Insider Sell: Vaxcyte Inc CFO Andrew Guggenhime Sells 8,000 Shares

Andrew Guggenhime, the President and CFO of Vaxcyte Inc (NASDAQ:PCVX), has sold 8,000 shares of the company on January 18, 2024, according to a recent SEC Filing. Vaxcyte Inc is a biotechnology company focused on the discovery, development, and commercialization of innovative vaccine candidates. The company aims to improve global health through the power of its vaccine technologies.

The transaction was executed at a price of $60.73 per share, resulting in a total sale amount of $485,840. Following this transaction, the insider's total sales over the past year amount to 46,000 shares, with no recorded purchases in the same period.

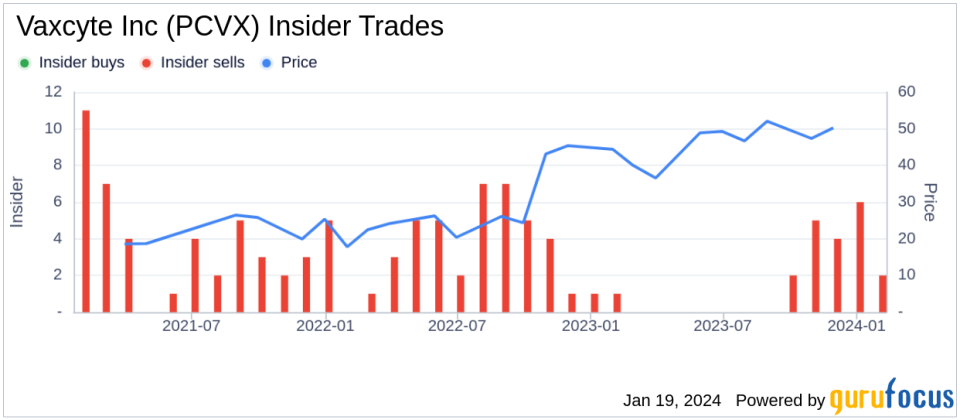

The insider transaction history at Vaxcyte Inc indicates a trend of insider sales, with 19 insider sells and no insider buys over the past year. This pattern of insider activity can often provide insight into the company's performance and insider sentiment.

On the day of the insider's recent sale, Vaxcyte Inc's shares were trading at $60.73, giving the company a market capitalization of approximately $5.76 billion.

Investors and analysts often monitor insider sales as they may suggest an insider's belief about the company's future prospects. However, it is also important to consider that insiders may sell shares for various reasons unrelated to their outlook on the company, such as personal financial planning or diversifying their investment portfolio.

For more detailed information on insider transactions and how they may relate to a company's financial performance and investor outlook, readers are encouraged to review the full SEC filings and consider the broader context of the market.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.