Insider Sell: Stephen Holdridge Sells 1,000 Shares of Ceridian HCM Holding Inc (CDAY)

On September 12, 2023, President Customer & Revenue Ops, Stephen Holdridge, sold 1,000 shares of Ceridian HCM Holding Inc (NYSE:CDAY). This move comes amidst a year where the insider has sold a total of 14,548 shares and purchased none.

Stephen Holdridge is a key figure at Ceridian HCM Holding Inc, a global human capital management software company. The company provides human resources, payroll, benefits, workforce management, and talent management functionality. Its flagship cloud HCM platform, Dayforce, provides human resources, payroll, benefits, workforce management, and talent management functionality. The company's platform is used by organizations, regardless of their size, complexity, or industry, to optimize management of the entire employee lifecycle, including attracting, engaging, paying, deploying, and developing their people.

The insider's recent sell-off raises questions about the company's current valuation and future prospects. Let's delve into the details.

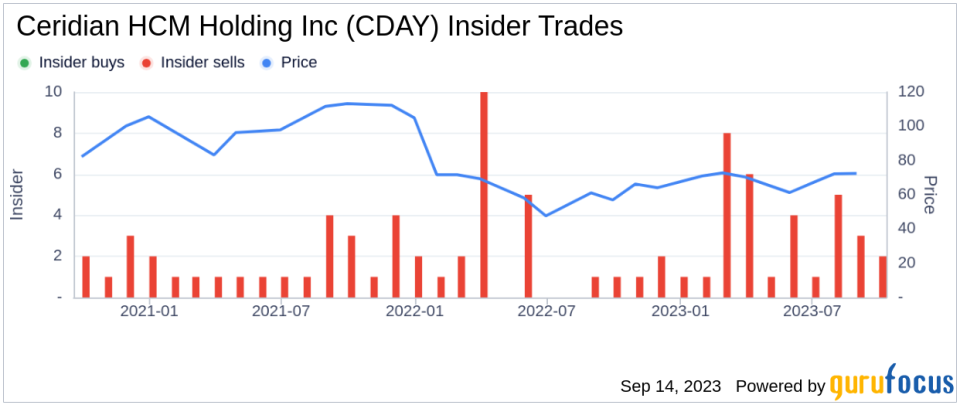

The insider transaction history for Ceridian HCM Holding Inc shows a clear trend of insider selling over the past year. There have been 36 insider sells and no insider buys. This could be a red flag for potential investors as it might indicate that those with the most intimate knowledge of the company do not see it as a good investment at the current price.

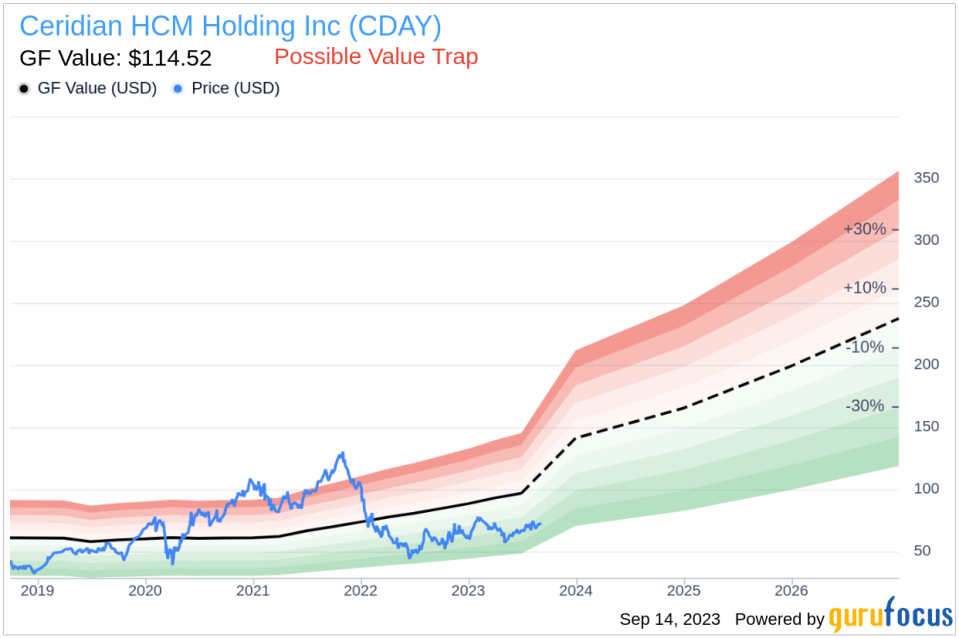

On the day of the insider's recent sell, shares of Ceridian HCM Holding Inc were trading for $75 apiece, giving the stock a market cap of $11.52 billion.

With a price of $75 and a GuruFocus Value of $114.52, Ceridian HCM Holding Inc has a price-to-GF-Value ratio of 0.65. This suggests that the stock is a possible value trap, and investors should think twice before investing. The GF Value is an intrinsic value estimate developed by GuruFocus, calculated based on historical multiples, a GuruFocus adjustment factor based on the companys past returns and growth, and future estimates of business performance from Morningstar analysts.

In conclusion, the insider's recent sell-off, coupled with the company's valuation and the lack of insider buys over the past year, may suggest that Ceridian HCM Holding Inc's stock is overvalued. Investors should exercise caution and conduct further research before making any investment decisions.

This article first appeared on GuruFocus.