Insider Sell: VP, Chief Accounting Officer Brian Shackley Sells 475 Shares of AeroVironment Inc

On September 11, 2023, Brian Shackley, the Vice President and Chief Accounting Officer of AeroVironment Inc (NASDAQ:AVAV), sold 475 shares of the company. This move is part of a trend observed over the past year, where the insider has sold a total of 475 shares and made no purchases.

AeroVironment Inc is a leading technology solutions provider that designs, develops, produces, supports, and operates an advanced portfolio of Unmanned Aircraft Systems (UAS) and electric transportation solutions. The company's electric-powered, hand-launched unmanned aerial vehicles generate and process data to deliver powerful insight, on demand, to people engaged in military, public safety, and commercial activities around the world.

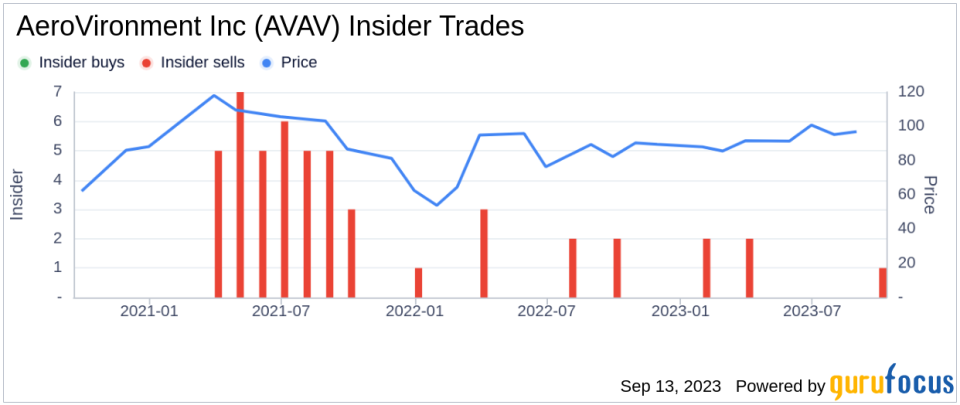

The insider's recent sell-off is part of a broader trend within the company. Over the past year, there have been no insider buys and six insider sells in total. This could indicate a bearish sentiment within the company's top management.

On the day of the insider's recent sell, shares of AeroVironment Inc were trading for $112.77 apiece, giving the company a market cap of $2.97 billion.

According to GuruFocus Value, the stock is fairly valued. With a price of $112.77 and a GuruFocus Value of $118.03, AeroVironment Inc has a price-to-GF-Value ratio of 0.96. The GF Value is an intrinsic value estimate developed by GuruFocus, calculated based on historical multiples, a GuruFocus adjustment factor, and future estimates of business performance from Morningstar analysts.

The relationship between the insider's sell-off and the stock price can be complex. While the insider's sell-off could be interpreted as a lack of confidence in the company's future performance, it's also possible that the insider is simply diversifying their personal investment portfolio. Regardless, potential investors should consider this insider activity as part of a broader analysis of AeroVironment Inc's financial health and market position.

In conclusion, while the insider's recent sell-off may raise some eyebrows, it's important to consider the broader context. AeroVironment Inc remains a leading player in the UAS and electric transportation solutions market, and its stock is currently considered fairly valued according to GuruFocus Value.

This article first appeared on GuruFocus.