Insider Sell: Tim Makowski Sells 2,500 Shares of Advanced Drainage Systems Inc (WMS)

On September 12, 2023, See Remarks Tim Makowski sold 2,500 shares of Advanced Drainage Systems Inc (NYSE:WMS). This move comes in the wake of a series of insider transactions that have taken place over the past year at the company.

Tim Makowski is a key insider at Advanced Drainage Systems Inc, a company that is a leading provider of innovative water management solutions in the stormwater and on-site septic wastewater industries. Its comprehensive suite of products and services are used in the construction, agriculture, and residential markets.

Over the past year, the insider has sold a total of 5,500 shares and has not made any purchases. This recent sale represents a significant portion of the insider's transactions over the past year.

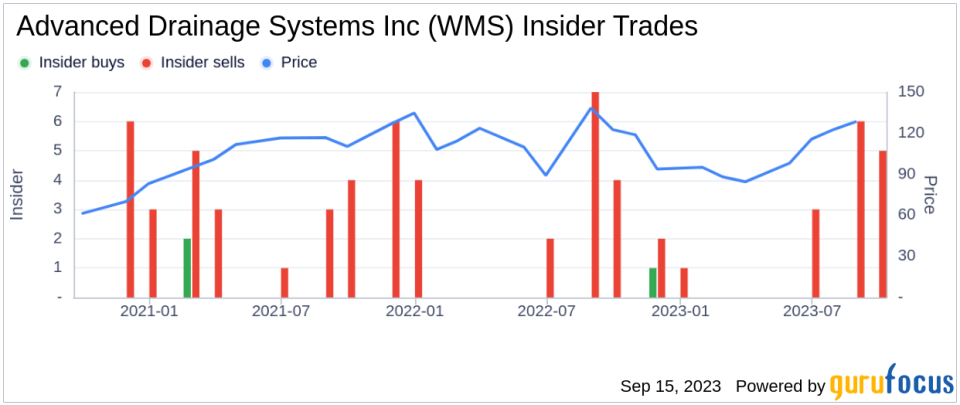

The insider transaction history for Advanced Drainage Systems Inc shows a trend of more sells than buys. Over the past year, there has been only 1 insider buy compared to 19 insider sells.

On the day of the insider's recent sell, shares of Advanced Drainage Systems Inc were trading for $122.35 apiece, giving the stock a market cap of $9.697 billion. The price-earnings ratio stands at 20.44, which is higher than the industry median of 14.39 but lower than the companys historical median price-earnings ratio.

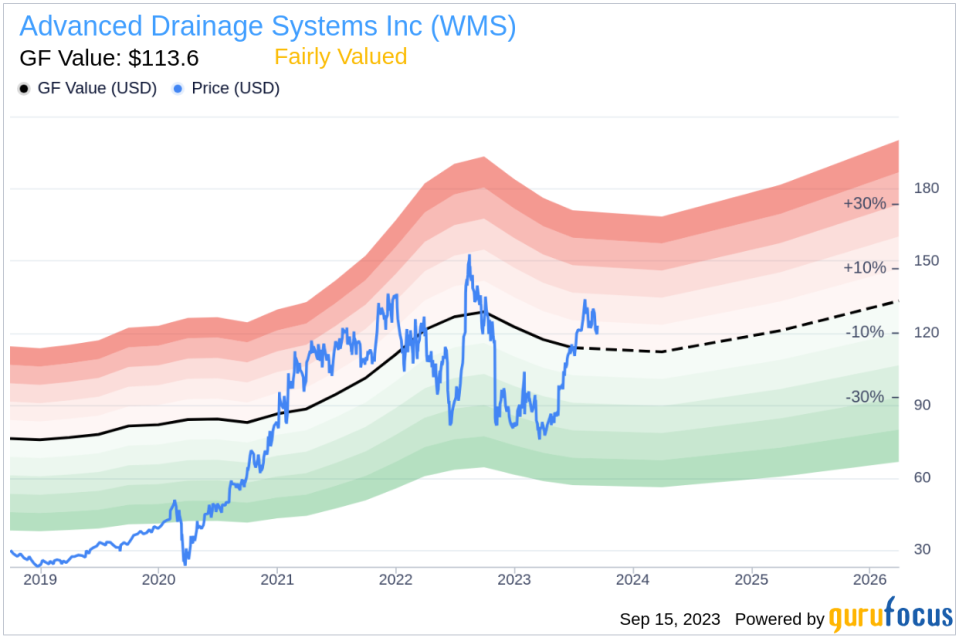

With a price of $122.35 and a GuruFocus Value of $113.60, Advanced Drainage Systems Inc has a price-to-GF-Value ratio of 1.08. This suggests that the stock is fairly valued based on its GF Value.

The GF Value is an intrinsic value estimate developed by GuruFocus. It is calculated based on historical multiples that the stock has traded at, a GuruFocus adjustment factor based on the companys past returns and growth, and future estimates of business performance from Morningstar analysts.

The recent sell by the insider, coupled with the stock's current valuation, suggests that the insider may believe that the stock is fairly valued at its current price. However, investors should always conduct their own due diligence and consider the company's fundamentals, market conditions, and other factors before making investment decisions.

As always, insider transactions should not be used in isolation to make investment decisions. Instead, they should be used as a tool to better understand the actions of company insiders and how these actions may reflect on the company's future performance.

This article first appeared on GuruFocus.