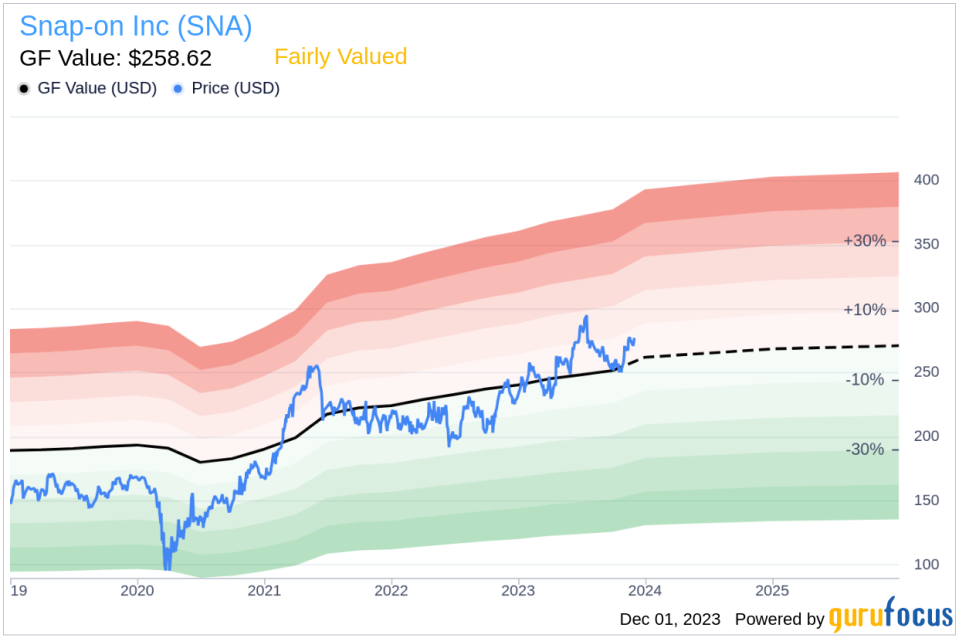

However, the price-to-GF-Value ratio stands at 1.06, indicating that the stock is Fairly Valued according to the GuruFocus Value. The GF Value is a proprietary intrinsic value estimate that takes into account historical trading multiples, a GuruFocus adjustment factor based on past returns and growth, and future business performance estimates from Morningstar analysts.

The sale by June Lemerand might raise questions among investors about whether this insider believes the stock has reached a peak or if there are other personal or strategic reasons for the sale. It is important to note that insider sales can occur for various reasons, including diversification, liquidity needs, or personal financial planning, and do not always signal a lack of confidence in the company's future prospects.

The insider trend image above provides a visual representation of the selling pattern, which could be interpreted as a cautious signal by some market participants. However, without additional context, it is challenging to draw definitive conclusions from this data alone.

The GF Value image further illustrates the stock's valuation relative to its intrinsic value estimate. While the stock is currently deemed Fairly Valued, any significant changes in the company's fundamentals or market conditions could alter this assessment.

Conclusion

The recent insider sale by June Lemerand at Snap-on Inc is a development that warrants attention from the investment community. While the company's stock appears fairly valued based on the GF Value and trades at a lower price-earnings ratio compared to the industry, the lack of insider purchases over the past year could be a point of consideration for potential investors. As with any insider transaction, it is crucial to consider the broader context and not rely solely on these events when making investment decisions. Investors should continue to monitor the company's performance, industry trends, and broader market conditions to make informed investment choices.

It is also recommended that investors keep an eye on future insider transactions, as they can provide additional clues about the confidence levels of Snap-on Inc's executives and their expectations for the company's trajectory.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.