Insider Sell: Srinivasagopalan Ramamurthy Sells 50,000 Shares of Freshworks Inc

On September 15, 2023, Srinivasagopalan Ramamurthy, the Chief Product Officer of Freshworks Inc (NASDAQ:FRSH), sold 50,000 shares of the company. This move is part of a series of insider transactions that have taken place over the past year.

Who is Srinivasagopalan Ramamurthy?

Srinivasagopalan Ramamurthy is the Chief Product Officer at Freshworks Inc. He plays a crucial role in the company's product development and strategy. His decisions and actions can significantly impact the company's performance and, consequently, its stock price.

About Freshworks Inc

Freshworks Inc is a leading provider of customer engagement software. The company's innovative solutions empower businesses to deliver exceptional customer service, increase customer satisfaction, and drive growth. Freshworks Inc's products are used by thousands of businesses worldwide, from small startups to large enterprises.

Insider Transactions and Stock Price

Over the past year, the insider has sold 50,000 shares in total and purchased 0 shares. This trend of selling without buying may raise eyebrows among investors, as it could indicate a lack of confidence in the company's future performance.

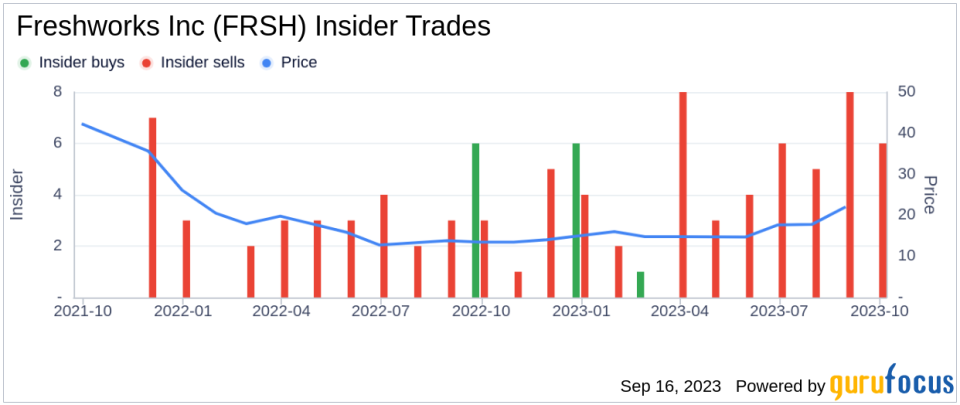

The insider transaction history for Freshworks Inc shows a total of 11 insider buys and 52 insider sells over the past year. This trend suggests that insiders are more inclined to sell their shares than to buy. This could be a red flag for potential investors, as it might indicate that insiders believe the stock is overvalued or that the company's future prospects are not as promising as the market believes.

Valuation

On the day of the insider's recent sell, shares of Freshworks Inc were trading for $20.05 apiece. This gives the stock a market cap of $5.87 billion. The high market cap, combined with the insider's sell, could suggest that the stock is overvalued. However, investors should also consider other factors, such as the company's financial health, growth prospects, and industry trends, before making investment decisions.

In conclusion, while the insider's recent sell might raise concerns, it is essential to consider the broader context. Insider transactions are just one of many factors that investors should consider when evaluating a stock. Therefore, potential investors should conduct thorough research and consider various factors before making investment decisions.

This article first appeared on GuruFocus.