Insider Sell: SVP and CFO Alan Curtis Sells 31,011 Shares of Oceaneering International Inc

On September 27, 2023, Senior Vice President and Chief Financial Officer Alan Curtis sold 31,011 shares of Oceaneering International Inc (NYSE:OII). This move comes amidst a year where the insider has sold a total of 31,011 shares and purchased none.

Alan Curtis is a key figure at Oceaneering International Inc, a global provider of engineered services and products, primarily to the offshore energy industry. The company also serves the defense, aerospace, and commercial theme park industries. With a market cap of $2.74 billion, Oceaneering International Inc is a significant player in its sector.

The insider's recent sell-off is part of a broader trend within the company. Over the past year, there have been 2 insider buys and 6 insider sells within Oceaneering International Inc. This trend is visualized in the following insider trend image:

The relationship between insider trading and stock price is complex. Generally, insider selling can be seen as a bearish signal, suggesting that those with the most knowledge about the company believe its stock may underperform. However, insiders may sell shares for many reasons, and it does not necessarily indicate a lack of confidence in the company.

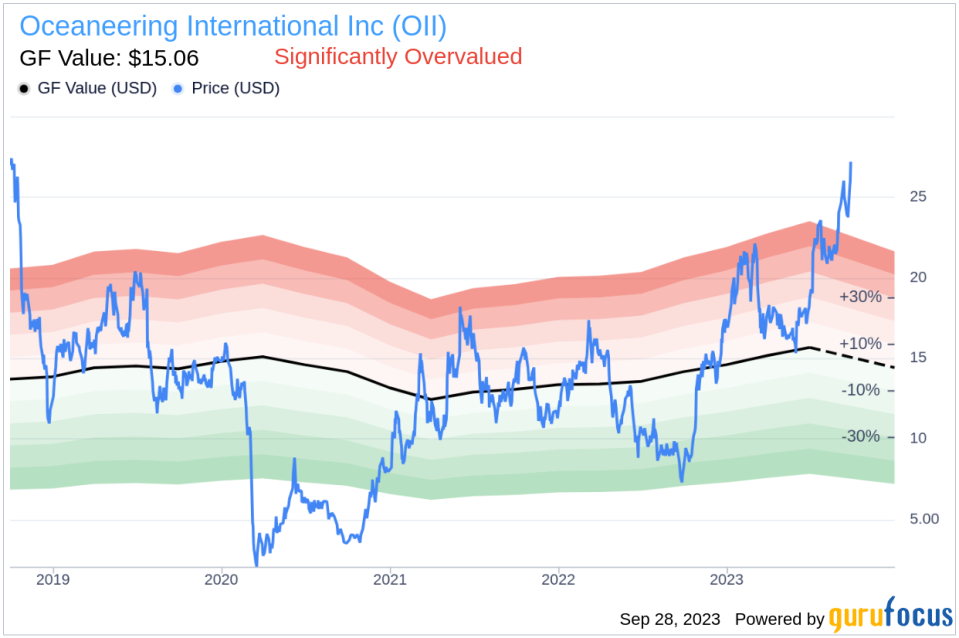

On the day of the insider's recent sell, shares of Oceaneering International Inc were trading for $26.48 each. This price gives the stock a price-earnings ratio of 42.48, significantly higher than both the industry median of 9.26 and the company's historical median price-earnings ratio. This high price-earnings ratio suggests that the stock may be overvalued.

Further analysis using the GuruFocus Value, which is an intrinsic value estimate based on historical multiples, a GuruFocus adjustment factor, and future business performance estimates, supports this conclusion. With a price of $26.48 and a GuruFocus Value of $15.06, Oceaneering International Inc has a price-to-GF-Value ratio of 1.76. This ratio indicates that the stock is significantly overvalued.

In conclusion, the insider's recent sell-off, combined with the stock's high price-earnings ratio and price-to-GF-Value ratio, suggests that Oceaneering International Inc may be overvalued. Investors should exercise caution when considering this stock.

This article first appeared on GuruFocus.