Insider Sell: TopBuild Corp's CEO Robert Buck Divests 4,500 Shares

In a notable insider transaction, Robert Buck, President and CEO of TopBuild Corp (NYSE:BLD), sold 4,500 shares of the company on November 29, 2023. This move has caught the attention of investors and market analysts, as insider transactions can provide valuable insights into a company's prospects and the confidence level of its top executives.

Robert Buck has been at the helm of TopBuild Corp, a leader in the installation and distribution of insulation products to the United States construction industry. Under his leadership, the company has expanded its reach and solidified its position in the market. Buck's role in steering the company through various market conditions has made his trading activities a point of interest for investors.

TopBuild Corp specializes in providing insulation and building material services, including installation and distribution to both commercial and residential customers. The company's business model focuses on leveraging its national footprint to deliver comprehensive solutions for builders and contractors, making it a key player in the construction supply chain.

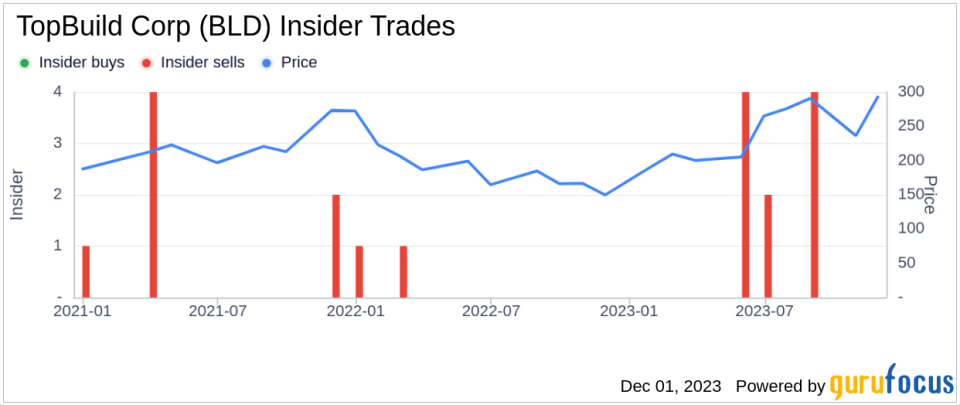

Over the past year, Robert Buck has sold a total of 13,473 shares and has not made any purchases, indicating a trend of divestment. This pattern of behavior is often scrutinized by investors as it may signal an insider's perspective on the company's valuation or future performance.

The insider transaction history for TopBuild Corp shows a lack of insider buying over the past year, with zero insider purchases recorded. On the other hand, there have been 11 insider sells during the same period, suggesting that insiders may perceive the stock's current valuation as being on the higher end or are taking profits after a period of appreciation.

On the day of the insider's recent sale, shares of TopBuild Corp were trading at $296.02, giving the company a market capitalization of $9,398.097 billion. This valuation places the stock in the upper echelon of the market, reflecting the company's strong position and investor confidence.

The price-earnings (P/E) ratio of TopBuild Corp stands at 15.32, slightly higher than the industry median of 14.46. This indicates that the stock is trading at a premium compared to its peers, but still below the company's historical median P/E ratio. A higher P/E ratio can suggest that investors are expecting higher earnings growth in the future compared to the industry average.

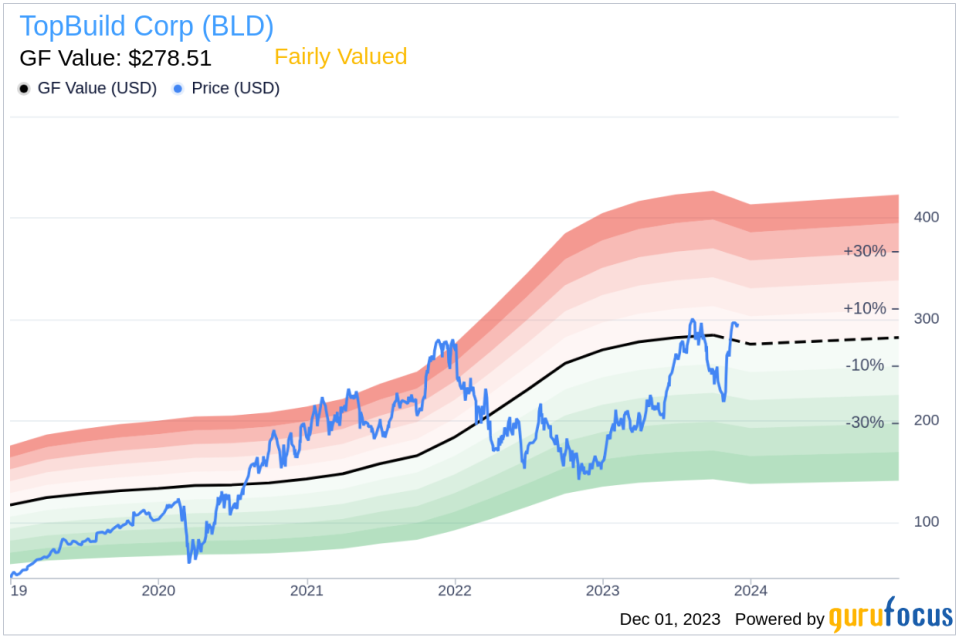

With the stock price at $296.02 and a GuruFocus Value (GF Value) of $278.51, TopBuild Corp has a price-to-GF-Value ratio of 1.06. This ratio suggests that the stock is Fairly Valued based on its intrinsic value as estimated by GuruFocus. The GF Value is a proprietary metric that considers historical trading multiples, a GuruFocus adjustment factor, and future business performance estimates provided by Morningstar analysts.

The relationship between insider trading activity and stock price can be complex. While insider selling does not always indicate a lack of confidence in the company, it can sometimes lead to negative market sentiment, especially when it follows a pattern or occurs in large volumes. In the case of TopBuild Corp, the consistent selling by the insider over the past year could raise questions among investors about the stock's future trajectory.

However, it is also important to consider that insiders may sell shares for various reasons unrelated to their outlook on the company, such as personal financial planning or diversifying their investment portfolio. Therefore, while insider transactions are an important piece of the puzzle, they should not be the sole factor in making investment decisions.

Investors and analysts often look at insider trends to gauge the internal perspective on the company's valuation. The absence of insider buying and the presence of multiple insider sells at TopBuild Corp could suggest that insiders believe the stock is fully valued or that they are taking advantage of the current market conditions to realize gains.

When examining the insider trend image, it is clear that the selling pattern has been consistent, which may lead to a cautious approach from potential investors. The lack of buying activity could be interpreted as a lack of compelling investment opportunities at the current price levels from the perspective of the insiders.

The GF Value image provides a visual representation of the stock's valuation relative to its intrinsic value. As the price-to-GF-Value ratio hovers around 1.06, it indicates that the stock is trading close to its fair value, which may offer limited upside potential for investors seeking undervalued opportunities.

In conclusion, the recent insider sell by Robert Buck, along with the overall trend of insider transactions at TopBuild Corp, offers a mixed signal to the market. While the company's strong market position and fair valuation based on GF Value provide a solid foundation, the insider selling activity may warrant a closer examination of the stock's potential for future growth. Investors should consider these factors in conjunction with broader market analysis and individual investment goals when evaluating TopBuild Corp as a potential addition to their portfolios.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.