Insider Sell: SVP of Public Affairs Jeffrey Malmen Sells 1,463 Shares of Idacorp Inc

On September 14, 2023, Jeffrey Malmen, the Senior Vice President of Public Affairs at Idacorp Inc (NYSE:IDA), sold 1,463 shares of the company. This move is part of a trend observed over the past year, where the insider has sold a total of 1,463 shares and made no purchases.

Idacorp Inc is a holding company that, through its subsidiary Idaho Power Company, engages in the generation, transmission, distribution, sale, and purchase of electric energy. With a market cap of $4.98 billion, the company is a significant player in the utilities sector.

The insider's recent sell has raised some eyebrows, especially considering the lack of insider buys over the past year. The company has seen a total of three insider sells in the same timeframe, with no insider buys to balance the equation. This could potentially signal a lack of confidence in the company's future performance from those with intimate knowledge of its operations.

On the day of the insider's recent sell, shares of Idacorp Inc were trading at $98.16 apiece. This price gives the stock a price-earnings ratio of 18.25, which is higher than the industry median of 15.67 but lower than the company's historical median price-earnings ratio.

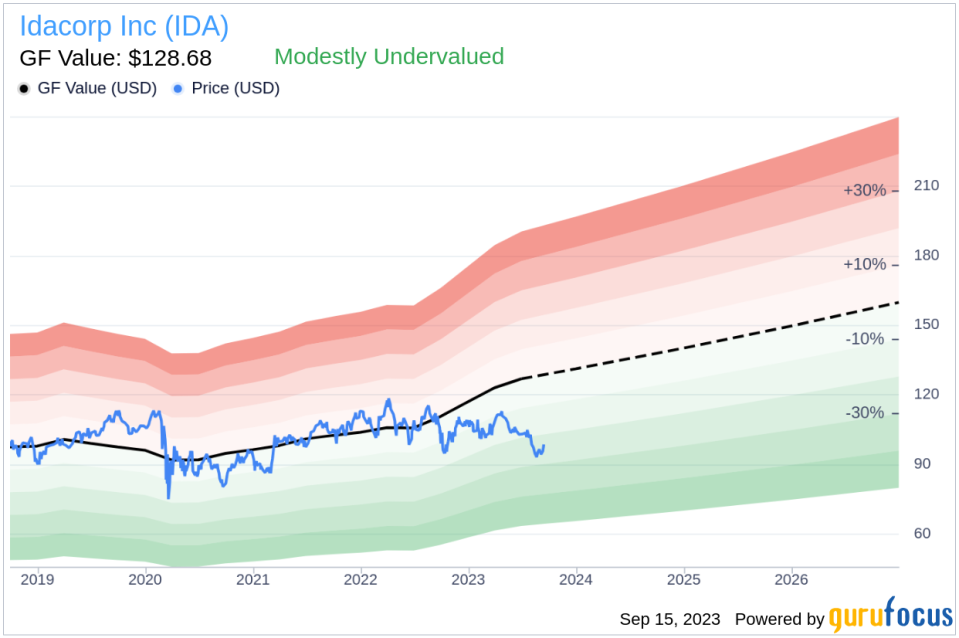

According to the GuruFocus Value, which is an intrinsic value estimate based on historical multiples, a GuruFocus adjustment factor, and future business performance estimates, Idacorp Inc is modestly undervalued. With a price of $98.16 and a GuruFocus Value of $128.68, the stock has a price-to-GF-Value ratio of 0.76.

While the insider's sell might raise some concerns, the company's valuation suggests that the stock might still be a good buy for investors. However, potential investors should keep a close eye on the insider's future transactions and the company's performance to make an informed decision.

As always, insider transactions should not be used in isolation to make investment decisions. Instead, they should be used as a starting point for further research into the company's fundamentals, financials, and market conditions.

This article first appeared on GuruFocus.