Insider Sell: VP & Chief Accounting Officer Steven Adams Sells Shares of First American ...

Steven Adams, the Vice President and Chief Accounting Officer of First American Financial Corp (NYSE:FAF), has recently sold 1,800 shares of the company's stock. The transaction took place on November 15, 2023, marking a notable insider move within the organization. This sale has caught the attention of investors and market analysts, as insider transactions can often provide valuable insights into a company's financial health and future prospects.

Who is Steven Adams of First American Financial Corp?

Steven Adams serves as the Vice President and Chief Accounting Officer at First American Financial Corp, a leading provider of title insurance, settlement services, and risk solutions for real estate transactions. Adams has been an integral part of the company's financial team, overseeing accounting practices, financial reporting, and compliance with regulatory requirements. His role positions him to have an in-depth understanding of the company's financial status and outlook.

First American Financial Corp's Business Description

First American Financial Corp is a prominent player in the financial services industry, specializing in title insurance and settlement services. The company operates through its Title Insurance and Services segment and its Specialty Insurance segment. It provides its services to homebuyers and sellers, real estate professionals, mortgage lenders, and servicers, as well as commercial property professionals. First American Financial Corp is known for its comprehensive title and closing services, including title insurance, closing and escrow, and real estate data and analytics.

Analysis of Insider Buy/Sell and the Relationship with the Stock Price

Insider transactions, particularly sales, can be interpreted in various ways. While an insider sell does not always indicate a lack of confidence in the company, it can raise questions among investors. In the case of Steven Adams, the insider has sold 1,800 shares over the past year without any recorded purchases. This one-sided activity might suggest that the insider is taking profits or reallocating personal investment portfolios rather than reflecting a negative outlook on the company's future.

On the day of the insider's recent sale, shares of First American Financial Corp were trading at $56.2, giving the company a market cap of $5.81 billion. The price-earnings ratio stood at 24.81, higher than the industry median of 10.79 and also above the company's historical median price-earnings ratio. This could indicate that the stock is somewhat overvalued compared to its peers and its own historical valuation, potentially justifying the insider's decision to sell.

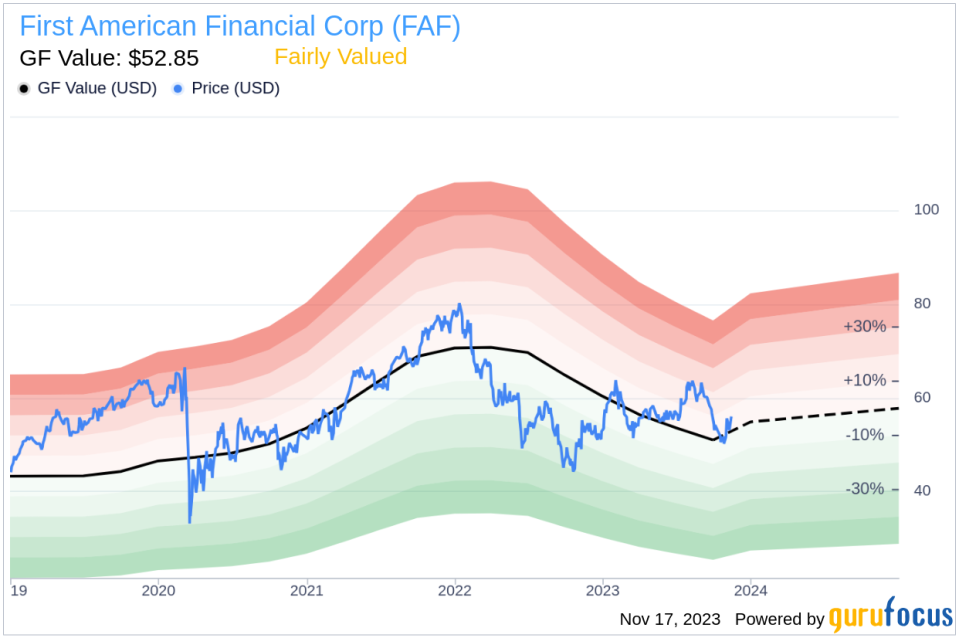

However, with a price-to-GF-Value ratio of 1.06, First American Financial Corp is considered Fairly Valued based on its GF Value. The GF Value is a proprietary intrinsic value estimate from GuruFocus, which factors in historical trading multiples, a GuruFocus adjustment factor, and future business performance estimates. This assessment suggests that the stock is not significantly over or undervalued, which might imply that the insider's sale is not necessarily a signal of overvaluation.

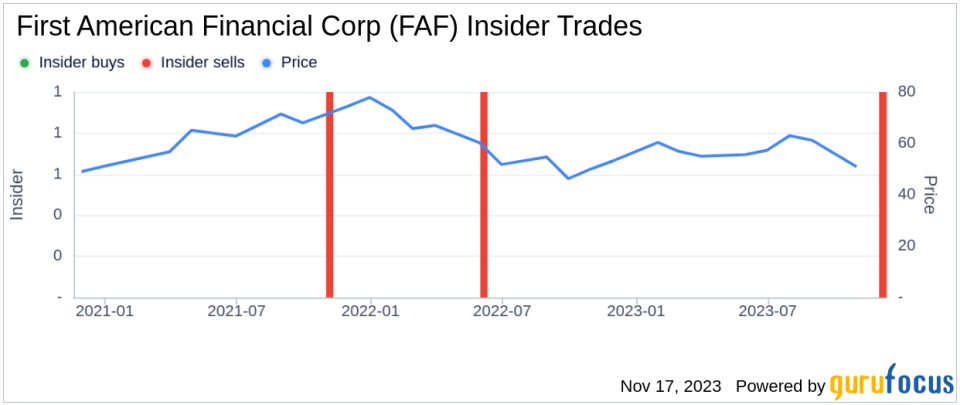

The insider trend image above provides a visual representation of the insider transactions over the past year. The lack of insider buys and the presence of insider sells could be a point of consideration for investors, as it may indicate that insiders are not currently seeing compelling buying opportunities at the current stock price levels.

The GF Value image further illustrates the stock's valuation in relation to its intrinsic value estimate. The proximity of the current stock price to the GF Value suggests that the market is pricing the stock in line with its estimated fair value, which could mean that the insider's transaction was not motivated by valuation concerns.

Insider Trends

Looking at the broader insider transaction history for First American Financial Corp, there have been no insider buys and only one insider sell over the past year. This pattern of activity can be indicative of a cautious stance from insiders, possibly due to market uncertainty or internal assessments of the company's growth potential. It is important for investors to consider these trends in the context of the overall market and the specific circumstances of the company.

Valuation

First American Financial Corp's stock valuation metrics present a mixed picture. While the price-earnings ratio is higher than the industry median, suggesting a premium pricing, the Fairly Valued status based on the GF Value indicates that the stock is not significantly mispriced. Investors should weigh these factors alongside other financial metrics and industry trends when making investment decisions.

In conclusion, the recent insider sell by Steven Adams at First American Financial Corp may not necessarily be a cause for alarm among investors. While it is essential to monitor insider activity, it is equally important to consider the broader financial context, valuation metrics, and market conditions. As always, a well-rounded analysis that includes insider trends, valuation, and company performance will provide the most reliable guidance for investment strategies.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.