Insider Sell: Vulcan Materials Co's Senior Vice President David Clement Sells 764 Shares

Senior Vice President David Clement of Vulcan Materials Co (NYSE:VMC) has recently sold 764 shares of the company's stock, according to a filing with the Securities and Exchange Commission. The transaction took place on November 30, 2023, and has caught the attention of investors and analysts who closely monitor insider activities as an indicator of a company's financial health and future performance.

Who is David Clement of Vulcan Materials Co?

David Clement serves as a Senior Vice President at Vulcan Materials Co, a major player in the construction materials industry. Clement's role within the company involves overseeing various aspects of the company's operations and strategy. His insider perspective on the company's performance and prospects is invaluable, and his trading activities are often scrutinized for insights into the company's future.

Vulcan Materials Co's Business Description

Vulcan Materials Co is a leading producer of construction aggregates, primarily crushed stone, sand, and gravel. The company also produces asphalt mix and ready-mixed concrete. Vulcan's products are essential for infrastructure and residential and nonresidential construction projects. With a strong presence in the United States, Vulcan Materials Co has a reputation for quality and sustainability in its operations.

Analysis of Insider Buy/Sell and the Relationship with the Stock Price

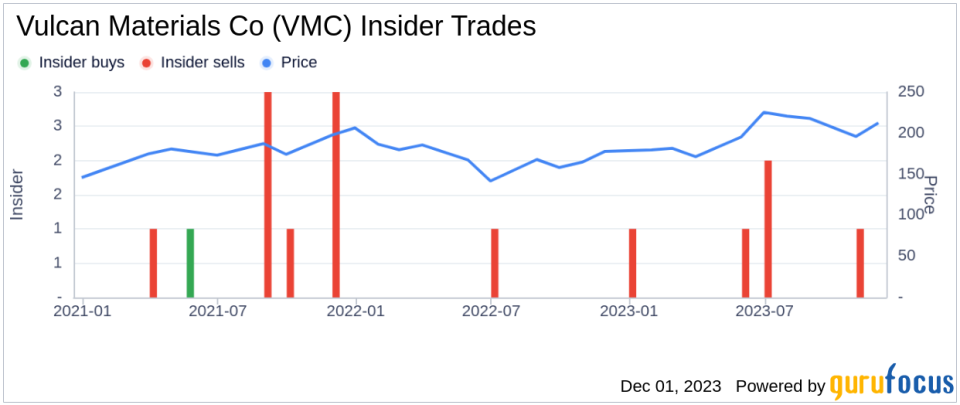

Insider trading activities, such as the recent sale by David Clement, can provide valuable clues about a company's internal dynamics and future prospects. Over the past year, Clement has sold a total of 5,917 shares and has not made any purchases. This pattern of selling without corresponding buys could suggest that insiders might perceive the stock's current price as being on the higher side of its value spectrum.

However, it is essential to consider these transactions in the broader context of overall insider trends. Vulcan Materials Co has seen 0 insider buys and 7 insider sells over the past year. This trend of more insider selling than buying could indicate that those with the most intimate knowledge of the company's workings are taking profits or reallocating their investments, which might be a signal for investors to watch the stock closely.

On the day of Clement's recent sale, Vulcan Materials Co's shares were trading at $212, giving the company a market cap of $28.376 billion. The price-earnings ratio stood at 34.61, higher than the industry median of 15.17 but lower than the company's historical median price-earnings ratio. This suggests that while the stock may be trading at a premium compared to the industry, it is still below its historical valuation levels.

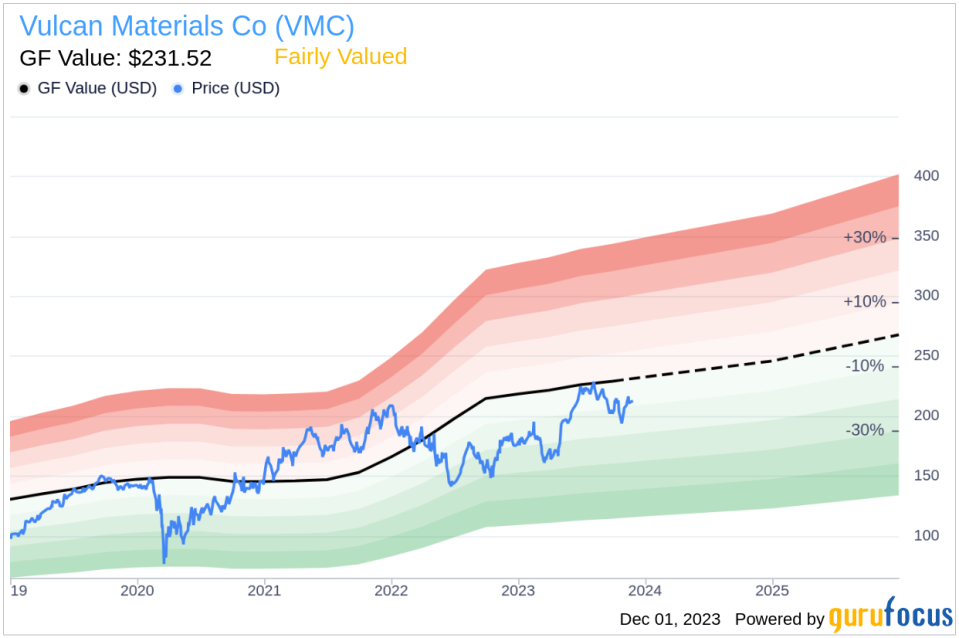

Considering the price-to-GF-Value ratio of 0.92, Vulcan Materials Co is deemed to be Fairly Valued based on its GF Value of $231.52. The GF Value is a proprietary intrinsic value estimate from GuruFocus, which factors in historical trading multiples, a GuruFocus adjustment factor based on past returns and growth, and future business performance estimates from Morningstar analysts.

When analyzing the relationship between insider trading activities and stock price, it is crucial to consider the company's valuation and market sentiment. While insider sells can sometimes signal a lack of confidence in the company's future growth, they can also be motivated by personal financial planning or diversification needs. Therefore, investors should not rely solely on insider trading patterns but should also consider the company's fundamentals, industry trends, and broader market conditions.

The insider trend image above provides a visual representation of the insider trading activities at Vulcan Materials Co. The image can help investors discern patterns and frequencies of insider transactions, which can be a useful tool in conjunction with other forms of analysis.

The GF Value image offers a snapshot of Vulcan Materials Co's valuation according to the GuruFocus model. This model provides a benchmark for investors to compare the current stock price with an estimated intrinsic value, helping to determine whether the stock is undervalued, fairly valued, or overvalued.

Conclusion

David Clement's recent sale of 764 shares of Vulcan Materials Co is a transaction that warrants attention from the investment community. While the insider's selling activities over the past year have been consistent, it is important to analyze these actions within the broader context of the company's valuation, industry performance, and overall market trends. Vulcan Materials Co's current valuation suggests that the stock is fairly valued, and investors should continue to monitor insider activities and other key financial metrics to make informed investment decisions.

As always, insider trading is just one piece of the puzzle when it comes to evaluating a stock's potential. It is essential for investors to conduct thorough due diligence, considering both the quantitative and qualitative aspects of the company in question. Vulcan Materials Co's role as a significant supplier of construction materials positions it as a key beneficiary of infrastructure development and construction growth, factors that should be taken into account when assessing the company's future prospects.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.