Insider Sell: Vice Chairman Jason Vanwees Sells 3,700 Shares of Teledyne Technologies Inc (TDY)

Teledyne Technologies Inc (NYSE:TDY), a leading provider of sophisticated instrumentation, digital imaging products and software, aerospace and defense electronics, and engineered systems, has recently witnessed a significant insider sell by its Vice Chairman, Jason Vanwees. On December 12, 2023, the insider executed a sale of 3,700 shares of the company, a move that has caught the attention of investors and market analysts alike.

Who is Jason Vanwees?

Jason Vanwees has been a key figure at Teledyne Technologies Inc, serving as the Vice Chairman. His role at Teledyne involves overseeing strategic planning and mergers and acquisitions, which are critical components of the company's growth strategy. With a deep understanding of the company's operations and market position, Vanwees's transactions in the company's stock are closely monitored for insights into the company's financial health and future prospects.

Teledyne Technologies Inc's Business Description

Teledyne Technologies Inc is a diversified company that operates through four primary business segments: Instrumentation, Digital Imaging, Aerospace and Defense Electronics, and Engineered Systems. The company's products range from monitoring and control instruments for marine and environmental applications to digital imaging sensors and cameras for industrial and government customers. Teledyne's aerospace and defense electronics segment provides sophisticated electronic components and subsystems for communication, monitoring, and control applications. The engineered systems segment offers solutions for aerospace, defense, and energy applications. With a strong focus on research and development, Teledyne is committed to delivering innovative technologies that address complex challenges in various industries.

Analysis of Insider Buy/Sell and Relationship with Stock Price

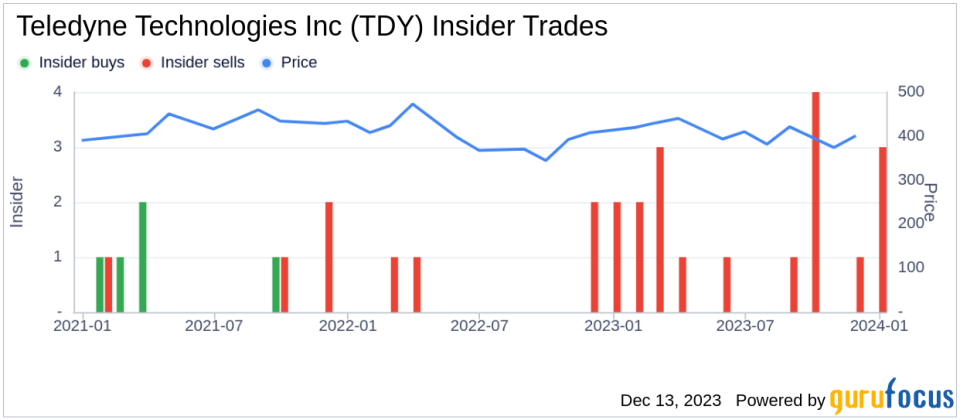

The recent sale by Jason Vanwees of 3,700 shares is part of a broader pattern of insider selling at Teledyne Technologies Inc. Over the past year, Vanwees has sold a total of 9,100 shares and has not made any purchases. This consistent selling could be interpreted in several ways. On one hand, it might suggest that insiders see the current stock price as relatively high and are taking the opportunity to realize gains. On the other hand, insider sales can sometimes be motivated by personal financial planning and therefore may not always reflect a bearish view on the company's future.

The insider trend image above provides a visual representation of the selling pattern. It's important to note that there have been 16 insider sells and no insider buys over the past year. This trend could indicate that insiders, including Vanwees, may believe that the stock is fully valued or that they are diversifying their personal investment portfolios.

Valuation and Market Cap

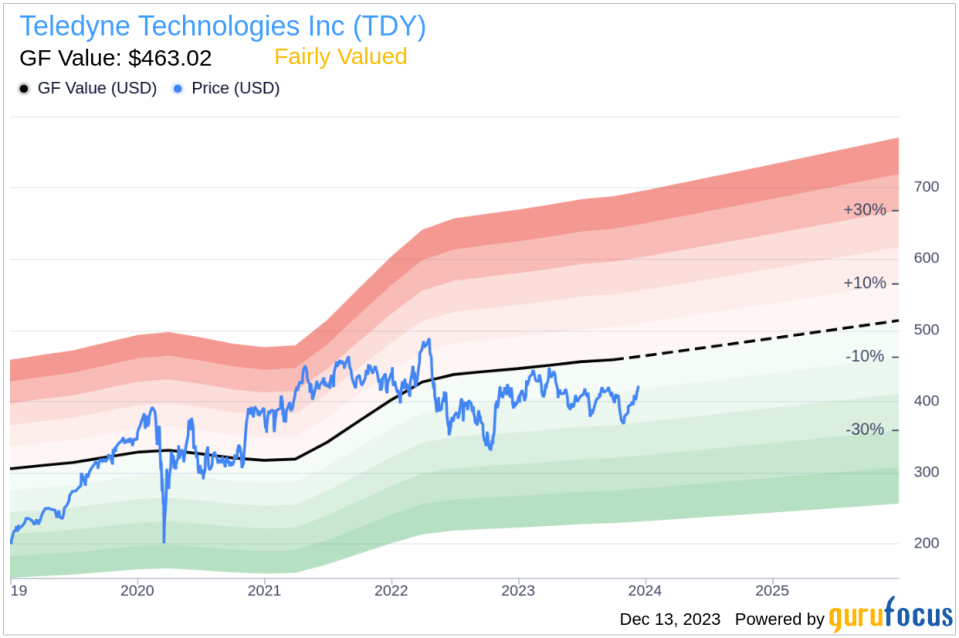

On the day of the insider's recent sale, shares of Teledyne Technologies Inc were trading at $420.29, giving the company a market cap of $19.907 billion. The price-earnings ratio of 25.59 is slightly higher than the industry median of 22.75 but lower than the company's historical median price-earnings ratio. This suggests that the stock is trading at a premium compared to the industry but may still be undervalued relative to its own historical standards.

The GF Value image above indicates that with a price of $420.29 and a GuruFocus Value of $463.02, Teledyne Technologies Inc has a price-to-GF-Value ratio of 0.91, which implies that the stock is Fairly Valued based on its GF Value. The GF Value is a proprietary intrinsic value estimate from GuruFocus, which takes into account historical trading multiples, a GuruFocus adjustment factor based on past returns and growth, and future business performance estimates from Morningstar analysts.

Conclusion

The insider selling activity by Vice Chairman Jason Vanwees at Teledyne Technologies Inc, particularly the recent sale of 3,700 shares, provides investors with valuable information. While the company's stock appears to be fairly valued based on the GF Value, the consistent pattern of insider selling could be a signal for investors to watch closely. It is essential for investors to consider the context of these transactions and to analyze broader market conditions, the company's performance, and other relevant factors before making investment decisions. As always, insider trading is just one piece of the puzzle when it comes to evaluating a company's potential as an investment.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.