Insider Sell: SVP & CFO Daniel Mchenry Sells 2,259 Shares of Group 1 Automotive Inc

On September 18, 2023, Senior Vice President and Chief Financial Officer Daniel Mchenry sold 2,259 shares of Group 1 Automotive Inc (NYSE:GPI). This move comes amidst a year where the insider has sold a total of 2,259 shares and purchased none.

Daniel Mchenry is a key figure in the Group 1 Automotive Inc company. As the Senior Vice President and Chief Financial Officer, his decisions and actions can significantly impact the company's financial health and stock performance.

Group 1 Automotive Inc is an international Fortune 500 automotive retailer. The company owns and operates automotive dealerships and collision centers in the United States, United Kingdom, and Brazil. It offers 31 brands of automobiles through its dealerships.

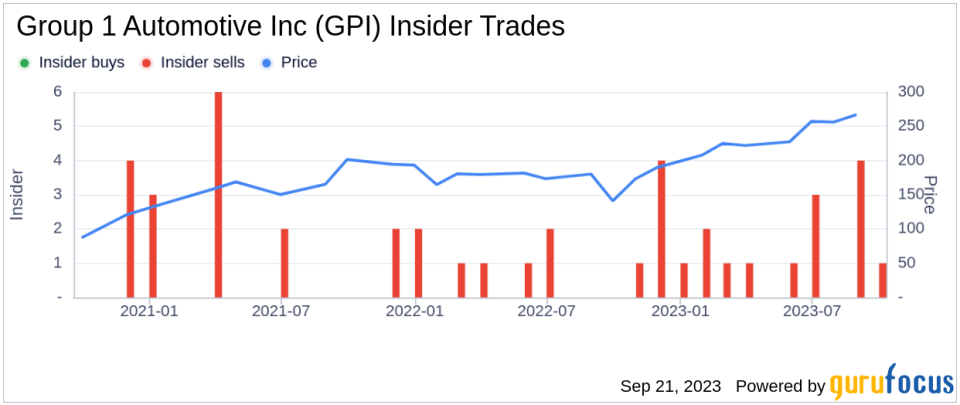

The insider's recent sell-off could be seen as a bearish signal, especially considering the lack of insider buys over the past year. The insider transaction history for Group 1 Automotive Inc shows zero insider buys and 19 insider sells over the past year.

The relationship between insider buy/sell actions and the stock price is often closely watched by investors. In this case, the insider's sell-off coincides with a stock price of $264.96 per share, giving the company a market cap of $3.66 billion.

The price-earnings ratio of Group 1 Automotive Inc is 5.62, which is lower than the industry median of 16.63 and also lower than the companys historical median price-earnings ratio. This could suggest that the stock is undervalued, despite the insider's sell-off.

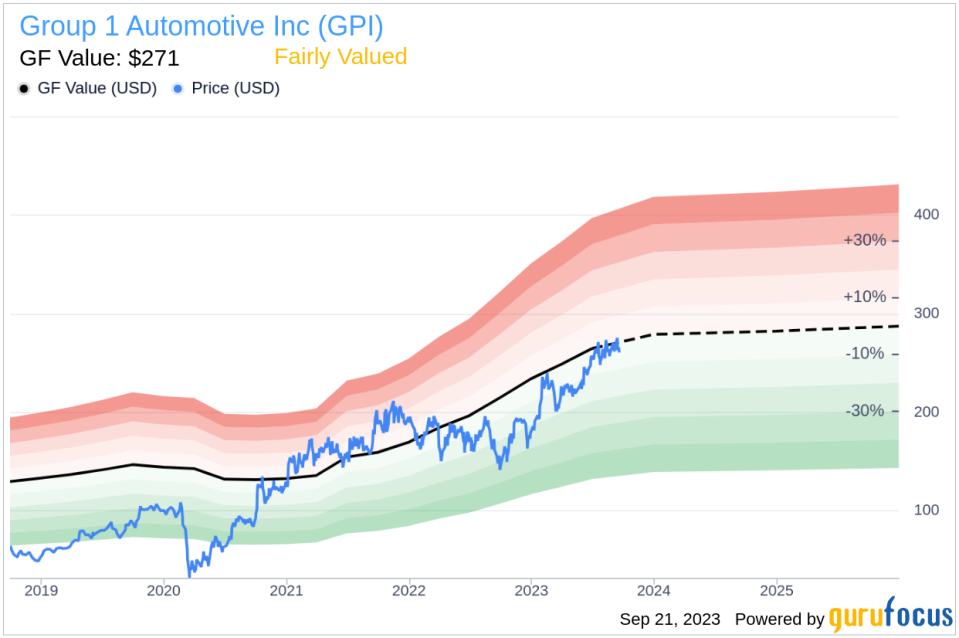

The stock's price-to-GF-Value ratio is 0.98, indicating that it is fairly valued based on its GF Value of $271.00.

The GF Value is an intrinsic value estimate developed by GuruFocus. It is calculated based on historical multiples that the stock has traded at, a GuruFocus adjustment factor based on the companys past returns and growth, and future estimates of business performance from Morningstar analysts.

In conclusion, the insider's recent sell-off could be seen as a bearish signal for Group 1 Automotive Inc. However, the stock's low price-earnings ratio and fair GF Value suggest that it could still be a good investment opportunity. As always, investors should conduct their own research and consider multiple factors before making investment decisions.

This article first appeared on GuruFocus.