Insider Sell: Sriprasadh Cadambi Sells 15,257 Shares of ZoomInfo Technologies Inc

On September 5, 2023, Sriprasadh Cadambi, the Chief Accounting Officer of ZoomInfo Technologies Inc (NASDAQ:ZI), sold 15,257 shares of the company. This move is part of a trend observed over the past year, where the insider has sold a total of 15,257 shares and purchased none.

ZoomInfo Technologies Inc is a leading global provider of go-to-market (GTM) intelligence solutions. Its platform empowers business-to-business sales, marketing, and recruiting professionals to hit their number by pairing best-in-class technology with unrivaled data coverage, accuracy, and depth of company and contact information.

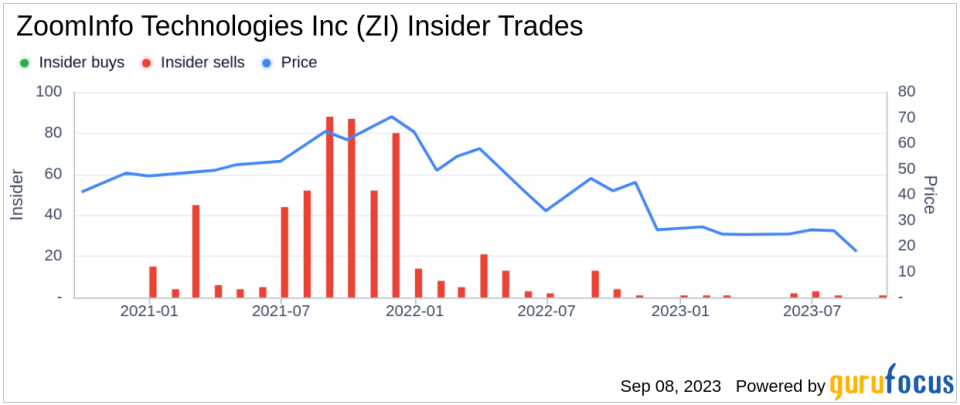

The insider's recent sell has raised questions about the company's stock performance and its relationship with insider trading activities. Over the past year, there have been 12 insider sells and no insider buys. This trend is illustrated in the following image:

On the day of the insider's recent sell, ZoomInfo Technologies Inc's shares were trading at $20.52 each, giving the company a market cap of $7.074 billion. The price-earnings ratio stands at 58.73, higher than the industry median of 27.86 but lower than the company's historical median price-earnings ratio.

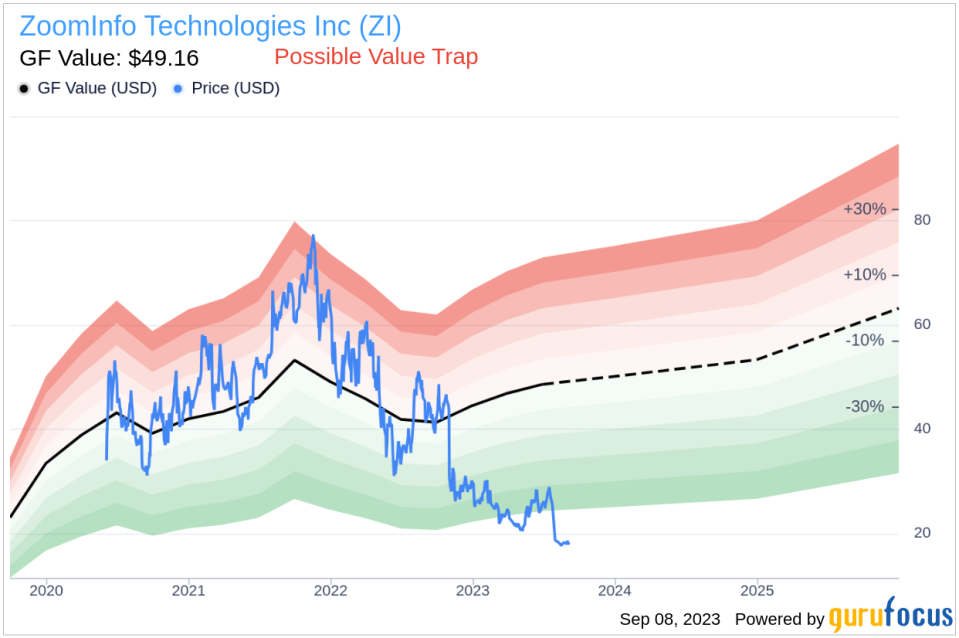

The GF Value, an intrinsic value estimate developed by GuruFocus, is calculated based on historical multiples, a GuruFocus adjustment factor, and future business performance estimates. For ZoomInfo Technologies Inc, the GF Value is $49.16, resulting in a price-to-GF-Value ratio of 0.42. This suggests that the stock may be a possible value trap, and investors should think twice before investing.

The insider's sell-off could be interpreted in various ways. It could be a personal financial decision or a lack of confidence in the company's future performance. However, it's crucial to note that insider selling doesn't necessarily indicate a company's poor performance. Investors should consider other factors, such as the company's financial health, market conditions, and industry trends, before making investment decisions.

In conclusion, while the insider's sell-off may raise eyebrows, it's essential to look at the bigger picture. ZoomInfo Technologies Inc's robust GTM intelligence solutions and its market position make it a company worth watching. However, the high price-earnings ratio and the possible value trap signal suggest that investors should tread carefully.

This article first appeared on GuruFocus.