Insider Sell: SVP and Chief Legal Officer Mary Gibbons Sells Shares of Essent Group Ltd

In the realm of stock market movements, insider trading activity is often a significant indicator that investors keep a close eye on. Recently, Mary Gibbons, the Senior Vice President and Chief Legal Officer of Essent Group Ltd, made a notable move by selling a substantial number of shares in the company. On December 14, 2023, the insider sold 8,355 shares of Essent Group Ltd (NYSE:ESNT), a transaction that has caught the attention of market analysts and investors alike.Before delving into the details of this transaction and its implications, it is essential to understand who Mary Gibbons is within the Essent Group Ltd company. Mary Gibbons serves as the SVP and Chief Legal Officer, a role that involves overseeing the company's legal affairs, ensuring compliance with laws and regulations, and providing strategic legal guidance to the company's executive team. Her position places her in a unique vantage point to assess the company's health and prospects, making her trading activities particularly noteworthy.Essent Group Ltd is a Bermuda-based company that provides private mortgage insurance and reinsurance for single-family mortgage loans in the United States. The company helps protect lenders and investors from credit risk, primarily focusing on managing risk through secure underwriting and risk management policies. Essent Group Ltd has established itself as a key player in the mortgage insurance industry, offering products that support homeownership for borrowers who might otherwise be unable to afford a down payment.The recent insider sell by Mary Gibbons has raised questions about the potential reasons behind the decision. Over the past year, Gibbons has sold a total of 24,427 shares and has not made any purchases of the company's stock. This pattern of selling without corresponding buys could suggest various things, including personal financial planning or a belief that the stock may not see significant appreciation in the near term.

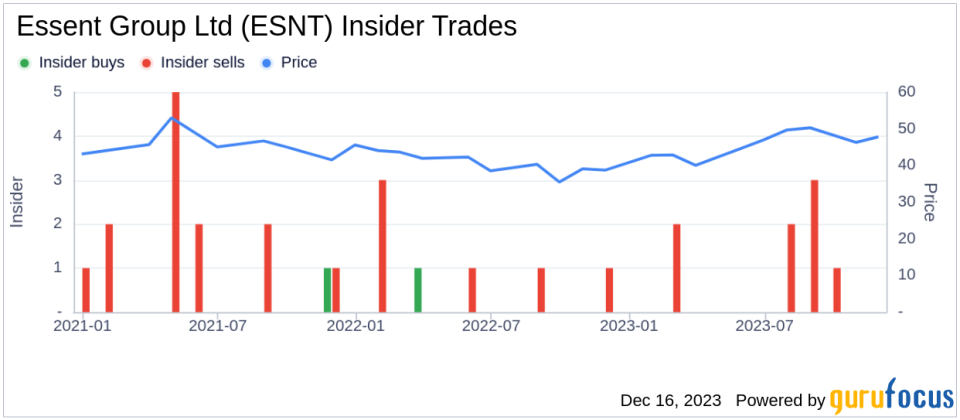

The insider transaction history for Essent Group Ltd shows a lack of insider buying over the past year, with zero insider buys recorded. However, there have been nine insider sells during the same period. This trend of insider selling could be interpreted in several ways, but it often indicates that insiders might believe the stock is fully valued or they are reallocating their personal investment portfolios.When analyzing the relationship between insider trading activity and stock price, it is crucial to consider the company's valuation metrics. On the day of Gibbons's recent sell, shares of Essent Group Ltd were trading at $52.15, giving the company a market cap of $5.434 billion. The price-earnings ratio stood at 8.17, lower than both the industry median of 10.945 and the company's historical median price-earnings ratio. This suggests that, from an earnings perspective, the stock was trading at a discount relative to its peers and its own historical valuation.

The price-to-GF-Value ratio, which compares the current stock price to the GuruFocus Value (GF Value), was 1.05, indicating that the stock was Fairly Valued based on its GF Value of $49.86. The GF Value is a proprietary intrinsic value estimate developed by GuruFocus, which takes into account historical trading multiples, a GuruFocus adjustment factor based on past returns and growth, and future business performance estimates from Morningstar analysts.Given the Fairly Valued status of the stock, the insider's decision to sell does not necessarily signal a lack of confidence in the company's future prospects. Instead, it could be a strategic move based on personal financial considerations or portfolio diversification. It is also possible that the insider is taking advantage of the stock's fair valuation to realize gains.In conclusion, the insider sell by Mary Gibbons, SVP and Chief Legal Officer of Essent Group Ltd, is a transaction that warrants attention. While the insider's selling activity over the past year and the absence of insider buys could be seen as a cautious signal, the company's current valuation metrics suggest that the stock is trading at a fair price relative to its intrinsic value. Investors should consider these factors, along with broader market conditions and company performance, when evaluating the implications of insider trading activity for their investment decisions.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.