Insider Sell: XPEL Inc's President and CEO Ryan Pape Sells 8,000 Shares

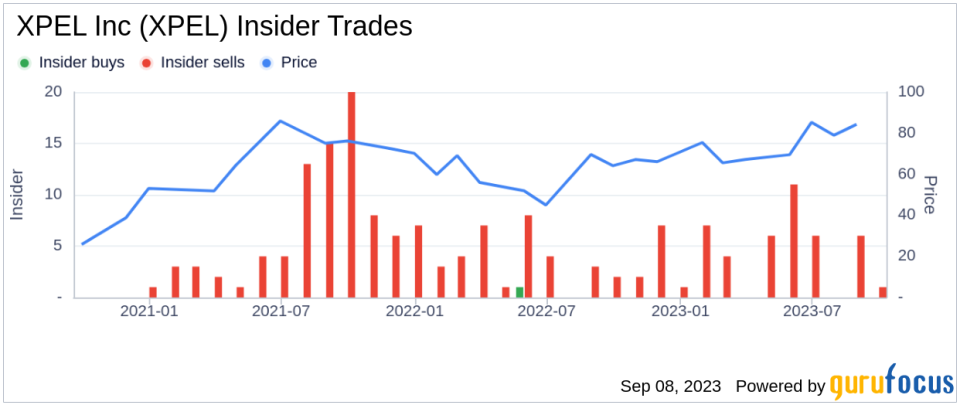

On September 5, 2023, Ryan Pape, President and CEO of XPEL Inc (NASDAQ:XPEL), sold 8,000 shares of the company. This move is part of a trend for the insider, who over the past year has sold a total of 49,000 shares and purchased none.

Ryan Pape has been with XPEL Inc for several years, leading the company through various stages of growth. Under his leadership, XPEL Inc has become a global provider of protective films and coatings, including automotive paint protection film, surface protection film, automotive and architectural window films, and ceramic coatings.

The company's products protect the surfaces of automobiles, commercial vehicles, recreational vehicles, and boats from debris, environmental elements, and everyday wear and tear. XPEL Inc has a strong presence in the automotive industry, with a wide range of products designed to enhance and protect vehicle appearance.

The insider's recent sell-off raises questions about the company's current valuation and future prospects. Let's delve into the details.

The insider transaction history for XPEL Inc shows a clear trend: over the past year, there have been 53 insider sells and no insider buys. This could be a signal that insiders believe the stock is currently overvalued, or it could simply reflect personal financial decisions by the insiders.

On the day of the insider's recent sell, XPEL Inc's shares were trading at $77.42, giving the company a market cap of $2.092 billion. This price represents a price-earnings ratio of 43.04, which is higher than the industry median of 16.8 but lower than the company's historical median price-earnings ratio.

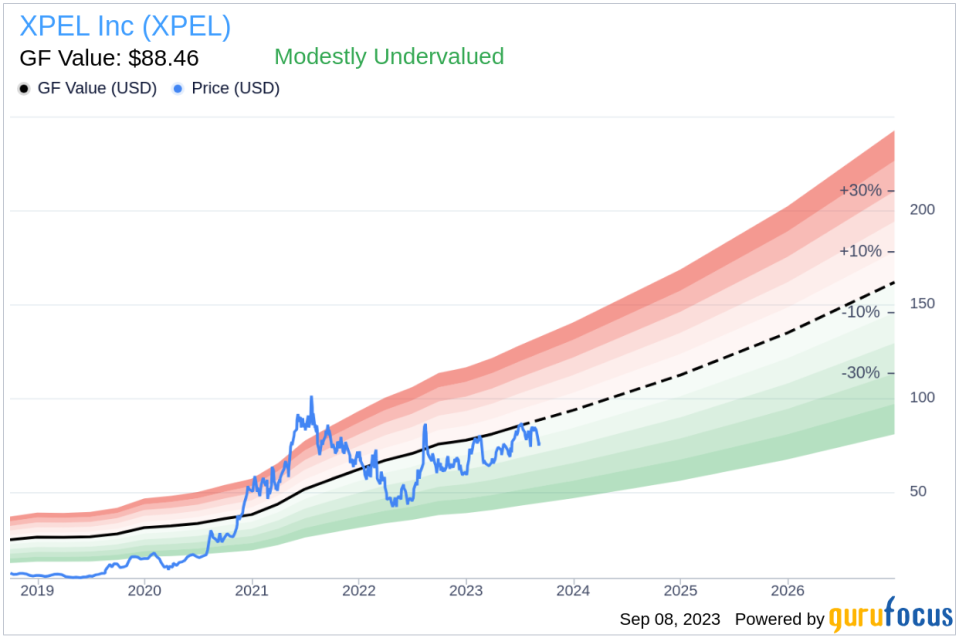

According to GuruFocus Value, which is an intrinsic value estimate based on historical multiples, a GuruFocus adjustment factor, and future business performance estimates, XPEL Inc is modestly undervalued. With a price of $77.42 and a GuruFocus Value of $88.46, the stock has a price-to-GF-Value ratio of 0.88.

While the insider's recent sell-off might raise eyebrows, it's important to remember that insider transactions can be influenced by many factors and do not necessarily reflect a company's future prospects. In the case of XPEL Inc, the company's modest undervaluation and strong position in the protective films and coatings market suggest that it still has potential for growth.

As always, investors should conduct their own research and consider multiple factors before making investment decisions.

This article first appeared on GuruFocus.