Insider Sell: SVP and Chief Strategy Officer David Rothenstein Sells 3,500 Shares of Ciena Corp

On October 16, 2023, David Rothenstein, the Senior Vice President and Chief Strategy Officer of Ciena Corp (NYSE:CIEN), sold 3,500 shares of the company. This move is part of a series of transactions made by the insider over the past year, during which Rothenstein has sold a total of 24,500 shares and made no purchases.

Ciena Corp is a leading provider of network hardware, software, and services. The company's high-capacity networks are used by communications service providers, cable operators, governments, and enterprises across the globe. With a market cap of $6.49 billion, Ciena Corp is a significant player in the technology sector.

The insider's recent sell has raised questions about the company's current valuation and future prospects. To understand the implications of this move, it's essential to analyze the relationship between insider transactions and the stock's price.

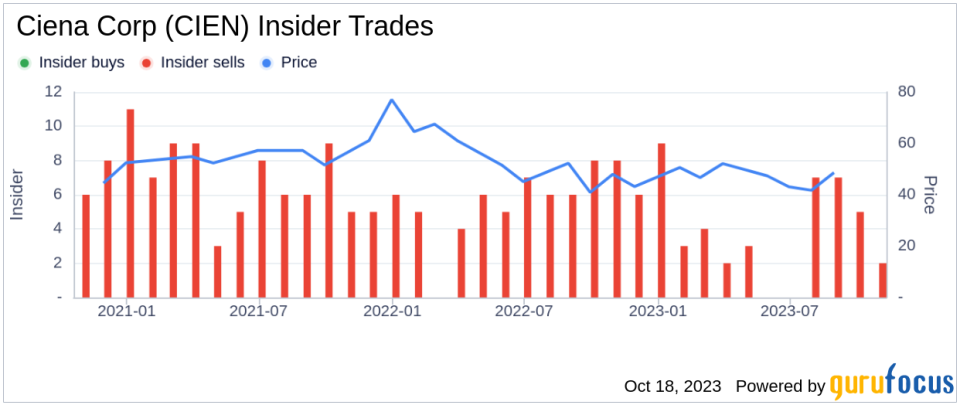

The insider transaction history for Ciena Corp shows a trend of more sells than buys over the past year. There have been 53 insider sells and no insider buys during this period. This trend could indicate that insiders believe the stock is overvalued or that they expect the price to decrease in the future.

On the day of the insider's recent sell, Ciena Corp's shares were trading at $42.45, giving the company a price-earnings ratio of 29.66. This ratio is higher than both the industry median of 21.22 and the company's historical median price-earnings ratio, suggesting that the stock may be overpriced.

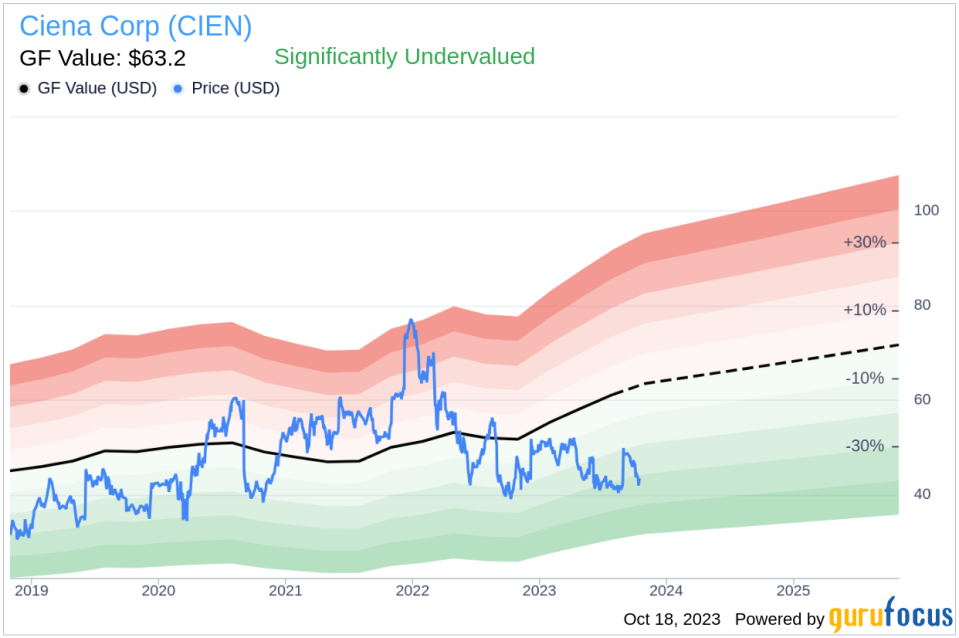

However, according to the GuruFocus Value, which is an intrinsic value estimate based on historical multiples, a GuruFocus adjustment factor, and future business performance estimates, Ciena Corp's stock is significantly undervalued. With a price of $42.45 and a GuruFocus Value of $63.20, the stock has a price-to-GF-Value ratio of 0.67.

In conclusion, while the insider's recent sell might raise concerns among investors, the GuruFocus Value suggests that Ciena Corp's stock is significantly undervalued. Therefore, investors should consider the company's future business performance and other market factors before making investment decisions.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.