Insider Sell: SVP & President Graham Robinson Offloads Shares of Stanley Black & Decker Inc

Stanley Black & Decker Inc (NYSE:SWK), a prominent player in the global tools and storage industry, has recently witnessed an insider sell that has caught the attention of market watchers. Graham Robinson, the Senior Vice President & President of the Industrial segment of the company, sold 2,000 shares on December 5, 2023. This transaction has prompted a closer look into the insider's trading behavior and its potential implications for the stock.

Who is Graham Robinson of Stanley Black & Decker Inc?

Graham Robinson is a seasoned executive with a wealth of experience in the industrial sector. As the Senior Vice President & President of the Industrial segment at Stanley Black & Decker Inc, Robinson is responsible for overseeing the strategic direction and operational execution of this critical division. His role is pivotal in driving growth and maintaining the company's competitive edge in a rapidly evolving market.

Stanley Black & Decker Inc's Business Description

Stanley Black & Decker Inc is a global provider of tools, storage, industrial, and security solutions. With a rich history dating back to 1843, the company has established a strong brand presence and a diverse portfolio of products that cater to professional, industrial, and consumer markets. Its well-known brands include Stanley, Black & Decker, DeWalt, Craftsman, and many others. The company's commitment to innovation and quality has solidified its position as a leader in its field, with operations spanning across various geographies and market segments.

Analysis of Insider Buy/Sell and the Relationship with the Stock Price

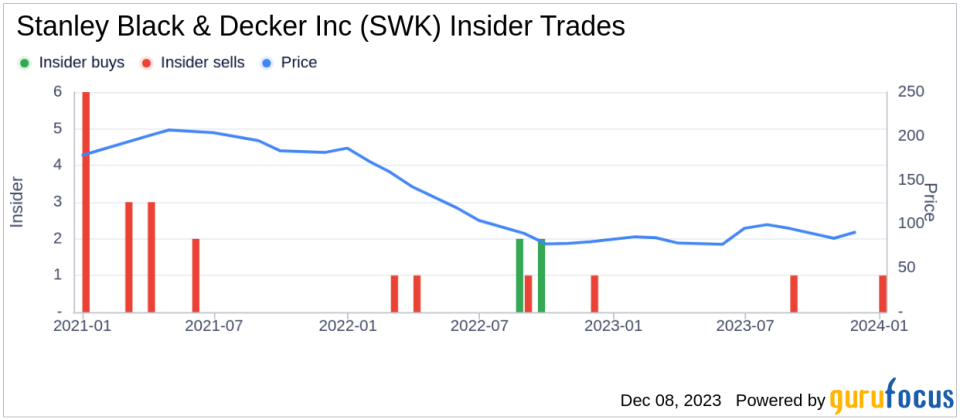

Insider trading activity, particularly sells, can provide valuable insights into a company's internal perspective on its stock's valuation. In the case of Stanley Black & Decker Inc, the insider, Graham Robinson, has sold 2,000 shares over the past year without any recorded purchases. This one-sided activity might raise questions among investors regarding the insider's confidence in the company's future prospects.

On the day of the insider's recent sell, shares of Stanley Black & Decker Inc were trading at $91.83, giving the company a market cap of $14.317 billion. This price point is significantly below the GuruFocus Value (GF Value) of $137.10, suggesting that the stock is undervalued. The price-to-GF-Value ratio stands at 0.67, indicating that the stock might be an attractive buy for value investors.

The GF Value is a proprietary metric developed by GuruFocus, which takes into account historical trading multiples, a GuruFocus adjustment factor based on past returns and growth, and future business performance estimates from analysts. When an insider sells at a price well below the GF Value, it could be interpreted in several ways. The insider might need liquidity for personal reasons, believe the stock is fully valued despite the GF Value, or see potential headwinds that could affect the stock's performance.

However, it's important to note that insider sells do not always signal a lack of confidence in the company. Executives may have diverse portfolios and personal financial planning strategies that necessitate selling shares, regardless of the company's intrinsic value or stock performance.

The insider trend image above provides a visual representation of the insider trading activity over the past year. With no insider buys and two insider sells, the trend might suggest a cautious stance from the insiders. Nevertheless, without additional context, it is difficult to draw definitive conclusions from this data alone.

The GF Value image further illustrates the disparity between the current stock price and the estimated intrinsic value. This discrepancy could present a buying opportunity for investors who believe in the company's long-term value proposition and are willing to look past the recent insider sell.

Conclusion

The recent insider sell by SVP & President Graham Robinson of Stanley Black & Decker Inc has prompted a detailed examination of the company's stock valuation and insider trading trends. While the sell activity might raise some concerns, the stock's significant undervaluation according to the GF Value suggests that the current price could be an attractive entry point for long-term investors. As always, it is crucial for investors to conduct their own due diligence and consider the broader context of insider trading activity when making investment decisions.

Investors should also keep an eye on the company's upcoming financial reports, market trends, and any potential strategic moves that could impact the stock's performance. Insider trading is just one piece of the puzzle, and a holistic approach to investment analysis is essential for making informed decisions in the dynamic landscape of the stock market.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.