Insider Sell: SVP, CFO Kenneth Hahn Offloads Shares of Coursera Inc (COUR)

In a notable insider transaction, Kenneth Hahn, the Senior Vice President and Chief Financial Officer of Coursera Inc, sold 23,869 shares of the company on December 11, 2023. This move has caught the attention of investors and market analysts, as insider transactions can provide valuable insights into a company's financial health and future prospects.

Who is Kenneth Hahn?

Kenneth Hahn is a seasoned executive with a wealth of experience in financial management and strategic planning. As the SVP and CFO of Coursera Inc, Hahn oversees the company's financial operations, including accounting, investor relations, and financial planning. His role is crucial in shaping the company's financial strategy and ensuring its growth and profitability.

About Coursera Inc

Coursera Inc is a leading online learning platform that offers a wide range of courses, specializations, and degrees from top universities and companies worldwide. The company's mission is to provide universal access to world-class education, enabling individuals to learn new skills, advance their careers, and transform their lives. Coursera's innovative platform connects learners with high-quality content, interactive learning experiences, and a global community of peers and educators.

Analysis of Insider Buy/Sell and Relationship with Stock Price

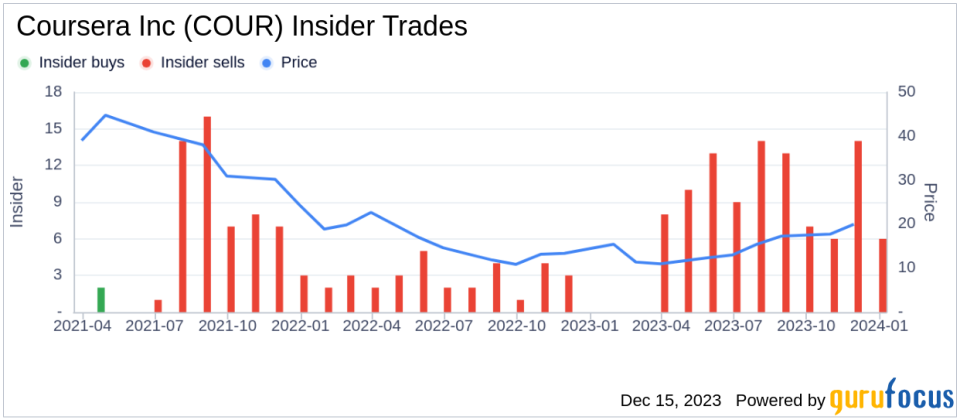

The insider's recent sale of 23,869 shares is part of a larger pattern observed over the past year. Kenneth Hahn has sold a total of 193,340 shares and has not made any purchases during this period. This consistent selling activity may raise questions among investors about the insider's confidence in the company's future performance.The lack of insider buys over the past year, coupled with 101 insider sells, suggests that insiders may perceive the stock as being fully valued or are taking profits after a period of appreciation. It is important to consider these transactions in the context of the stock's price movement and overall market conditions.

The insider trend image above provides a visual representation of the selling activity by insiders at Coursera Inc. This trend can be a valuable indicator for investors, as insiders may have access to non-public information that could influence their decision to sell shares.

Valuation and Market Cap

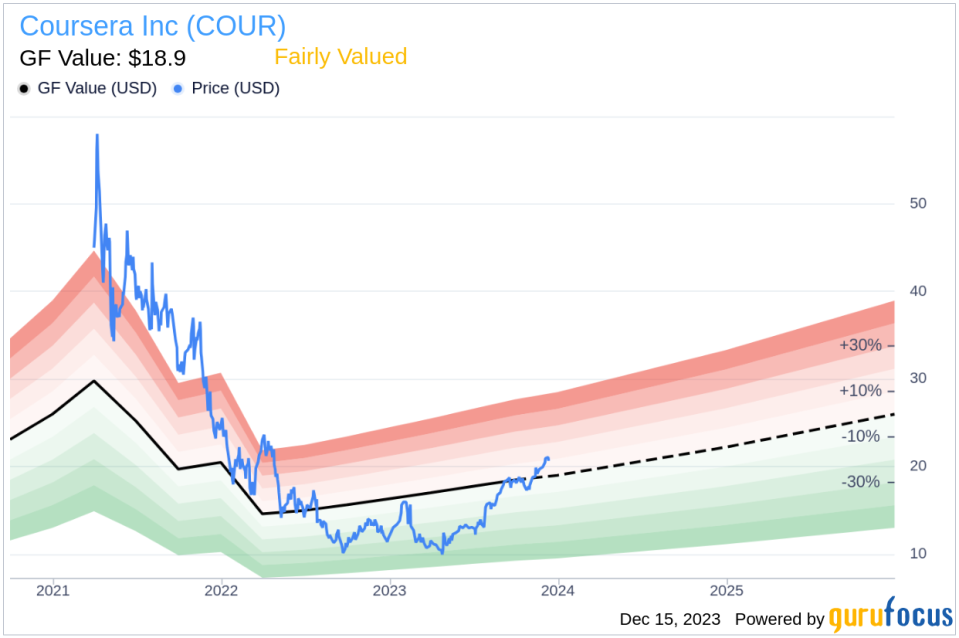

On the day of the insider's recent sale, Coursera Inc's shares were trading at $21.06, giving the company a market cap of $3.166 billion. This valuation places the company in the mid-cap category, which can offer a balance between the growth potential of smaller companies and the stability of larger firms.With a price of $21.06 and a GuruFocus Value of $18.90, Coursera Inc has a price-to-GF-Value ratio of 1.11, indicating that the stock is Fairly Valued based on its GF Value. This assessment suggests that the stock is trading at a price that is in line with its intrinsic value, as estimated by GuruFocus.

The GF Value is a proprietary metric that takes into account historical trading multiples, a GuruFocus adjustment factor based on past returns and growth, and future business performance estimates from analysts. The GF Value image above provides a visual guide to the stock's valuation relative to its intrinsic value.

Conclusion

The recent insider sell by Kenneth Hahn, the SVP and CFO of Coursera Inc, is a significant event that warrants attention from investors. While the stock is currently deemed Fairly Valued, the consistent selling by insiders over the past year may suggest a cautious outlook from those with intimate knowledge of the company's financials and strategic direction.Investors should consider the insider transaction trends, the company's valuation, and the broader market context when making investment decisions. While insider transactions are just one piece of the puzzle, they can provide valuable clues about the potential future performance of a stock. As always, it is recommended to conduct thorough research and consider a diversified investment strategy to mitigate risk.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.