Insider Sell: SVP - Chief Marketing Officer Maurice Herrera Sells 4,200 Shares of Adtalem ...

Adtalem Global Education Inc (NYSE:ATGE), a leading workforce solutions provider, has recently witnessed an insider sell that has caught the attention of investors and market analysts. Maurice Herrera, the Senior Vice President and Chief Marketing Officer of Adtalem Global Education Inc, sold 4,200 shares of the company on December 8, 2023. This transaction has prompted a closer look into the insider's trading behavior and its potential implications on the stock's performance.

Who is Maurice Herrera?

Maurice Herrera is a seasoned executive with extensive experience in marketing and brand strategy. As the SVP and Chief Marketing Officer at Adtalem Global Education Inc, Herrera is responsible for overseeing the company's marketing initiatives, enhancing brand visibility, and driving growth through strategic marketing campaigns. His role is pivotal in shaping the public perception and outreach of Adtalem's educational services and offerings.

About Adtalem Global Education Inc

Adtalem Global Education Inc is a global provider of educational services, offering a wide range of programs across the medical and healthcare, financial services, and business and law sectors. The company operates several institutions, including Chamberlain University, Ross University School of Medicine, and Becker Professional Education, among others. Adtalem's mission is to empower students to achieve their goals, find success, and make inspiring contributions to the global community.

Analysis of Insider Buy/Sell and Relationship with Stock Price

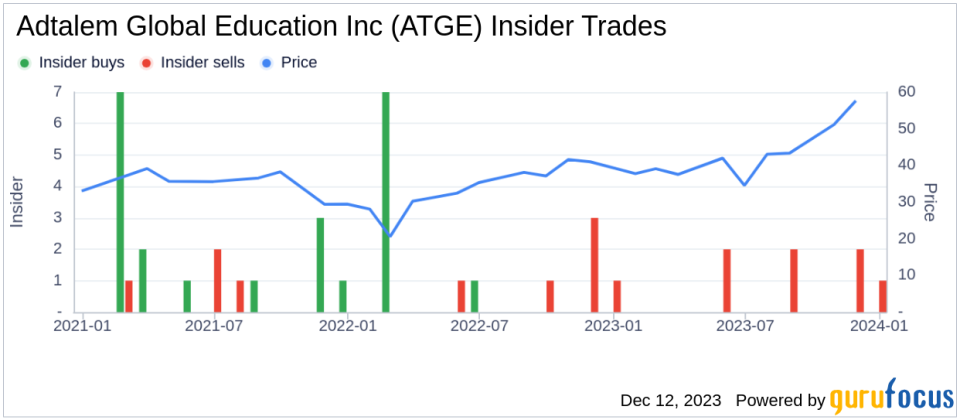

The insider transaction history for Adtalem Global Education Inc reveals a pattern of more insider sells than buys over the past year. Specifically, Maurice Herrera has sold a total of 7,000 shares and has not made any purchases. This could be interpreted in various ways by investors. On one hand, insiders might sell shares for personal financial reasons that do not necessarily reflect their outlook on the company's future. On the other hand, consistent selling by insiders could be perceived as a lack of confidence in the company's stock performance or valuation.

When analyzing the relationship between insider trading activity and stock price, it is important to consider the context of each transaction. Maurice Herrera's recent sell of 4,200 shares took place when the stock was trading at $60, giving Adtalem Global Education Inc a market cap of $2.424 billion. This price point is higher than the industry median P/E ratio and the company's historical median, suggesting a premium valuation for the stock.

Insider Trends

The absence of insider buys and the presence of 9 insider sells over the past year could signal caution to potential investors. It is essential to monitor insider trends as they can provide valuable insights into the internal perspectives of a company's executives and board members.

Valuation

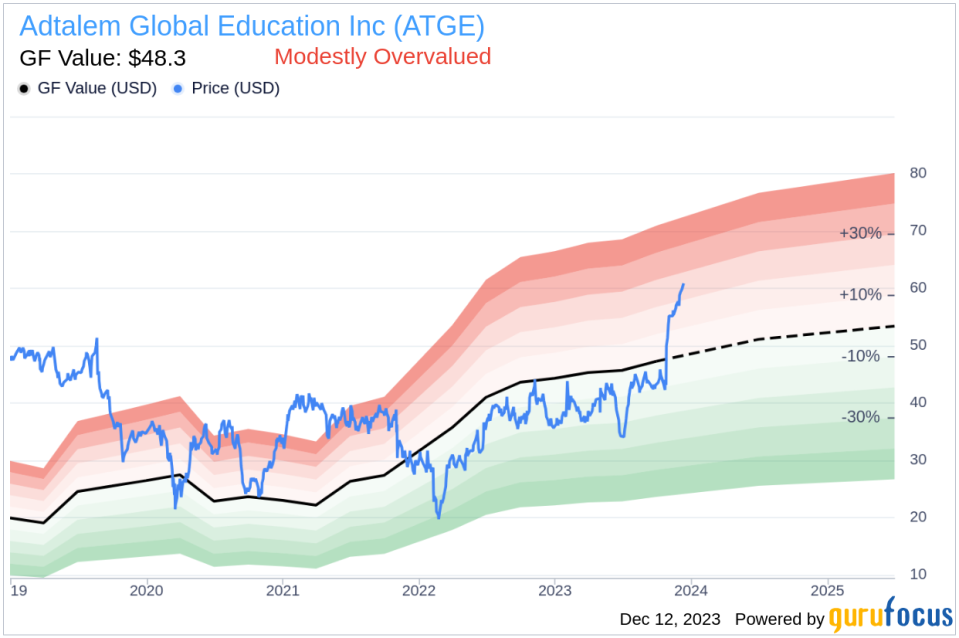

Adtalem Global Education Inc's P/E ratio of 26.70 is higher than the industry median of 19.22, indicating that the stock may be trading at a higher valuation compared to its peers. This is further supported by the stock's price-to-GF-Value ratio of 1.24, which classifies it as modestly overvalued based on its GF Value.

The GF Value is a proprietary intrinsic value estimate developed by GuruFocus, taking into account historical trading multiples, a GuruFocus adjustment factor, and future business performance estimates. With a current price of $60 and a GF Value of $48.30, investors should consider whether the premium they are paying for Adtalem's shares is justified by the company's growth prospects and financial performance.

Conclusion

Maurice Herrera's recent insider sell of 4,200 shares of Adtalem Global Education Inc has prompted a detailed examination of the company's valuation and insider trading trends. While insider sells are not always indicative of a company's health or future performance, they do warrant attention, especially when they occur in the context of a stock that appears to be trading at a higher valuation than its historical averages and industry peers. Investors should conduct thorough due diligence and consider the broader market conditions, the company's growth trajectory, and the potential reasons behind insider trading activity before making investment decisions.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.