Insider Sell: T-Mobile US Inc President, Business Group Callie Field Sells Company Shares

T-Mobile US Inc (NASDAQ:TMUS), a leading provider of wireless communication services, has reported an insider sell according to a recent SEC filing. President, Business Group Callie Field has sold 2,288 shares of the company on March 5, 2024. The transaction was disclosed in a legal filing with the Securities & Exchange Commission, which is accessible through this SEC Filing.

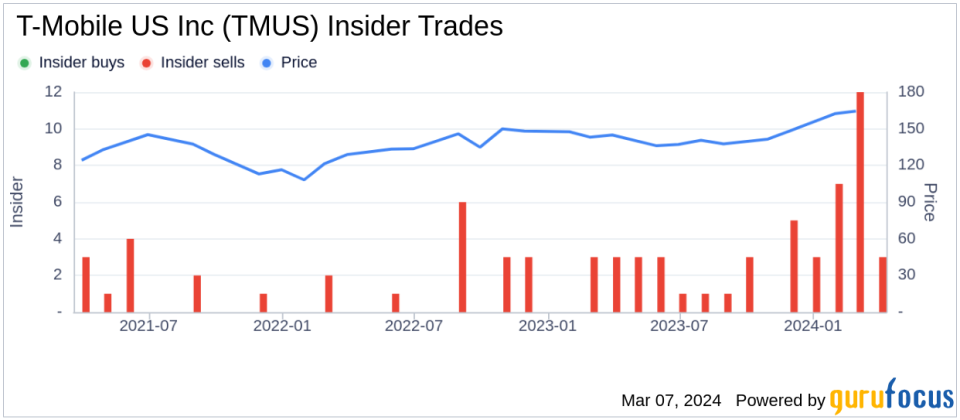

Over the past year, the insider has sold a total of 2,288 shares of T-Mobile US Inc and has not made any purchase of the company's stock. The insider transaction history for T-Mobile US Inc shows a pattern of 43 insider sells and no insider buys over the past year.

On the day of the insider's recent sell, shares of T-Mobile US Inc were trading at $163.99, resulting in a market capitalization of $198.68 billion. The company's price-earnings ratio stands at 24.16, which is above the industry median of 16.49 but below the company's historical median price-earnings ratio.

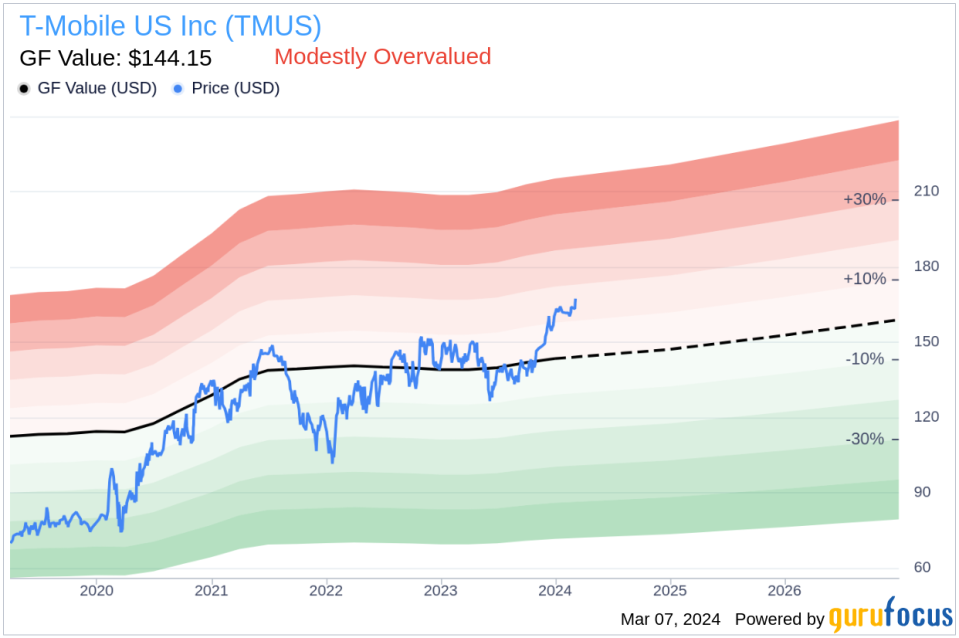

According to the GuruFocus Value assessment, T-Mobile US Inc, with a share price of $163.99 and a GF Value of $144.15, has a price-to-GF-Value ratio of 1.14, indicating that the stock is modestly overvalued. The GF Value is calculated based on historical trading multiples, a GuruFocus adjustment factor, and future business performance estimates from Morningstar analysts.

Investors and analysts often monitor insider selling as it can provide insights into an insider's perspective on the value of the company's stock. While a single insider selling transaction may not be indicative of the company's future performance, a trend of insider sales could signal that insiders believe the stock may be fully valued or overvalued.

It is important to note that insider transactions are just one piece of the puzzle when evaluating a company's financial health and investment potential. Shareholders and potential investors should consider a wide range of financial metrics and market conditions before making any investment decisions.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.