Insider Sell: SVP, Chief People Officer Richard Jacquet Sells 62,312 Shares of Coursera Inc (COUR)

In a notable insider transaction, Richard Jacquet, the Senior Vice President and Chief People Officer of Coursera Inc (NYSE:COUR), sold 62,312 shares of the company on November 17, 2023. This sale has caught the attention of investors and market analysts, as insider transactions can provide valuable insights into a company's prospects and the sentiment of its top executives.

Who is Richard Jacquet of Coursera Inc?

Richard Jacquet has been an integral part of Coursera Inc, serving as the Senior Vice President and Chief People Officer. In his role, Jacquet is responsible for overseeing the company's global human resources strategy, including talent acquisition, employee development, and organizational culture. His actions and decisions are critical to the company's ability to attract, retain, and develop the best talent in the competitive tech and online education sectors.

Coursera Inc's Business Description

Coursera Inc is a leading online learning platform that offers courses, specializations, certificates, and degree programs. The company partners with universities and other organizations to provide a wide range of learning opportunities to individuals around the world. Coursera's platform is designed to help learners acquire new skills, advance their careers, and pursue their personal and professional goals through accessible, flexible, and affordable online education.

Analysis of Insider Buy/Sell and the Relationship with the Stock Price

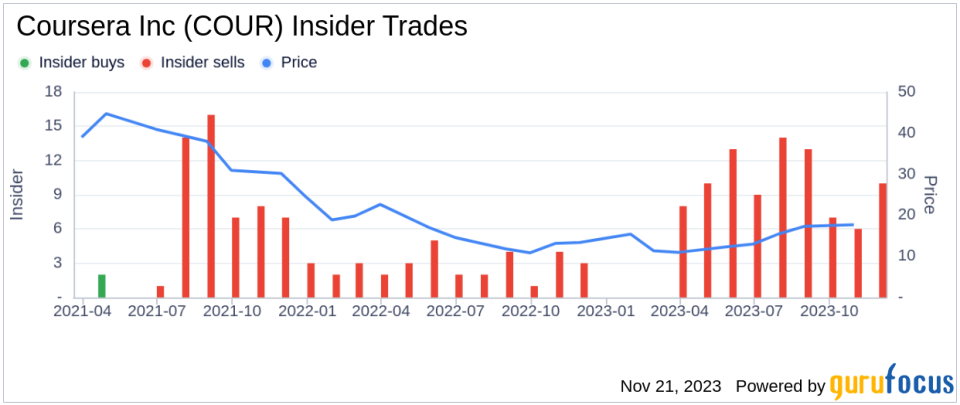

Insider transactions, particularly sales, can be interpreted in various ways. While an insider sell does not always indicate a lack of confidence in the company, a significant sale such as the one executed by Richard Jacquet may lead investors to question the insider's view of the company's future prospects. Over the past year, Jacquet has sold a total of 278,964 shares and has not made any purchases. This one-sided activity could suggest that the insider is taking profits or reallocating personal investment portfolios rather than reflecting a bearish stance on the company's valuation or performance.

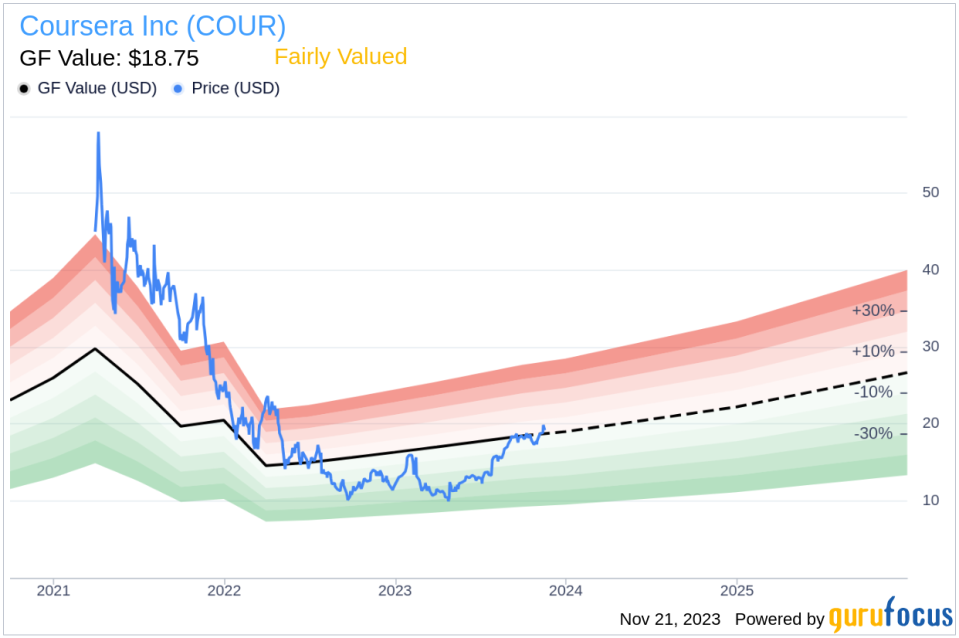

When analyzing the relationship between insider transactions and stock price, it is essential to consider the broader context. Coursera Inc's stock price was $19.35 on the day of Jacquet's recent sale, with a market cap of $2.956 billion. This price point is slightly above the GuruFocus Value (GF Value) of $18.75, indicating that the stock is Fairly Valued based on its intrinsic value estimate.

The GF Value is a proprietary metric developed by GuruFocus, which takes into account historical trading multiples, a GuruFocus adjustment factor based on past returns and growth, and future business performance estimates from analysts. With a price-to-GF-Value ratio of 1.03, Coursera Inc's stock is trading close to its estimated fair value, suggesting that the insider's decision to sell may not be based on an overvaluation concern.

The insider trend image above illustrates the pattern of insider transactions over the past year. Notably, there have been no insider buys, while there have been 91 insider sells. This trend could indicate that insiders, on the whole, have been more inclined to sell their shares than to acquire more, possibly due to personal financial planning or diversification reasons rather than a collective negative outlook on the company's future.

The GF Value image provides a visual representation of Coursera Inc's stock price in relation to its GF Value. The proximity of the current stock price to the GF Value line suggests that the market is pricing the shares reasonably accurately, taking into account the company's historical performance and future growth prospects.

Conclusion

Richard Jacquet's recent sale of 62,312 shares of Coursera Inc is a significant transaction that warrants attention from investors. While the sale may raise questions about the insider's confidence in the company's future, the Fairly Valued status of the stock based on the GF Value and the overall pattern of insider transactions suggest that the sale may not necessarily be a signal of negative sentiment. Investors should consider the context of the sale, including the company's business prospects and the broader market conditions, when interpreting the implications of insider transactions.

As always, insider transactions are just one piece of the puzzle when it comes to evaluating a stock's potential. Investors should conduct thorough due diligence, considering a range of factors including financial performance, industry trends, and broader economic indicators, before making investment decisions.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.