Insider Sell: Sr. EVP, Deputy CFO Lori Wright Sells 13,000 Shares of Pacific Premier Bancorp ...

Pacific Premier Bancorp Inc (NASDAQ:PPBI), a prominent player in the banking industry, has recently witnessed a significant insider transaction. Lori Wright, the Senior Executive Vice President and Deputy Chief Financial Officer of the company, sold 13,000 shares on December 14, 2023. This move by a key insider has sparked interest among investors and market analysts, prompting a closer look at the implications of such insider activities on the company's stock performance and valuation.

Who is Lori Wright of Pacific Premier Bancorp Inc?

Lori Wright has been serving as the Senior Executive Vice President and Deputy Chief Financial Officer of Pacific Premier Bancorp Inc. In her role, Wright is responsible for overseeing the financial operations and reporting of the company. Her position places her in a strategic spot to understand the company's financial health and future prospects, making her trading activities particularly noteworthy for investors.

Pacific Premier Bancorp Inc's Business Description

Pacific Premier Bancorp Inc is a bank holding company that operates primarily through its subsidiary, Pacific Premier Bank. The company provides a wide range of banking services, including deposit accounts, commercial and consumer loans, and treasury management services to businesses, professionals, real estate investors, and non-profit organizations. With a focus on delivering superior service and fostering long-term customer relationships, Pacific Premier Bancorp Inc has established itself as a trusted financial institution in the markets it serves.

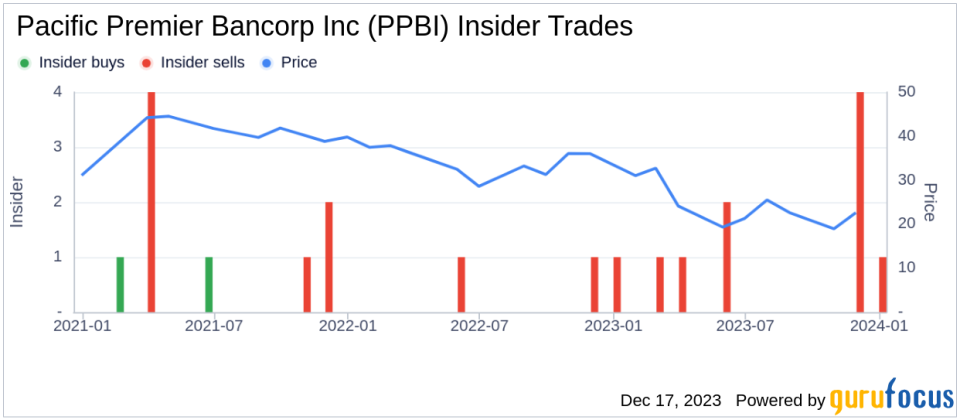

Analysis of Insider Buy/Sell and the Relationship with the Stock Price

The insider transaction history for Pacific Premier Bancorp Inc shows a pattern of insider selling over the past year, with 10 insider sells and no insider buys. Lori Wright's recent sale of 13,000 shares is part of this trend. Such consistent selling by insiders can sometimes raise concerns among investors about the insiders' confidence in the company's future performance.

However, it is essential to consider that insider selling can occur for various reasons that may not necessarily reflect a negative outlook. Insiders might sell shares for personal financial planning, diversification, or other non-company-specific reasons. Therefore, while insider selling can be a valuable indicator, it should not be the sole factor in making investment decisions.

Valuation and Market Reaction

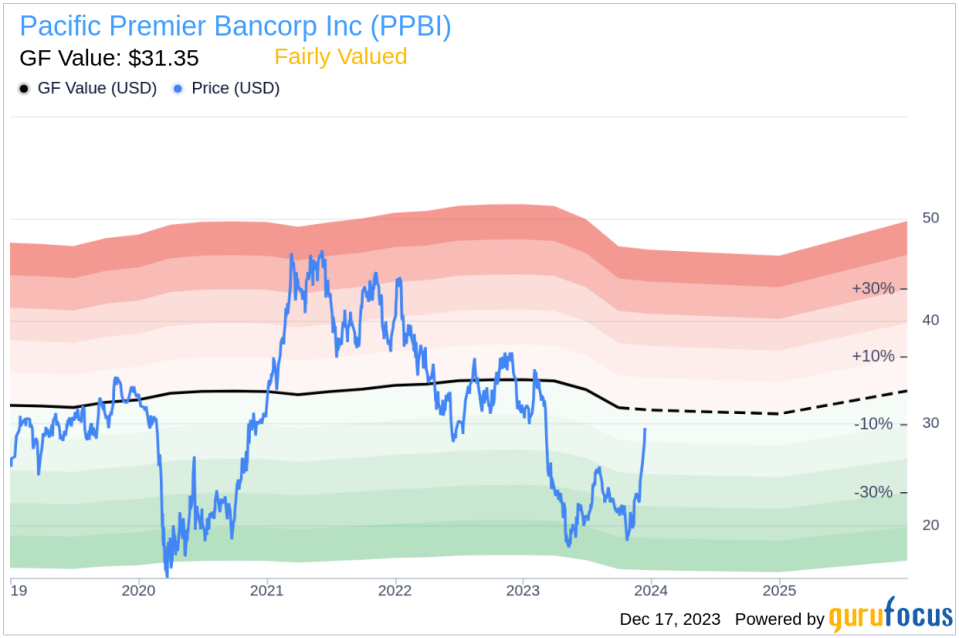

On the day of the insider's recent sale, shares of Pacific Premier Bancorp Inc were trading at $29.62, giving the company a market cap of $2.805 billion. The price-earnings ratio stood at 11.65, which is higher than the industry median of 9.01 but lower than the company's historical median price-earnings ratio. This suggests that the stock is trading at a reasonable valuation compared to its peers and its own historical standards.With a price of $29.62 and a GuruFocus Value of $31.35, Pacific Premier Bancorp Inc has a price-to-GF-Value ratio of 0.94, indicating that the stock is Fairly Valued based on its GF Value.

The GF Value is a proprietary intrinsic value estimate developed by GuruFocus, which takes into account historical trading multiples, a GuruFocus adjustment factor based on past returns and growth, and future business performance estimates from Morningstar analysts. The current price-to-GF-Value ratio suggests that the market has adequately priced in the company's fundamentals and growth prospects.

Conclusion

The recent insider sell by Lori Wright, the Sr. EVP and Deputy CFO of Pacific Premier Bancorp Inc, is part of a broader pattern of insider selling at the company. While such activities can be a cause for investor scrutiny, the current valuation metrics and the price-to-GF-Value ratio suggest that the stock is fairly valued. Investors should consider the context of insider transactions and look at a comprehensive set of factors, including company performance, industry trends, and broader market conditions, before making investment decisions. As always, a well-rounded approach that considers both insider activities and fundamental analysis is prudent when evaluating investment opportunities in the stock market.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.